The crypto community is still reeling with fear, doubt, and uncertainty (FUD) from the latest regulatory tension in the industry since U.S. regulators have taken enforcement actions on some crypto firms.

Firstly, the Securities and Exchange Commission struck Kraken with a fine and halted its staking program. Also, the NYDFS and SEC have been on Paxos, the issuer of Binance USD stablecoin.

Rumors have been flowing about the possible enforcement action on other stablecoins and their issuers. Some fingers pointed at USDC as the SEC’s latest target. But the issuer of the stablecoin, Circle, debunks such rumors against them.

Circle Counters Rumors Of Wells Notice From The SEC

There have been rumors about the SEC giving out a Wells notice to Circle, the issuer of USDC. Usually, a Wells notice from the regulator discloses its intended legal action against a company, leaving it more time to prepare a response.

On February 15, Dante Dispaerte, the Chief Strategy Officer and Head of Global Policy at CirclePay debunked the rumors. While responding to the tweet of a journalist at Fox News, he stated that Circle had not received a Wells Notice.

The journalist Eleanor Terrett earlier posted that SEC issued a Wells Notice to Circle regarding its management and issuance of USDC, a stablecoin. At the time of writing, the journalist deleted the post.

However, Terrett took to Twitter to apologize for the first wrong post concerning Circle. The journalist noted that it was an error and admitted to trying to set things right by apologizing openly.

Though the journalist has admitted the mistake in SEC’s target against USDC, the FUD is already spreading. Several reactions have been rotating around the issue, while some crypto community members cited their panic sell-off of the stablecoin. In a response tweet, one Twitter user who goes by @MotownCrypto reported selling off all USDC tokens due to the rumors.

Circle Reacts To Wells Notice

A tweet from the founder DeFi and NFT 0xfoobar implies a twist in recent events. He mentioned that Circle issued a Reverse Wells Notice to the SEC Chair Gary Gensler. This is a notice from firms to regulators stating their non-violations of all compliance rules. With such notice, the SEC can’t investigate the company until the court case alleging their regulatory overreach concludes.

Meanwhile, the SEC’s Wells notice to Paxos and the stop issuance order from the NYDFS on the firm are impacting BUSD negatively. The market cap of the stablecoin dropped drastically by over $900 million within the past few days.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

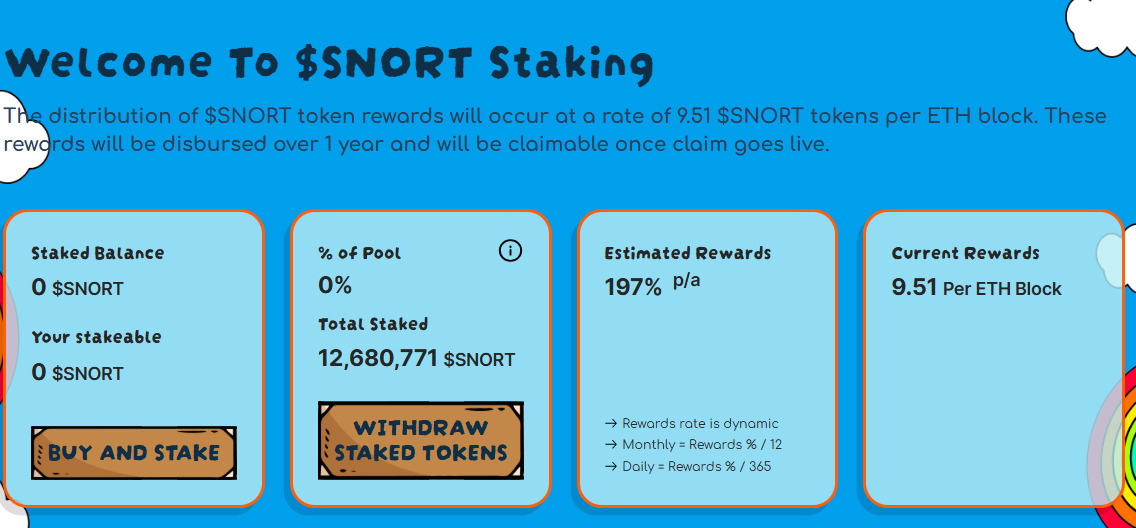

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments