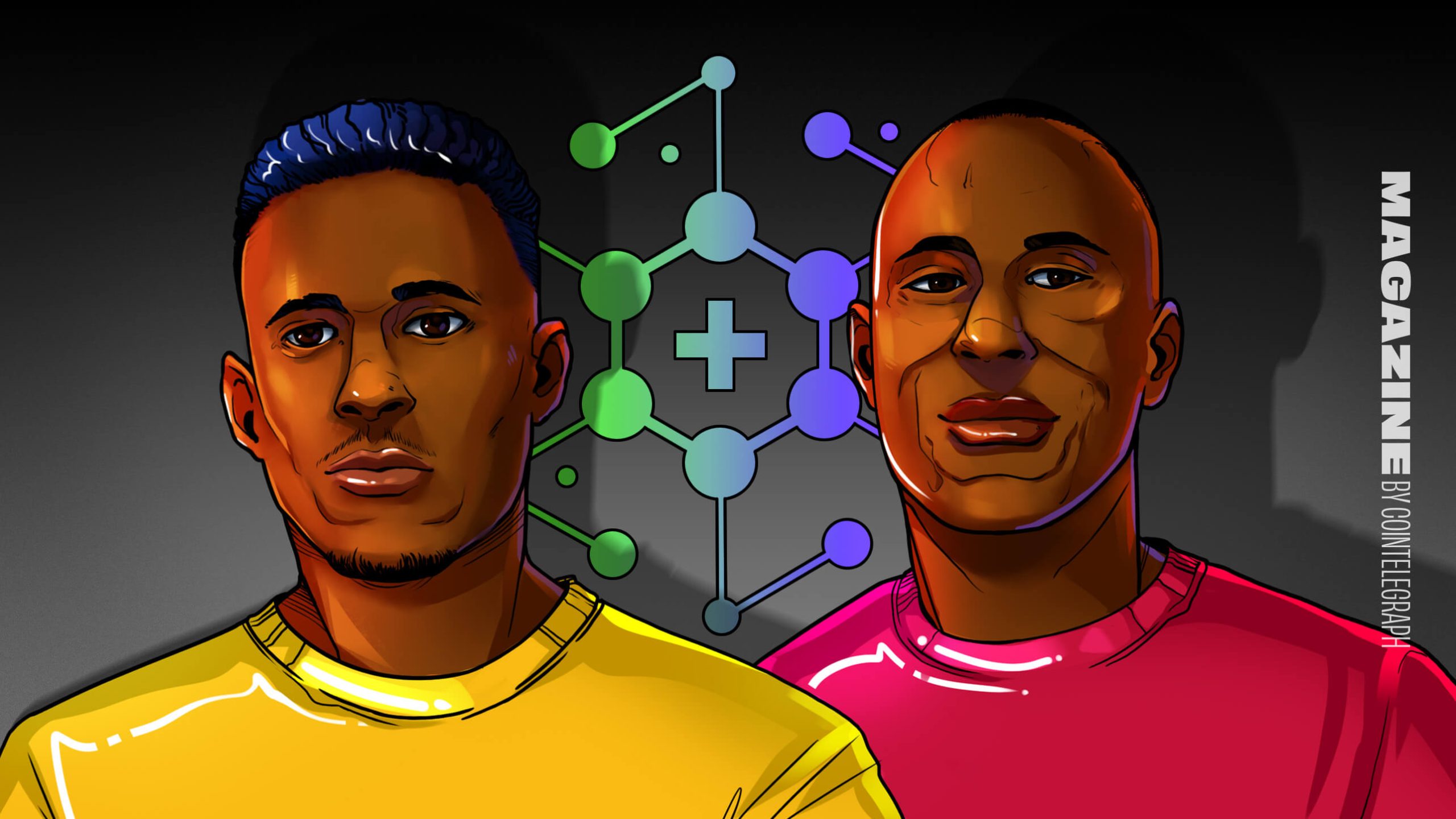

Company Name: Ark Labs

Founders: Marco Argentieri and Simone Giacomelli

Date Founded: June 2024

Location of Headquarters: Europe

Number of Employees: Six full time

Website: https://arklabs.to/

Public or Private? Private

Ten years ago, just after graduating from high school, Marco Argentieri began his career in Bitcoin.

Some of his earliest work in the industry included helping people make remittance payments using bitcoin. From those early days, Argentieri looked at bitcoin more like a currency and less like an investment, and he helped to make it easier for others to use.

“I had many people that were using Bitcoin because it was like a Western Union without the KYC hurdles, and it was much cheaper back then,” Argentieri told Bitcoin Magazine.

“They were not even interested in bitcoin price or volatility. They were just using it to send money overseas,” he added.

Fast forward to 2024, and Argentieri is still focused on the same mission: helping people to use bitcoin cheaply, easily and privately. Though these days he does this in a more sophisticated way via his company Ark Labs, through which Argentieri and his team develop the Bitcoin layer 2 Ark.

What is Ark?

Ark is an open-source protocol created to help scale Bitcoin. The protocol enables users to amortize the cost of a single on-chain transaction across many off-chain swaps. These swaps occur on Ark’s servers, and they’re most well-suited for Bitcoin users who already operate Lightning nodes.

Ark servers were created to remedy the liquidity constraints of Lightning by allowing users to receive funds off-chain in what are called vTXOs (Virtual Transaction Outputs), which alleviates the need to open a channel and/or receive inbound liquidity. The off-chain system runs on Ark servers, which also enable unilateral withdrawals on-chain.

Ark provides and sources the liquidity for the transactions it facilitates via its servers (instead of relying on peers for liquidity the way that Lightning does). Argentieri embraced Ark as a solution after acknowledging Lightning’s shortcomings.

“Looking at a current scaling solution like Lightning, the developers were idealistic in the sense that they were saying ‘Okay, people should hold the keys, which is a big, big, big step. And plus they also run server and plus they also became very expert in liquidity management and whatnot,” explained Argentieri. “I think that hasn’t been a very realistic assumption for how people operate.”

Argentieri founded Ark Labs under the pretext that just as most people didn’t want to deal with using bitcoin on their own for remittance payments 10 years ago, they don’t want to become experts in running Lightning nodes to make payment these days.

“Ark tries to build on top of this assumption that there will be specialized people or specialized enterprises that know how to handle liquidity, and that's what we call Ark servers,” he explained.

“Then you have like the clients — people that only want to send or receive a payment and use bitcoin. They don't really want to get into all the complexity,” he added.

“Ark starts by assuming that not everyone is a peer, so there will be a liquidity provider on one side and a user on the other side. We acknowledge that this is the natural course of things — even though we may not like it.”

Argentieri, a pragmatist, acknowledges that while the centralized design of Ark might not be philosophically flawless, it is effective.

“The goal again was to have a protocol that starts working backwards from the user perspective and not from an ideal scenario,” explained Argentieri.

“If you think from the user perspective, they really just want to have a user experience that looks like Bitcoin on-chain. With Bitcoin on-chain, you just have a key pair. You just create a simple key and, boom, you can receive,” he added, detailing how Ark works.

A Bitcoin Interest Rate

UTXO owners can serve as liquidity providers for Ark, which Argentieri sees as an opportunity, especially for those in the West.

“In the Western world, we know people really are attached to this concept of yield,” said Argentieri.

“Westerners cannot just hold sats in cold storage and be good with it. They really feel that they’re missing something,” he added with a laugh.

To both obtain liquidity for Ark servers as well as to quench Westerners’ thirst for yield, those willing can become liquidity providers to Ark in exchange for a small fee.

“Ark is really like a way to introduce a bitcoin interest rate,” posited Argentieri. “Ark can be a discovery mechanism for a real true native interest rate for Bitcoin.”

Argentieri described how liquidity providers can share a small percentage of their bitcoin holdings via what he terms a “warm wallet,” a wallet that enables users to hold the keys but that Ark still has access to.

The yield would come in the form of transaction fees via the VTXO model. While Argentieri said that some may look at this as “financializing bitcoin,” he simply sees it as a win-win, a way to help scale while providing a small reward to those who provide the liquidity to help do so.

Scaling Horizontally

While a layer 2 solution like Lightning helps Bitcoin scale vertically, Ark helps Bitcoin scale horizontally, according to Argentieri.

“With Lightning, we set up one address and then two people can do an infinite amount of transactions between each other — but that doesn't scale,” he said.

With Ark, a UTXO can provide liquidity for an exponential number of transactions compared to the amount of funds in the UTXO. Argentieri gave the example that 100 BTC can provide liquidity for tens of thousands of virtual transactions.

Not only does Ark enable more transactions, but it’s also usable in many of the ways that Bitcoin itself is usable.

“People are very focused on Ark for payments, but the beauty of Ark is that you retain most of the UTXO capability, which means that you can do 95% of things you can do in Bitcoin right now on ARK,” said Argentieri. “You can do multisig and you can open multiple channels with a single address.”

Argentieri also shared that using Ark is nearly as trustless as using Bitcoin, because even if Ark shuts its servers down, you can still get your sats back on-chain.

“If for any reason the server goes away, censors me or goes offline, the whole virtual transactions tree goes on-chain,” explained Argentieri. “This is what we call unilateral exit.”

The Future of Ark

Argentieri said that Ark is hard at work in preparing to bring Ark Node to market, a B2B enterprise-grade offering that Argentieri described as a “plugin for your LND node” that will help businesses with rebalancing liquidity.

At Bitcoin Amsterdam last month, Ark Labs announced a partnership with Boltz to enable off-chain Lightning liquidity management, with the intention of making swaps faster, cheaper and easier via the Ark Node.

Other than that, it seems Argentieri and the team at Ark Labs have a seemingly countless number of new advancements in the works, though, it will take the company some time to roll these out.

“I'm living inside the action, so I wish to release things every week, but engineering takes time, especially when you are the first one doing these things,” he said.

The plan for now is to remain on mission — the latest state of the mission he embarked on ten years ago.

“We can really have a tangible result within the Bitcoin ecosystem,” concluded Argentieri. “People will see Bitcoin payments get better, and we hope to be part of the reason why that will happen.”

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments