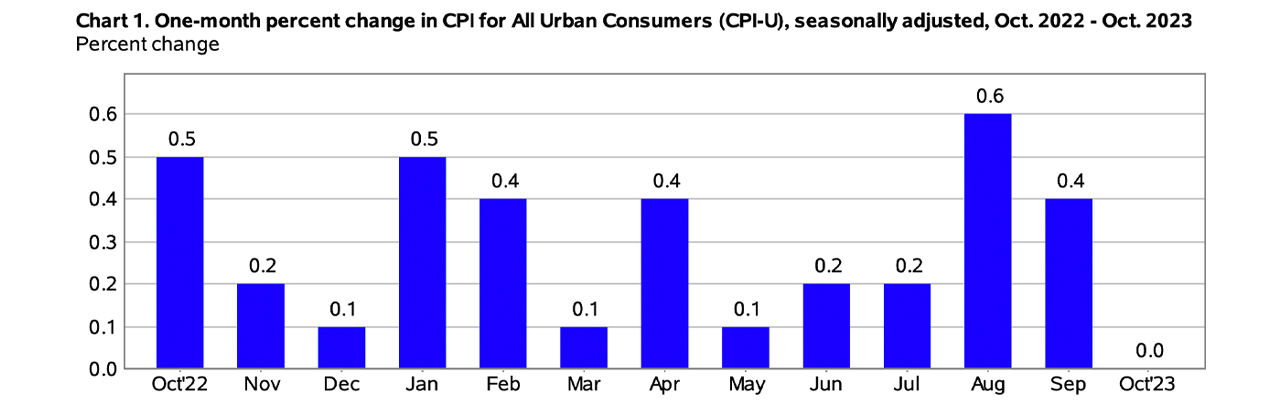

On Tuesday, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers (CPI-U) remained unchanged in October, following a 0.4% increase in September. Over the past year, the all-items index rose 3.2% before seasonal adjustment, marking a notable trend in consumer pricing.

Steady CPI in October Balances Shelter Rise Against Gasoline Drop; Markets and Crypto React With Mixed Sentiments

The October CPI report highlighted a continuous rise in the shelter index, balancing out a significant 5% drop in the gasoline index. This juxtaposition resulted in an overall unchanged seasonally adjusted index for the month. The broader energy index decreased by 2.5%, further contributing to the stabilization of consumer prices, according to the report.

The U.S. Labor Department noted that the food index saw a modest increase of 0.3% in October, continuing its upward trend from a 0.2% rise in September. Notably, the cost of food at home mirrored this increase, while expenses for food consumed away from home rose slightly higher, at 0.4%.

Looking at the 12-month period ending in October, the all-items index’s 3.2% rise represents a deceleration from the 3.7% increase seen in the previous year’s period. Over the past year, the energy index decreased by 4.5%, contrasting with the food index’s 3.3% increase. After the release of the report, the U.S. stock market presented a varied response, with the Dow Jones Industrial Average and the Russell 2000 Index both noting upward movements.

In the cryptocurrency market, sentiments were similarly mixed on Tuesday in the wake of the report. The overall crypto market value dipped by 0.84% in the last 24 hours. In this period, bitcoin (BTC) saw a decline of 0.69%, and ethereum (ETH) decreased by 0.6%. In contrast, the precious metals market experienced growth, with gold prices increasing by 0.6% and silver surging by over 2%.

Currently, the yield on the 10-year U.S. Treasury note stands at a reduced rate of 4.457%. Investors remained uncertain following the announcement of an unremarkable Consumer Price Index (CPI) report, which showed some slowing down. This uncertainty stems from speculation about the U.S. Federal Reserve’s next steps.

“Despite the deceleration, the Fed will likely continue to speak hawkishly and will keep warning investors not to be complacent about the Fed’s resolve to get inflation down to the long-run 2% target,” stated Jeffrey Roach, Chief Economist at LPL Financial, in a discussion with CNBC on Tuesday following the CPI release.

What do you think about Tuesday’s CPI release? Share your thoughts and opinions about this subject in the comments section below.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments