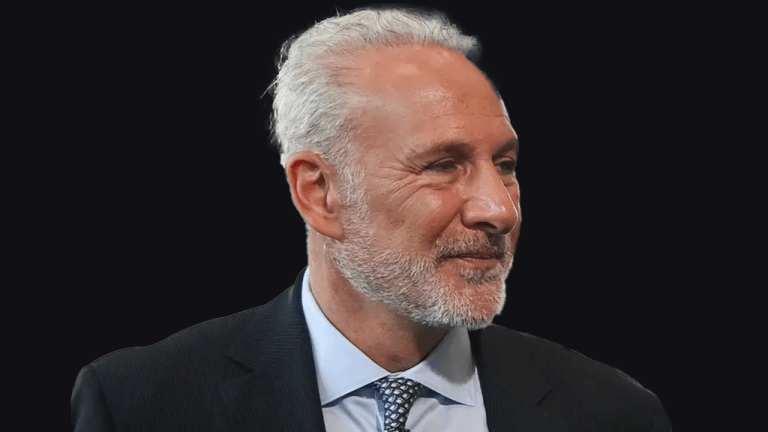

Bob Diamond believes that cryptocurrency is a very broad term.

The former Barclays CEO said the big lesson with FTX’s collapse is onshore vs. offshore.

His firm Atlas Merchant Capital is an active investor in the stablecoin issuer Circle.

Crypto is a broad term and has a lot of use cases

Bob Diamond, Atlas Merchant Capital CEO and former Barclays CEO told CNBC in a recent interview that cryptocurrency is a broad term and has a lot of use cases.&

"The big lesson with @FTX_Official is onshore vs. offshore," says Atlas Merchant Capital CEO & fmr. @Barclays CEO Bob Diamond. "Strong banks want strong regulation. Will strong firms in the crypto space want strong regulation?" pic.twitter.com/FJXchVBtU9

— Squawk Box (@SquawkCNBC) January 4, 2023

He revealed that Atlas Merchant Capital has been working with and investing in Circle for quite some time. Diamond said Atlas Merchant Capital is bullish about cryptocurrency and blockchain technology. He stated that;

“Do we believe there is going to be a digital version of the US Dollar over time? Absolutely. Do we believe that the best way to develop that is to have the central bank do it or have the private sector do it? We believe strongly in what Circle is doing.”

Diamond added that Atlas Merchant Capital is confident that Circle will become real winner in the cryptocurrency space. He added that;

“Crypto is a very broad term. Our focus is on the technology of blockchain and the excitement of having a digital version of the major fiat currencies.”

FTX’s collapse is a lesson for the crypto space

When asked about his outlook on the crypto space in the next 2-3 years, the former Barclays CEO believes the crypto industry is going to be different. Diamond added that what happened with FTX (the exchange’s collapse) reminded him a lot about what happened with Enron (the now-defunct American energy company). He said;

“FTX was like the go-to brand in the crypto space. It had incredibly smart people. It took very illiquid and bad positions during the crypto winter, and it had criminal accounting. As we come out of this, I think there is going to be a lot of focus on payments, technology and blockchain.”

The Atlas Merchant CEO added that the other big lesson from all these is onshore vs. offshore. He added that;

“Circle operates within the regulatory perimeter of the US while FTX was operating in the Bahamas. Strong banks want strong regulation. Will strong firms in the crypto space want strong regulation? Part of that is operating within the US perimeter.”

This& latest cryptocurrency news comes as Sam Bankman-Fried’s case with the United States government continues over the collapse of the FTX exchange.&

The post The big lesson with FTX’s collapse is onshore vs. offshore, says former Barclays CEO appeared first on CoinJournal.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments