Note: by ETH burning, I refer to the transition to proof of stake, EIP-1559, and the merge, removing the mining and emission with proof of work, reducing the cost for validators, and the inflationary nature of ETH 1.0. I summarize it as “burning, “hopefully without causing new misconceptions.

This is always a good reminder because not everybody understands how markets work. A common misconception is: “Removing liquidity decreases market depth and results in volatility, up or down.”

While the sentence itself is correct, BTC halving and ETH burning remove liquidity from the supply side, with no impact on the demand side. This is bullish.

Let’s explain how:

BTC halving halves the amount of BTC miners obtain per block. Let’s avoid variables and explain with numbers, imagine that:

- The BTC network allows for 10 BTC to be mined per day.

- The demand for BTC by the market is $100K per day, e.g., DCA.

- The equilibrium point is $100K = 10BTC, therefore 1 BTC = $10K.

- After the halving, 5 BTC are mined per day.

- With the same demand $100K = 5 BTC, therefore 1 BTC = $20K. The price expands to accommodate the demand.

It is never an overnight process or strictly like that, because:

- People do not HODL, and as BTC reaches $11K, some people sell, and similarly with other prices, it takes longer to get to $20K.

- As people see the price increasing, many rush to buy some BTC, hoping it will get even higher, increasing demand and price above 2x the previous price.

- As a new pump happens, BTC becomes older and more reliable, and gains attention, investors, and users; therefore, the demand does not stay constant but increases. An increase in demand causes a similar increase in price. Therefore the equilibrium point should stabilize higher than 2x the previous cycle.

- Many other factors impact demand, including institutional adoption. No other factors impact supply, that is, the transparency and reliability of BTC.

- Note that eventually halving will result in BTC mining reaching zero new BTC emissions, with miners getting their rewards from fees. Then, the only supply will be people that do not HODL.

For ETH, the supply of new ETH is negative on average. Therefore, only sellers or price expansion can satisfy any new demand. If the demand increases in absolute terms (more buyers than sellers), the only option is price expansion because there are no new emissions in absolute terms.

If you want to read more about this, consider:

- Supply and demand, and more importantly,

- Monetary policy.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

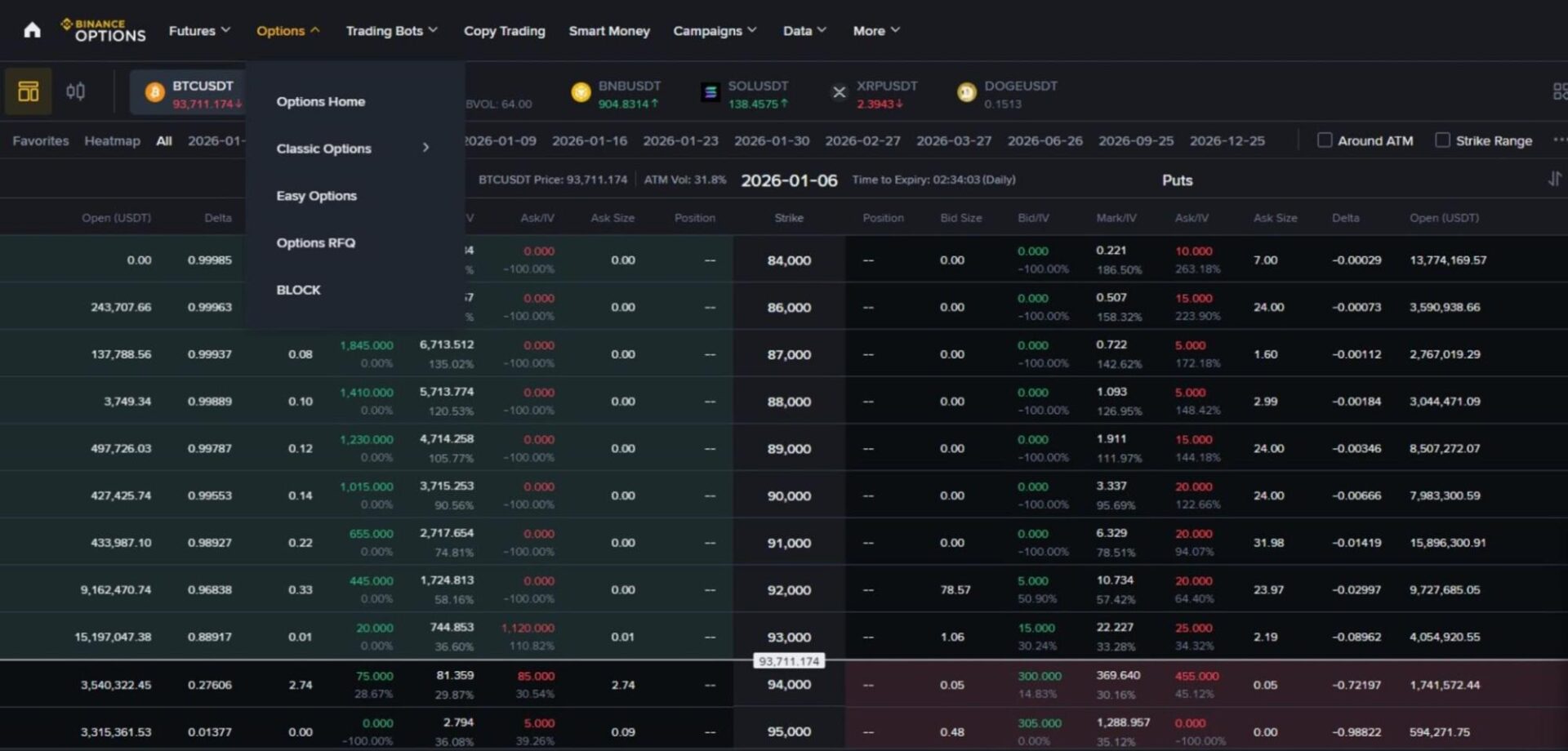

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments