Interest rate hikes in the euro area are already causing a decline in housing investment, the zone’s central bank revealed in a study. While smaller than in the United States, the impact of the monetary policy tightening on the Old Continent is likely to grow further, the regulator expects.

Housing Investment in Europe Declining Amid ECB’s Rate Increases

The series of rate hikes announced by the European Central Bank (ECB) is already depressing housing spending across the eurozone, the monetary authority has established in a study, the results of which were published on its website on Wednesday.

The findings come after in early May the ECB raised its key interest rates by 25 basis points (bps), slowing the pace from previous increases. The bank has raised them by a total of 375 bps since last July, Reuters noted in a report.

The impact of the rate hikes on home purchases in Europe is likely to increase in the future, although it will remain smaller than that in the United States, according to the research, which also covers the American housing market.

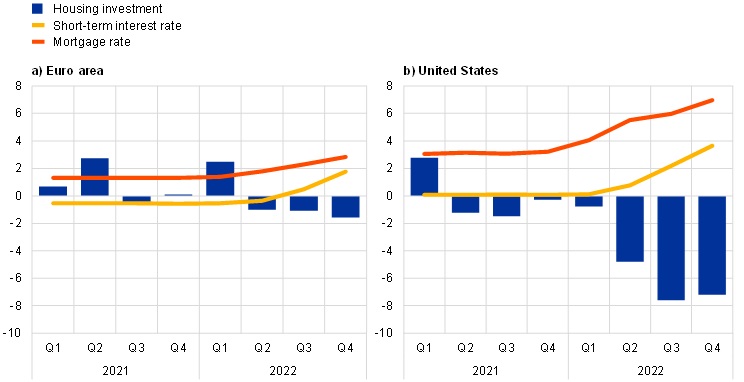

“While housing investment is one of the most interest rate-sensitive components of economic activity, it is generally much less volatile in the euro area than in the United States,” the ECB commented in an economic bulletin article presenting the study.

The European regulator estimates that “a temporary monetary policy shock that increases the short-term interest rate by 1 percentage point on impact leads, all else being equal, to a decline in housing investment in the euro area of around 5% after about three years … However, in the United States, the same shock has a greater impact on housing investment, leading to a drop of around 8%.”

Housing investment in the euro zone began to decline in the second quarter of 2022 and fell by a cumulative 4% by the end of the year. The decline in the U.S. started in Q2 of 2021 and since then housing spending has dropped by around 21%.

On May 3, the U.S. Federal Reserve increased interest rates by 25 bps, stating that some additional raises may be appropriate to return inflation to 2%. Following the latest rate hike in Europe, ECB officials, including President Christine Lagarde and most recently Vice President Luis de Guindos, have indicated that amid stubborn inflation it’s still early for a pause in the tightening in the eurozone as well.

What are your forecasts about the housing markets in Europe and the United States? Tell us in the comments section below.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments