BTC megabull here that invests with proxies like MSTR. I was looking at an ETH position and I saw Fink was considered (or already selected?) ETH to potentially tokenize the entire ETF industry. This shouldn't be priced in so im willing to ride this trade.

My question is, what about SOL? It is already #1 in volume, memecoins are being traded fast and cheap, so what if ETH fails to deliver a fast and cheap performance with no hiccups and SOL does and Fink is forced to move to SOL?

I see people complaining about ETH fees all the time, so what's going to happen when the entire ETF trading volume is supposed to be happening 24/7 in there?

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

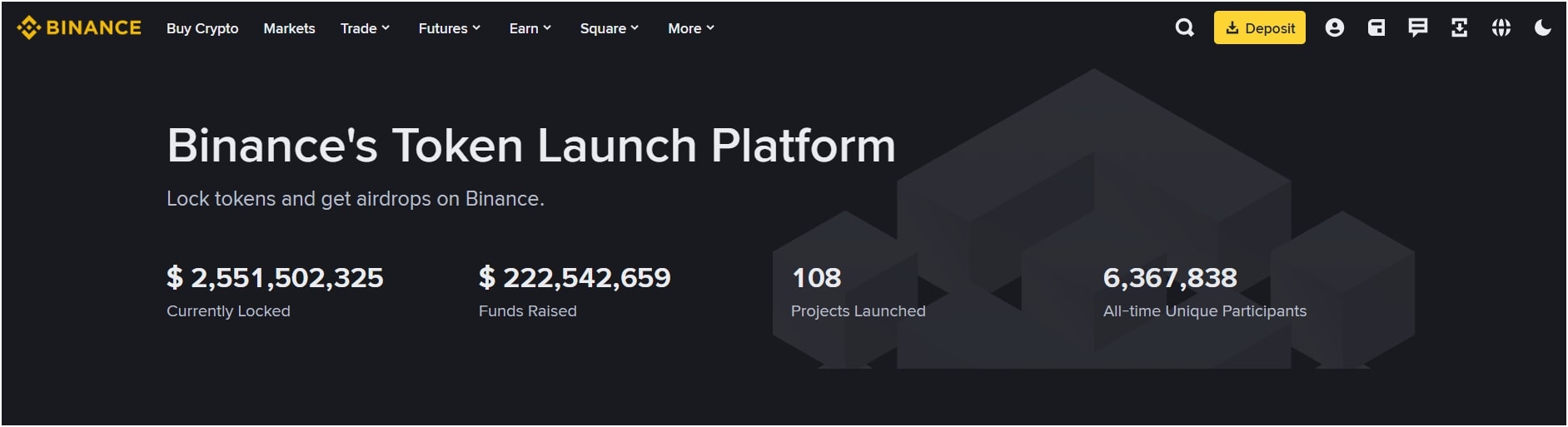

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments