This is an opinion editorial by Bitcoin Graffiti, a software developer and graffiti artist.

In 1714, the British Parliament introduced the Longitude Act, a law rewarding a £20,000 bounty (more than $1 million in today’s money) to anyone who could accurately determine longitude at sea. Captains had been struggling with poor navigation since the onset of global trade. Though sailors could easily measure latitude by gauging the sun’s height, longitude was very hard to determine and inapt techniques veered vessels of course. Without visual bearings, humans were sailing blind on the open seas. The increased travel time led to scurvy, delays and ships smashing on the rocks — losing crew and cargo forever to the deep.

Fortunately, a genius Brit came up with the solution — the chronometer, a clock that could keep its beat on the volatile seas. John Harrison was this genius and his invention outperformed crude astronomical techniques that relied on clear skies, number tables and hours of calculation. There was no second best.

But his innovation wasn’t adopted!

According to “Longitude” by Dava Sobel, it took until 1828 for the Board of Longitude to be disbanded and the chronometer to reach mass adoption.

Why on Earth did it take so long?

Going Beyond The S Curve

“...the diffusion of innovations is a social process, even more than a technical one.”

–Everett M. Rogers, “Diffusion Of Innovations”

Another timekeeping device was invented in 2008 by Satoshi Nakamoto. Bitcoin is a decentralized clock in cyberspace enabling accurate economic calculation and financial navigation in the uncertain waters of life. Though its properties are superior in the eyes of its users, the rate of adoption is not as spectacular.&

Many claim it’s at the brink of crossing the chasm: “This is the internet of 1995!” But in our bullishness, we expected an iPhone-like adoption. Certainly, ideas spread faster than ever before, but to consider this trend as the sole variable governing adoption rate is oversimplifying it. The longitude story shows us that, even when an innovation is a complete no-brainer, it may take longer than you think to catch on.

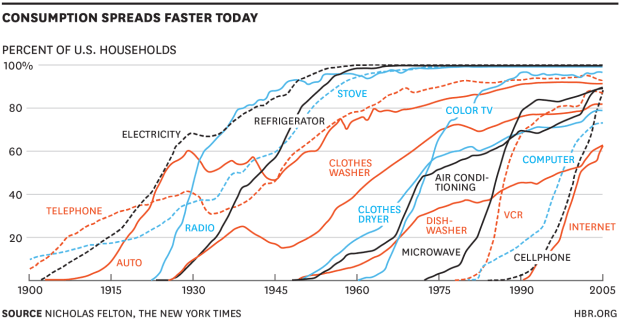

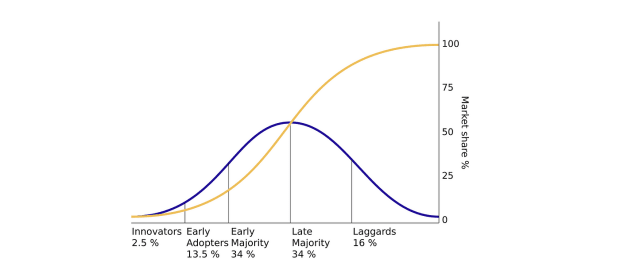

Everett Rogers was the social scientist who popularized the observation of how innovations diffuse across the social medium by a normal distribution. By aggregating adopters over time, the uptake looks like an S curve that hockey-sticks upward after a critical mass of users has been reached. This model gained popularity early this century as it explained the exponential growth of mobile phones and the internet.

But Rogers’ research encompasses more than just this memorable model. In his book, “Diffusion Of Innovations,” he discerned five parameters that govern a technology’s adoption rate.

The Five Perceived Attributes Of Bitcoin

One: Relative Advantage

“Diffusion is a particular type of communication in which the message content that is exchanged is concerned with a new idea.”

–Rogers, “Diffusion Of Innovations”

Bitcoin’s perceived value is determined by two things: needs and price.

In order to have a need, one has to experience a problem. The issues with fiat money have long been recognized within the cypherpunk and sound money communities, and they were the first to adopt. But outside of these social cliques, the awareness of dollar debasement is low. A lack of financial education and fiat immersion leads people not to seek solutions. Without a proper diagnosis, nobody needs a cure.

Bitcoin’s price is slowing adoption and unit bias makes the coin look expensive. People don’t know it's subdividable. The price is also volatile, obfuscating its store-of-value function. You can contrast this with other adoption cases. For example, mobile phone users perceive value instantly — calling anyone, anytime, anywhere. But with Bitcoin, 80% drawdowns and “number go down” for years are not uncommon. It takes a high level of abstraction to see Bitcoin's value and high conviction not to be shaken out of the market.

Two: Compatibility

“Potential adopters may not recognize that they have a need for an innovation until they become aware of the new idea or its consequences.”

–Rogers, “Diffusion Of Innovations”

The first version of a new technology is rarely a perfect match for the entire market, catering only to a niche group of innovators. According to Rogers, an innovation needs to be reinvented to find product-market fit.

Bitcoin is currently compatible with the financially educated. But beyond this group, Bitcoin is not perceived to be in line with people’s value and belief systems. It’s still a niche product in the innovator stage.

For Bitcoin to reach more early adopters, it has to be reinvented for different global markets. Currently, two distinct paths are emerging: its narrative and medium-of-exchange (MoE) usage. Here are three examples:

- “Banking the unbanked”: Bitcoin can help people in developing countries to leapfrog the legacy banking system. Starlink and smartphones enable adoption where an MoE, system for remittances and a bank account in your pocket have high value. Leaders in countries like El Salvador, Mexico and Indonesia use such narratives to explain Nakamoto’s invention.

- “Cyber warfare”: In his book, “Softwar,” Jason Lowery uses military language to reinvent bitcoin as a geopolitical asset to be fought over by states in cyberspace, creating a new domain of war. Through the military lens, he recoins Bitcoin as “Bitpower,” creating a vision in which ASICs convert energy to raise a cryptographic wall, increasing the cost of attack on financial data. Lowery is a change agent, someone who translates Bitcoin to make it compatible with the U.S. army.

- “Grid balancing”: This is the language for the energy sector clique. Proof-of-work mining can be used to make energy grids more resilient, balance supply and demand and turn a profit out of stranded energy sources.

These narratives are designed to make Bitcoin more compatible with specific social groups that speak different languages. With increased understanding, these groups will drive the creation of new uses and applications.

Three: Complexity

The chronometer was far ahead of its time and it took years before crafty entrepreneurs copied and manufactured the device. Similarly, Nakamoto had to introduce his invention to its first adopters on the Bitcoin Talk forum. Since then, entrepreneurs have had to join and build services on top of the protocol, including cold storage solutions, mnemonic seed phrases and exchanges. These upgrades improved the user experience, but compared to the mobile phone, Bitcoin’s still relatively complicated.

This also holds true at Bitcoin’s development level. New software developers experience a steep barrier of entry implementing Bitcoin in applications — the ecosystem is not as well developed as regular web development. And while it’s true that Bitcoin is not what it was back in 2008, and upgrades continue to make it more accessible — with groups like Spiral and Breeze having recently launched software development kits to make integration easier, for instance — where is the Steve Jobs “boom” moment?

We are still waiting for the out-of-the-box killer app.&

Four: Trialability

“One must learn by doing the thing, for though you think you know it, you have no certainty until you try.

–Sophocles, “The Trachiniae”

The chronometer had a long trial period. By the time captains could update their peers on improved navigation, months of trial and travel had passed. The device was deemed good only if it was accurate along the full sailing journey. On top of that, a ship was underway for months, retarding the word of mouth.

The Bitcoin journey takes time, too. Since price is volatile, it is not uncommon to be "under water" for some time. This can have an effect on the advantages perceived by the user, but may also deter peers from adopting. The trial period may be as long as the reward halving, and true advocates are only minted after enough time in the market.

Though trialability of Bitcoin is easy — one can just buy a little — the overall net benefit is only great with a larger purchase, proving the point that the full trial period might be as long as one halving.

Five: Observability

Bitcoin is digital and thus poorly visible. It is not like a Ford Model T racing over the roads with its advantages on display. Most people only learn about Bitcoin in news reports when it has broken through its all-time highs, which can last only for a relatively-short duration.

Adoption speeds up with more visible applications. Perhaps in the not too distant future, Bitcoin miners may be integral parts of power plants and homes. People might send Bitcoin with their phones to friends on the street. Or they see the Lightning buttons on a Nostr client and discover it’s possible to zap satoshis to their favorite influencers.

Also, increased wealth through bitcoin is hard to spot. Unless Bitcoiners start wearing Gucci and driving orange Lambos, rich HODLers are hard to observe. But wearing a giga-chad t-shirt might not be in vain and could potentially speed up the spread.

Reward

Harrison slaved away at his timekeeper alone for 20 years. His invention got blocked and retarded by bureaucracy, but he finally got his £20,000 bounty. Smart entrepreneurs were able to scale his ingenious design to mass production, bringing chronometers aboard ships where they saved time, cargo and lives. It took a long time, but the chronometer eventually floated to the top.

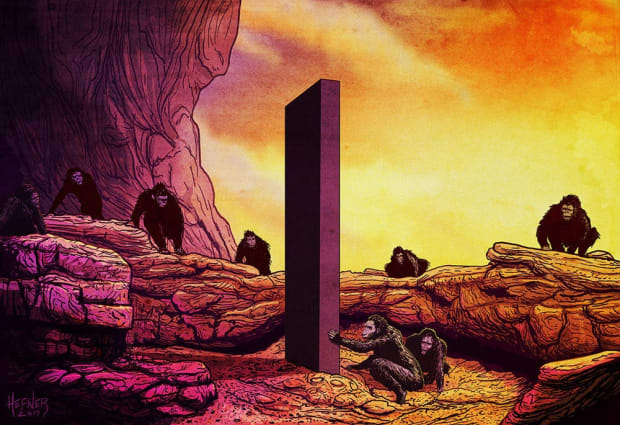

Today, the people of Earth are financially adrift. Like ships ignorant of longitude, they sail blindly through the treacherous waters of life, unable to financially calculate. We are barbarians living in the pre-science Stone Age of money. Future generations will look at us in dismay.

But this is about human psychology and how people embrace new ideas. In hindsight, world-changing technologies all appear self-evident. You’re right in the middle of a paradigm shift, the ignition of scientific revolution, and it is hard to see where things are going.

Bitcoin won’t diffuse rapidly like Facebook, the internet or the iPhone. Much needs to be built, reinvented and translated before the masses get onboard. Like with electricity, base layers are hard to grok without the actual appliances.

We will get there.

But it will take longer than you think.

This is a guest post by Bitcoin Graffiti. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments