Here’s what emerging tech representatives think about the decentralized nature of blockchain technology and which network is the most decentralized.

Vasja Zupan of Matrix Exchange:

Vasja is the president of Matrix Exchange, a regulated digital-asset exchange operating globally.

“Bitcoin is the most decentralized and stable blockchain network there is. It has survived countless challenges, and decentralization ensures its resilience. Only a truly decentralized network can survive hindrances from block size wars and forks to regulatory pressure. While new anonymous networks are available today, transaction anonymity, more functionality or new approaches to blockchain validation do not ensure higher decentralization and resilience.”

These quotes have been edited and condensed.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Tim Draper of Draper Associates and Draper Fisher Jurvetson:

Tim is a pioneer of business ventures in the United States and a co-founder of Draper Fisher Jurvetson, a leading investment firm in early-stage tech startups.

“Bitcoin. And maybe Bitcoin Cash. We want a completely decentralized currency, one that is global, transparent, open, frictionless and not subject to inflationary pressures of any kind, government or otherwise.”

Roger Ver of Bitcoin.com:

Roger is an early Bitcoin adopter and investor. He is the executive chairman of Bitcoin.com, a site featuring cryptocurrency news in addition to an exchange and wallet service. He is also one of the five original founders of the Bitcoin Foundation.

“The original goal was not decentralization.

The goal was censorship-resistant money for the world, and decentralization was the tool that was used to achieve that goal.”

Phillip Gara of OctaneRender/Otoy:

Phillip is the director of strategy at OctaneRender, an unbiased rendering application with real-time capability developed by graphics software company Otoy Inc.

“When you look at applications and usage — in other words, what people are building on top of blockchains — Ethereum right now is the most decentralized. Ethereum smart contracts enable anyone to build applications, services and goods on-chain — from games and DeFi platforms to NFTs and DAOs — using the Ethereum Virtual Machine. Decentralization is transforming the world because it is eliminating intermediaries. Bitcoin has done this extraordinarily well within the financial industry, while Ethereum is advancing decentralization and removing intermediaries for nearly every sector from media and entertainment to art, lending, crowdfunding and even governance. It is the diversity of applications and usage that currently makes Ethereum the most decentralized.”

Mitchell Cuevas of Stacks Foundation:

Mitchell is the head of growth at Stacks Foundation, which supports the mission of a user-owned internet through Stacks-related governance, research and development, education, and grants.

“Bitcoin, and it’s probably not even close. Bitnodes estimates that there are over 13,000 nodes on the network today, and while mining centralization has been raised as a concern, Bitcoin’s design isn’t predicated on, nor does it rely on, decentralized mining power.

It’s simply more profitable to play by the rules and too expensive to sustain a profitable attack; its sheer size, its incentive structure and the open membership make it extremely robust. We also shouldn’t forget that when China banned crypto, the network took it in stride despite the concerns about hashing power concentrated there.

This is why it’s the foundation for the Stacks blockchain and why it will one day be the bedrock for a better internet where provable ownership is baked in.”

Michal Cymbalisty of Domination Finance:

Michal is the founder of Domination Finance, a noncustodial, decentralized exchange for dominance trading.

“It has to be Ethereum. The genesis event started with a non-restricted public sale, allowing anybody to participate. Even though Bitcoin may be more decentralized when looking at miners and wallet holders, Ethereum decentralized something much more important: applications. Users can participate in full-fledged economies, whereas that is not really possible with Bitcoin.”

Marek Kirejczyk of TrustToken:

Marek is the chief technology officer of TrustToken, a platform to create asset-backed tokens that can be easily bought and sold around the world.

“Broadly speaking, decentralization is this ideal state that every project strives for. There are many ways people go about it, from adding more node operators and putting ever greater authority in the hands of tokenholders to allocating treasury to non-employee contributors. You may have noticed a persistent theme here: Decentralization is about more than technology, it’s also about governance. It’s about layer zero, which is what people sometimes call the community of miners, developers, users and companies working with a specific blockchain.

Now, in more concrete terms, we’d actually argue that Ethereum is pretty decentralized. True, it has strong backing from the Ethereum Foundation, but it’s still largely limited to a support role. Ethereum’s father, Vitalik Buterin, is not its CEO either — he acts more like a researcher and a thought leader. The actual design decisions are made by the developers, and Ethereum has the most diverse developer pool, and the most diverse wider community too. And with most updates, there are multiple teams working on multiple initiatives that could take Ethereum in different directions, so the process has little to do with centralized linear development.

Bitcoin is way more conservative in many ways. It’s not really moving forward, so there is no active developer or startup community around it. It’s also possible to make the argument that Bitcoin mining is centralized to a degree these days, as a small group of entities controls the majority of Bitcoin hashing power.”

Mance Harmon of Hedera Hashgraph:

Mance is the co-founder and CEO of Hedera Hashgraph, a next-generation distributed ledger technology that claims to possess higher speeds and security guarantees than existing blockchain solutions.

“When we talk about decentralization, I think it’s very important to be specific about what we mean. When talking about layer-one protocols, precisely what is being measured when we talk about decentralization? Two separate categories of decentralization are important: 1) governance and 2) transaction ordering.

First, governance: How many different entities (people or organizations) are involved in making decisions on the product roadmap, pricing of services, payments of rewards and other governance-related decisions? Are these entities all known by name, or can they be anonymous? If they can be anonymous, then there is no way to truly determine how decentralized the governance is because the same anonymous actor may pretend to be multiple different entities. Is there an opportunity for consolidation of voting rights? For example, if voting rights are associated with a governance token, then a single actor can increase their influence by buying or earning additional tokens, which leads to the consolidation of rights and increased centralization.

The Hedera Governing Council model is exceptional among public ledgers. It consists of up to 39 term-limited organizations, chosen to represent a broad range of industries, with member headquarters around the globe, running nodes on six different continents. The council members are all publicly disclosed, minutes of the council meetings are published (and hashed on Hedera using the Hedera Consensus Service (HCS)), and each member has a single vote to ensure fairness, stability and truly decentralized decision-making. Even the LLC member agreement that companies must sign to join the council is public and hashed on HCS. This model lies in stark contrast to protocols that are governed by a small group of core developers or a single foundation.

Next, decentralization of transaction ordering: What is the minimum number of entities required to dictate the order of transactions in the network? For example, with Bitcoin, just a handful of mining organizations (often five or fewer) control more than 50% of the hashing power of the network, which is enough to dictate the ordering of transactions. (As of this writing, just three mining pools control 47% of Bitcoin’s hashing power, and just two mining pools control almost 48% of Ethereum’s hashing power). Also, if a network allows anonymous node operators, then it is impossible to know to what degree any given entity controls the hashing power of the network.

Phase 1 of the Hedera network requires more than two-thirds of its council members to agree on the ordering of transactions, and each council member currently has equal weight in their vote. Because every council member is publicly known by name, we can say for certain that transaction ordering is decentralized. This is already more decentralized than Bitcoin and Ethereum. Phase 2 will add publicly identifiable community nodes, and only after there is a very high degree of certainty that consolidation of stake is unlikely will anonymous nodes be added to the network.

The Hedera network, both in its governance model and in the technical ordering of transactions, was designed from the ground up to embody the ideals of sustainable decentralization.”

Lex Sokolin of ConsenSys:

Lex is the head economist and global fintech co-head at ConsenSys, a global community of developers, businesspeople, programmers, journalists, lawyers and others made to create and promote blockchain infrastructure and peer-to-peer applications.

“There are different meanings of the word decentralization at play here. One question is to ask how many miners or validators are securing the transactions on the network and how expensive it will be to attack such technological infrastructure.

Another question is to ask about the implicit governance of the network and how many influential people are really needed to generate some particular fork of the network, and the process by which that happens.

Yet another is to look at the economic and development activity on the network and try to understand how dispersed and unique the players are in the complex system that is a blockchain macroeconomy.

Rather than accord points to networks based on this rubric, I think it’s more constructive to use them as principles for blockchains to aspire to reach. Further, ‘more decentralization’ of any of these particular types doesn’t always result in more ‘traction’ — we should be careful to preserve the spirit of Web 3.0 together.”

David Khalif of Viridi Funds:

David is the co-founder and head of operations at Viridi Funds, a registered investment adviser and emerging fund manager that offers environmentally conscious crypto investing options.

“Although there are many other blockchains, Bitcoin is still the king of decentralization. The protocol has a fixed supply cap, allows anyone to participate in securing it and incentives all parties in the ecosystem to reach consensus in a non-fraudulent manner.

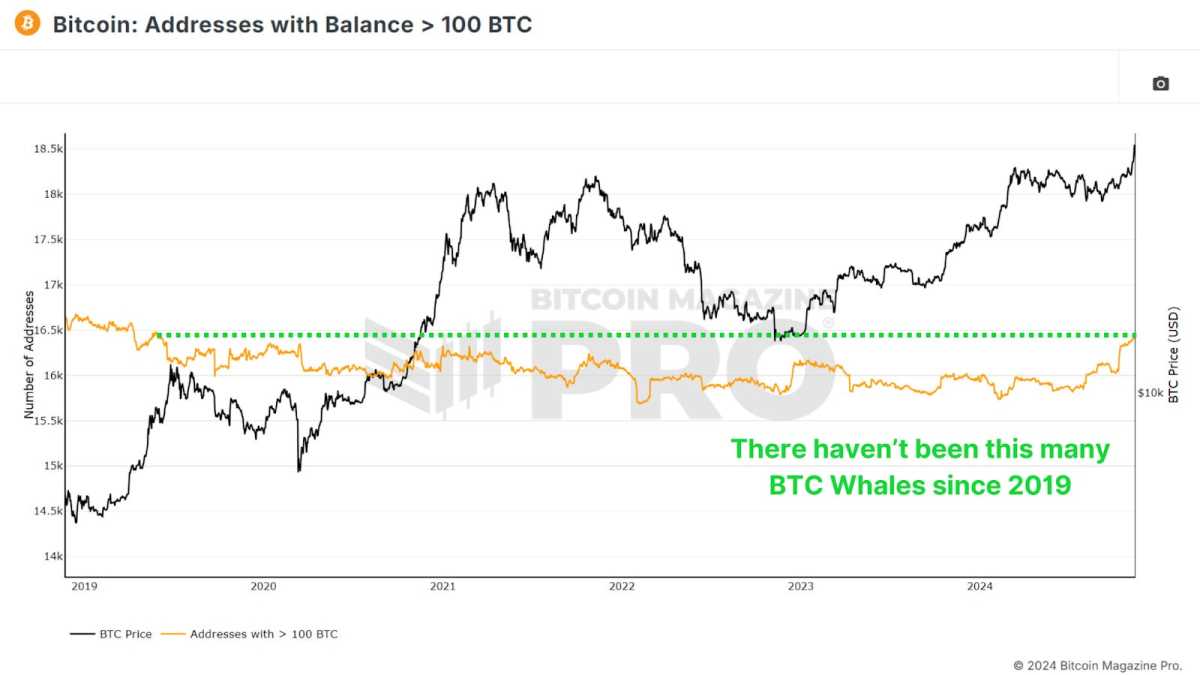

Despite numerous attempts since its inception, including the most recent China ban, Bitcoin has never failed at remaining a strong, secure network. The significant adoption we have seen by institutions that are purchasing Bitcoin is evidence that smart money is flocking to the best asset in the crypto space for security, stability and growth.”

Darren Franceschini of BlockBank:

Darren is the co-founder and chief operating officer of BlockBank, a multi-protocol utility wallet that combines the power of decentralized and centralized technology in a simple, secure application.

“We’re still in our infancy, but more and more projects are moving toward becoming more decentralized. I wouldn’t claim that any blockchains are truly decentralized other than Bitcoin, which has no central control. Bitcoin’s true strength, however, is that it does not have one figure who represents its token creation. That provides a higher level of safety than any other blockchain because there is no single point of failure.”

Daniela Barbosa of Hyperledger:

Daniela is the executive director of Hyperledger and the general manager of blockchain, healthcare and identity for the Linux Foundation.

“Decentralization has many angles, and one of them is control of the underlying software and something in the open-source community called ‘the right to fork.’ We think seeing lots of different layer-one networks all running similar protocols (such as Hyperledger Fabric or Hyperledger Besu/Ethereum) is inherently more ‘decentralized’ than a single layer-one network, no matter what the protocol. That is why the Hyperledger community is building an ecosystem with a focus on interoperability.”

Ayesha Kiani of LedgerPrime:

Ayesha is a vice president of business development at LedgerPrime, a quantitative and systematic digital asset investment firm. Ayesha is a faculty professor at New York University Tandon School of Engineering, investor board member at Ventures for America and venture partner at NextGen Venture Partners.

“Bitcoin is the most decentralized protocol in the entire ecosystem. It has nothing to do with the controlling authority but more to do with its consensus algorithm, proof-of-work. The algorithm requires the miners to solve for equations that, in return, generate Bitcoin, and blocks are created. Miners are incentivized for their work. Though mining has become concentrated over the years and the network’s hash rate is mostly controlled by large miners, we are still far away from anyone controlling 51%. Ethereum, on the other hand, has moved to proof-of-stake, which is less decentralized. But Ethereum shouldn’t be compared with Bitcoin in terms of decentralization, as both serve different use cases. Vitalik initially proposed the scalability trilemma, and he’s been delivering on it by moving the structural algorithm and letting stakers make improvements to the protocol. Others are much more centralized than they claim to be.”

Alan Chiu of Enya/Boba Network:

Alan is CEO of Enya, a data privacy company that operates the world’s largest secure multiparty computation platform. Alan also serves on the Stanford Graduate School of Business Alumni Board, as well as on the board of Stanford Angels and Entrepreneurs as co-president.

“While Bitcoin remains the most decentralized blockchain, Ethereum is a close second, and certainly the most decentralized among smart contract platforms, with a diverse base of node operators and multiple centers of gravity when it comes to influencing the future of Ethereum (witness the iterations EIP-1559 went through and how long it took to be adopted). No other smart contract-capable blockchain comes close to the same level of decentralization yet.”

Adrian Krion of Spielworks:

Adrian is the CEO of Spielworks, a company that combines a DeFi wallet with the massively popular world of mobile games.

“Decentralization can mean a number of things:

a. Decentralized infrastructure: The (number of) parties running the network infrastructure, the diversity of hardware, and the distribution and number of different locations.

b. Decentralized governance: How decisions about future development of the network are being taken.

c. Decentralized software development: Who contributes to source code development, and who decides which changes get accepted?

d. Scattered/equal token distribution: Who owns how many native tokens on the network?

Typically, when people speak about the grade of decentralization of a network, they do so based upon one or more of these aspects, but they hardly make it clear which ones they are reflecting on. Also, the question is: What exactly is emphasized in each of the categories? I.e., is it more important to have an even geographical distribution of Bitcoin miners if it means that most of those nodes are being run by the same company?

The fact that there is no absolute measure of decentralization in turn means that networks other than Bitcoin actually have a chance of being labeled ‘more decentralized’ than Bitcoin itself. Some might call Bitcoin very centralized, as there’s a very small number of providers building mining hardware, so that companies like Bitmain effectively are controlling the Bitcoin network to a large extent. Others will argue that not having a central entity control the development of the network is the most relevant factor in measuring decentralization, which is why Bitcoin is the most decentralized one.

I would probably still agree with Bitcoiners in saying that Bitcoin is the most decentralized, even though it’s a very tough choice given the lack of governance structured within the protocol and the relatively low level of decentralization of miners. However, the fact that there is no single entity deciding on a roadmap for Bitcoin means that the price will be most independent of any decisions taken within that organization.”

Aatash Amir of StarLaunch:

Aatash is the CEO of StarLaunch, an insured project accelerator and launchpad for the Solana network.

“I’d like to note that the terms ‘decentralization’ and ‘ownership’ are too often thrown around without true consideration to what they really imply. For example, decentralization should be considered a dynamic state. One method of determining the ownership of a chain can be defined by the percentage of total supply belonging to any given entity and, by virtue of such, incurring a truly variable state of ‘decentralization’ throughout its lifecycle. For example, when the first Bitcoin block was mined, Satoshi ‘owned’ 100% of the Bitcoin network. This continued until, of course, other miners entered the space.

All that being said, token share is only one of multiple factors in determining locality. We mustn’t neglect the root of all blockchain utility: consensus. Different chains offer different solutions to block/transaction validity. This, arguably, is where one should first look when searching for signs of decentralization. If one entity runs 51-plus percent of incoming hashing power, they now have majority influence on (what should be) consensual circumstances. Currently, there are a handful of layer-one chains proposing a variety of unique consensus and distribution methods. Which is the best? Well, right now, that answer is TBA.”

Aaron Lammer of Radkl:

Aaron currently serves as a DeFi specialist at Radkl, a quantitative trading firm with a focus on digital assets.

“If the platonic ideal of decentralization is taken to be the model put forth by Satoshi Nakamoto (and the cypherpunks who preceded them), then it would be hard for any network to beat Bitcoin. But the purpose of networks like Ethereum and other smart contract platforms isn’t to beat Bitcoin in a decentralization competition. Smart contracts are intended to introduce whole new universes of possibility that might be impossible within the confines of someone else’s definition of decentralization, and we’ve already seen some of those possibilities realized in NFTs and DeFi.

The power of crypto is that it can align the interests of multiple parties even when they have fundamental disagreements –– like how important decentralization really is. So, I think it’s less about which chain is more decentralized than some other chain and more about figuring out what the optimal form of decentralization is for each application.”

Introduction

Almost 13 years ago on Oct. 31, 2008, Satoshi Nakamoto published Bitcoin’s (BTC) white paper. As a “purely peer-to-peer version of electronic cash,” the first cryptocurrency was deployed with a consensus mechanism called “proof-of-work” that allows networks to agree on which transactions are valid in order to verify them without the involvement of a third party. Three years later, a new approach dubbed “proof-of-stake” was proposed to address the inefficiencies of the PoW consensus mechanism and lower the amount of computational resources required to run a blockchain network.

During those 13 years of existence, we’ve already seen the rise and fall of initial coin offerings in 2017, which became “an alternative means of acquiring funding for business projects using the new, evolving digital financial market for tokens”; the significant growth of the decentralized finance, or DeFi, sector in 2020, which is changing the old financial systems and paving the way for a brand-new type of finance; the tremendous popularity of nonfungible tokens, or NFTs, which have taken the cryptocurrency sector by storm in 2021; and the ongoing development of central bank digital currencies, or CBDCs, all over the world.

Blockchain technology, which is at the core of this technological revolution, has become one of the most discussed topics not only within the financial sector but also far beyond it. Blockchains are being deployed in enterprise use cases, charity and philanthropy, responses to the global environmental crisis, healthcare and longevity, government services, and so on.

Related: How will blockchain technology help fight climate change? Experts answer

Despite where the technology has been applied, one thing remains crucial: At the very core of blockchain technology lies decentralization. Leaving aside the discussion about the dichotomy between centralization and decentralization that we raised earlier this year, let’s circle back to the decentralized nature of blockchain. Indeed, there is a fundamental difference between private and public networks.

Meanwhile, not all public blockchains are equally decentralized — or are they? Some experts say that since Bitcoin is not controlled by any centralized entity, and was built by the pseudonymous (and later vanished) Satoshi Nakamoto, it can be considered the most decentralized network. Ethereum, on the other hand, can be criticized as not being as decentralized as Bitcoin. But to be fair, even co-creator Vitalik Buterin doesn’t control Ethereum. There are now many more blockchain networks, such as Stellar, Cardano, Neo, Lisk and Iota, to name a few.

To find out what industry experts think about the decentralized nature of different blockchains, Cointelegraph reached out to several representatives of this emerging technology space. The experts gave their opinions on the following question: Which blockchain network is the most decentralized and best reflects the original idea of decentralization?

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments