Summary:

- USDT stablecoin issuer Tether released the latest report on its reserves.

- The report was independently audited by BDO, a major accounting firm ranked in the top five globally.

- Friday’s audit revealed a further reduction in the firm’s commercial paper holdings over the last quarter.

- Cash holdings and bank deposits increased as well, per the audit.

- Tether previously announced plans to shrink commercial paper holdings to zero by the end of 2022.

- The digital asset firm still holds around $8.5 billion in short-term debts at press time.

Tether, the digital asset firm behind crypto’s largest stablecoin USDT, released its quarterly assurance report independently audited by a top-ranked public accounting outfit called BDO on Friday.

The stablecoin issuer tapped BDO’s service as a means to further validate the Consolidated Reserves report released earlier. Indeed, the report focused on assets held by the company as of the end of Q2 2022.&

BDO Report Confirms Tether’s Report On Its Stablecoin Reserves

According to BDO’s assessment of Tether’s reserves, commercial paper holdings dropped by 58%. During the last quarter of 2022, the total amount of such holding in the firm’s reserves shrunk from $20 billion to $8.5 billion.

Notably, this aligns with previous rhetoric from CTO Paolo Ardoino regarding plans to significantly reduce short-term corporate debt held by the stablecoin issuer. Ardoino was quoted earlier in the year that the digital asset giant would cut down its commercial paper to zero by the end of 2022.

Over the past quarter, the company also propped up cash holdings and bank deposits by some 32%, per Friday’s audit report. In addition, Friday’s audit reaffirmed the firm’s reserve assertions for assets held as of June 30, 2022.

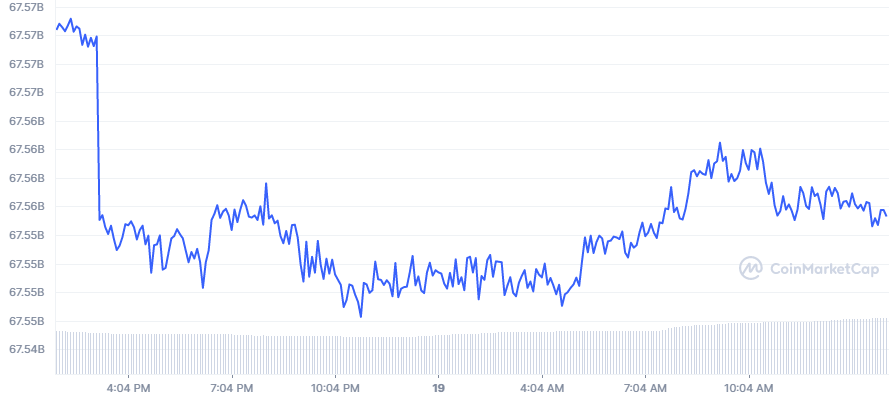

- The Group’s consolidated total assets amount to at least US$ 66,409,619,424.

- The Group’s consolidated total liabilities amount to US$66,218,725,778, of which US$ 66, 204,234,509 relates to digital tokens issued.

- The Group’s consolidated assets exceed its consolidated liabilities.

- The total gross consolidated contractual redemption value related to all digital tokens issued, including those held by the Group is equal to US$ 66,430,393,253.

- The consolidated amount related to digital tokens held by the Group but not in its treasury wallet is equal to US$ 226,158,744.

At press time, Tether’s USDT remains the leading stablecoin in crypto with over $60 billion in market cap. Circle’s USDC is the closest competitor with a market cap above $50 billion, per data from CoinMarketCap.&

Ardoino opined that the firm plans to maintain its spot at the top while delivering utility for the global digital economy.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments