Hi, I'm Jimmy He, here to take you through the day's crypto market highlights and news.

Bitcoin (BTC) slumped for the fifth consecutive day and was changing hands around $19,700, down 4.3% over the past 24 hours.

Some analysts believe bitcoin’s recent dips below $20,000 show the price level is not as critical anymore.

“A move below $17,500-$18,500 support could accelerate the sell-off, while a break of $19,500 may also signal further pain to come,” said Oanda senior market analyst Craig Erlam.

The Crypto Fear and Greed Index dropped six points to 16, the lowest in a week, but remains in the "extreme fear" category.

Nearly all altcoins were down Tuesday, with ATOM declining by the most, down 11% over the past 24 hours. Ether (ETH) was down 7.8%.

Latest prices

●Bitcoin (BTC): $19,453 −5.5%

●Ether (ETH): $1,042 −9.1%

●S&P 500 daily close: 3,818.80 −0.9%

●Gold: $1,724 per troy ounce −0.3%

●Ten-year Treasury yield daily close: 2.96% −0.03

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

More Long-term Bitcoin Holder Confidence Needed Before Market Recovery, Glassnode Report Shows

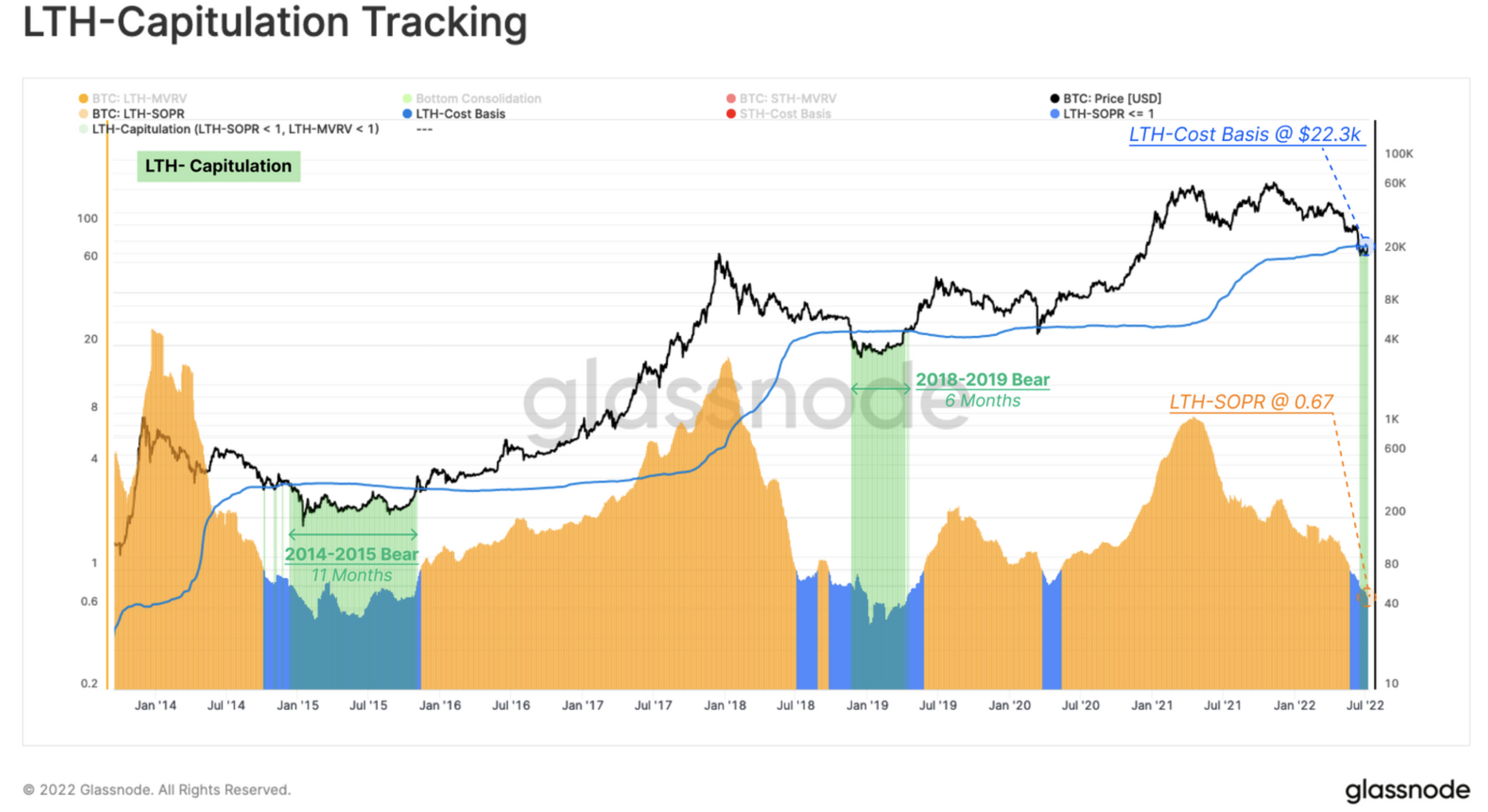

The shaded green regions show periods where the LTH-SOPR is less than 1.0 and the market valuation is less than long-term holders’ cost basis. (Glassnode)

Long-term bitcoin holders are experiencing both actual and unrealized losses and are likely feeling massive selling pressure, the blockchain analysis firm Glassnode wrote in a report.

Actualized losses can be seen by using the Long-Term Holder Spent Output Profit Ratio (LTH-SOPR), a metric that compares the price at which a coin investor sold coins to the cost at which the coins were bought. An LTH-SOPR above 1.0 means that long-term holders are netting a profit.

However, the current LTH-SOPR is 0.67, the lowest since January 2019, meaning that the average long-term holder is selling coins at a 33% loss.

Realized losses can be seen through the long-term holders' cost basis. If the market valuation falls below the LTH-Cost Basis, it means that long-term holders are holding coins at a loss.

Right now, LTHs are, on average, underwater, with an aggregate unrealized loss of 14%.

The immediate consequence of this combination of actualized and unrealized losses is that long-term holders are selling coins, which are then bought by price-sensitive short-term holders, who are less likely to hold coins at a loss.

However, in order for the market to recover, these coins should mostly be held by price-resistant long-term holders.

During the depths of previous bear markets, long-term holders held more than 34% of the crypto supply at a loss while short-term holders held just 3% to 4%. However, short-term investors currently hold 16.2% of the supply, suggesting that more tokens have to be redistributed to long-term holders before the market can emerge from a bottom.

“While many bottom formation signals are in place, the market still requires an element of duration and time pain to establish a resilient bottom,” Glassnode wrote. “Bitcoin investors are not out of the woods yet.”

Altcoin roundup

- Tokensoft Launches Web3-Enabled Platform: The chain-agnostic token sales platform has successfully deployed Tokensoft version 2 on the Ethereum and Avalanche blockchains. Tokensoft said in a press release that the platform is intended to provide a way for customers to sell and distribute their own tokens with increased transparency. Read more here.

- France Starts Second Stage of Wholesale CBDC Experiments: The French central bank, Banque de France, wants a working wholesale central bank digital currency (CBDC) ready to go as early as 2023. Banque de France head François Villeroy de Galhau said the work ensures that France stands ready to bring central bank money as a settlement asset. Read more here.

- STEPN Reports $122.5M in Q2 Profits: The Solana-based game platform reported $122.5 million in Q2 profits even as crypto market conditions have declined in the past few months. The team will use 5% of the profits to initiate a buyback and burn program of its native GMT tokens. Read more here.

Relevant insight

- Listen ????: Today’s "CoinDesk Markets Daily" podcast discusses the latest market movements and takes a look at decentralization's limits in sanctioned nations like Iran.

Other markets

Biggest Gainers

There are no gainers in CoinDesk 20 today.

Biggest Losers

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments