The crypto industry has been wobbling under severe volatility, India out of all the countries has been affected considerably. With rigorous clamping down of the digital asset space, which also includes action by enforcement agencies the industry has just not been able to take a breather.

New rules, regulatory measure and the massive lack of clarity involving the policy has started to cause brain drain in the industry. Several start ups in the blockchain and crypto industry have been forced to shut their operation and migrate out of the country.

Most companies have chosen pro-crypto nations such as Dubai and Singapore to shift their base. Reports suggested that close 30-50 such companies have moved out of India owing to unclear regulatory measures.

Recently the Co-founders of WazirX, which happens to be India’s largest crypto exchange moved to Dubai along with their families. Sandeep Nailwal, Polygon’s Co-founder too have migrated to Dubai over the past two years. ZebPay and CoinDCX also have moved to Singapore.

In Search Of More Welcoming Administration

The Indian cryptocurrency industry is seeking a more welcoming and positive authority. In case of ZebPay for instance, the platform was responsible for processing most of India’s transaction, shut its operations and moved to Singapore.

This was primarily because of the stifling environment of India’s jurisdiction that it left no option for the company but to move to a different nation. Reserve Bank Of India (RBI) had banned banks from performing business with digital asset platforms from the year 2018 itself.

That year also witnessed other exchanges migrating out of the country. In 2020, Polygon, a decentralised Ethereum scaling platform also shut operations in the country and moved to Dubai.

Top management of the industry in the country are leaving because of the regressive nature of regulation in the market, on top of which, most of this remains quite unclear even till date.

Suggested Reading | CBDCs Will ‘Kill’ Crypto, Reserve Bank of India Governor Says

What’s Making Crypto Companies Leave India?

India’s stance on crypto has continued to waver which has left investors, company owners in a state of constant doubt. Initially, the country had allowed the industry to grow and bolster its scope but in July 2018, it started to prohibit regulated Indian banks from facilitating transactions. This had caused crypto companies a great deal of hassle to secure a bank account.

A year later, RBI issued a circular stating that the 2018 order was not valid anymore indicating erratic decision making on the government’s side.

Heavy and regressive taxation has also been a major concern for both investors and companies, Finance Ministry levied a 30 per cent tax on income from cryptocurrencies.

According to the tax rules investors can’t deduct transactional cost, interest cost of borrowing, etc, while calculating income. Additionally, basic income exemption limit of Rs 2.5 lakh is also not applicable on income from transfer of cryptocurrencies.

Adding to this, from July 1, all payments towards crypto and virtual digital assets beyond Rs 10,000 will be liable to attract 1 per cent TDS which shall be deducted by exchanges. Virtual digital assets (VDA) in the form of gifts shall also be subjected to taxation.

India has also been trying to impose a shadow ban on the industry. For instance, Coinbase launched in India but the exchange was prohibited from letting users add money through the United Payment Interface (UPI) system.

As a result, Coinbase and exchanges like CoinSwitch Kuber and WazirX could not continue with that particular function anymore. All these issues have been contributory to the downfall of the industry which is finally leading to the crypto brain drain.

Related Reading | India To Levy 28% GST On All Crypto Transactions?

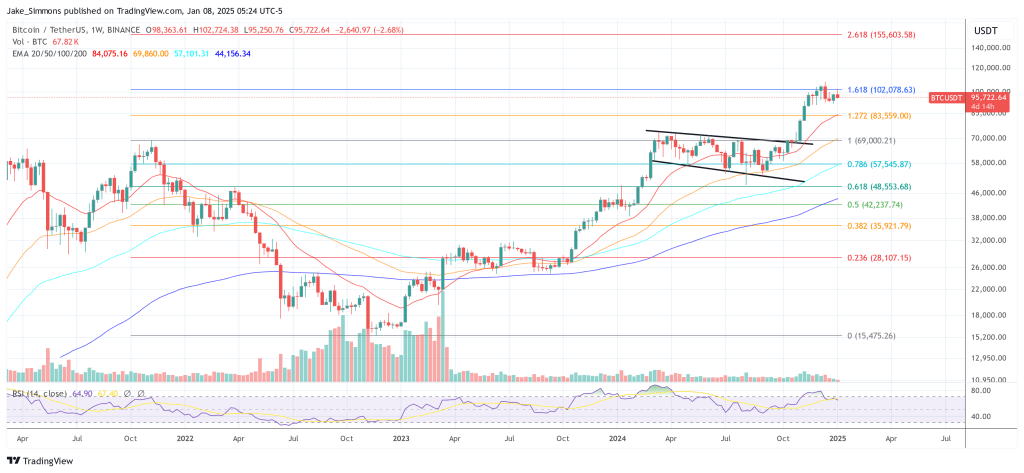

Featured image from Business Today, chart from TradingView.com

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments