The US Supreme Court has decided to review a case involving tech company Nvidia Corp.’s crypto mining revenue, which could significantly impact shareholder lawsuits. According to Bloomberg, Nvidia is seeking to dismiss an investor suit claiming that the company was “deceptive” about its dependency on crypto mining revenue before a 2018 market downturn.

The court’s ruling will determine whether the lawsuit lacks sufficient specificity. If the decision favors Nvidia, it could give companies greater leverage to dismiss shareholder suits early on, potentially avoiding costly litigation.

Nvidia CEO Accused Of Concealing Crypto Mining Profits

Shareholders in the current Nvidia case argue that the company’s CEO, Jensen Huang, concealed that the record revenue growth in 2017 and 2018 was primarily driven by crypto mining-related sales of the flagship GeForce GPU product rather than gaming sales.

The shareholders claim that the crypto market’s volatility exposed Nvidia to more risk than disclosed. In November 2018, Nvidia announced a revenue shortfall, causing a more than 28% decline in its stock over two days. Huang attributed the decline to a “crypto hangover.”

The investors further contend that analysts quickly recognized an alleged “discrepancy” between Nvidia’s prior statements, which downplayed the significance of mining-related demand, and the reality of the situation.

They argue that internal communications involving Nvidia’s CEO would reveal the true extent of GPU sales to cryptocurrency miners, but Nvidia asserts that no such evidence has been presented.

Company Appeals To Supreme Court

The 9th US Circuit Court of Appeals in San Francisco ruled that the shareholders’ lawsuit could proceed, disagreeing with Nvidia’s argument for dismissal.

However, Nvidia appealed the decision, emphasizing the absence of internal company documents supporting the claim that officials were aware of making “misleading statements.”

Suppose the Supreme Court sides with the tech company and sets a higher bar for shareholder lawsuits. In that case, firms may find it easier to secure early dismissals of such cases, saving them from the substantial costs of mounting full-scale defenses.

This outcome could reshape the dynamics of shareholder litigation, impacting the level of accountability demanded from companies regarding their public statements and disclosures.

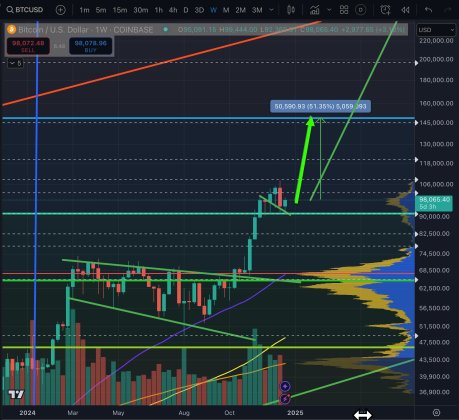

At the time of writing, the total valuation of the crypto market stands at $2.3 trillion, experiencing a decline from its mid-March peak of $2.7 trillion. Despite the anticipation for significant catalysts to reignite the previous upward trend in the prices of major cryptocurrencies, such catalysts have yet to materialize.

For instance, Bitcoin (BTC) has been trading between $56,000 to $71,000 over the past two months. Currently, it is valued at $65,000, following an unsuccessful attempt to retest its all-time high of $73,700.

Featured image from DALL-E, chart from TradingView.com

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments