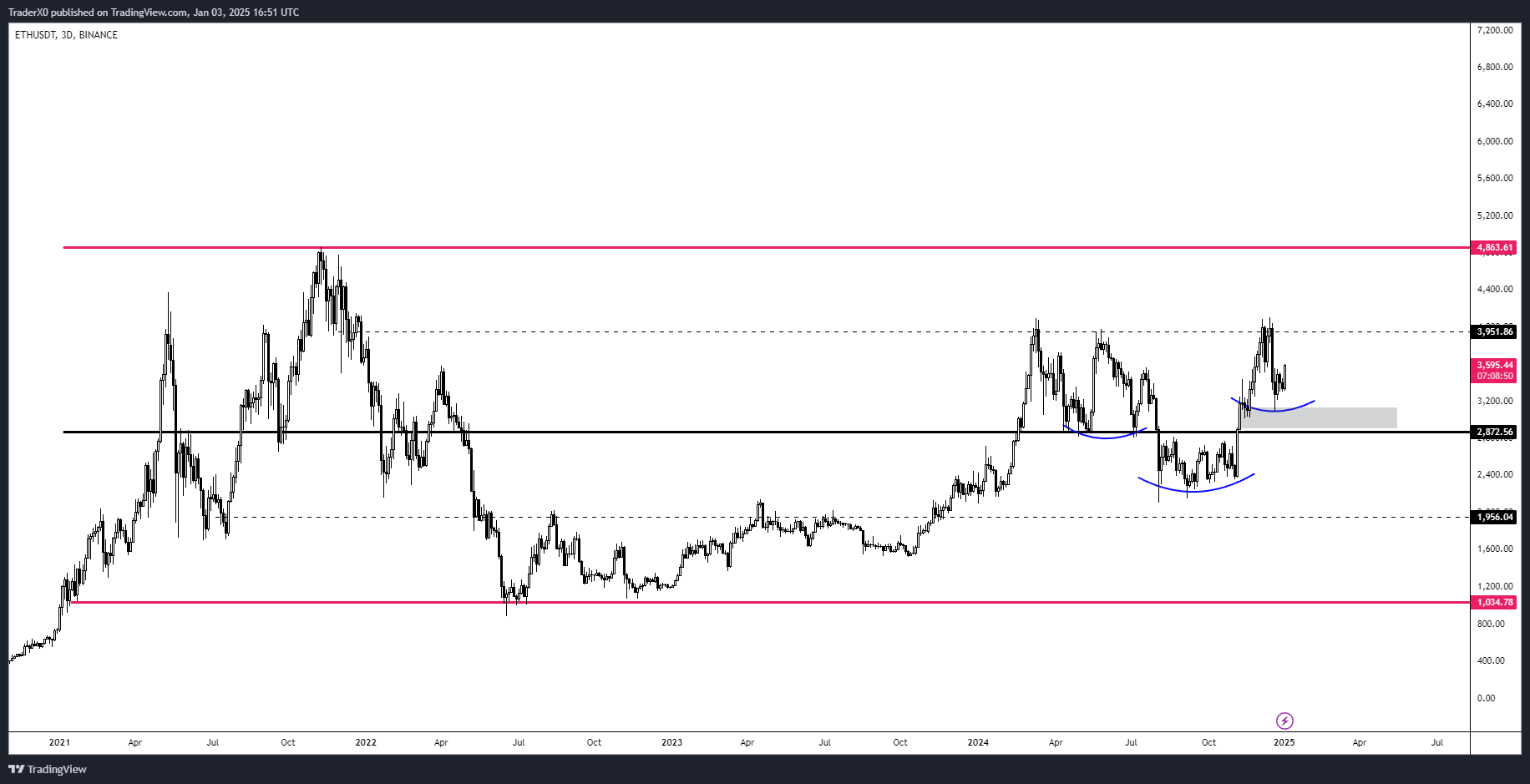

![I've discovered something concerning about Binance [SERIOUS2] I've discovered something concerning about Binance [SERIOUS2]](https://external-preview.redd.it/blS8D2gmsff3jMjwZXHjZ14I9WpZR553Fh4gYhBBGYE.jpg?640&crop=smart&auto=webp&s=c41c2478ac8255f351429378696ebf7f9653a76e) | First of all this is not a FUD post. I'm a simple day trader that discovered something odd in the markets. An anomaly in the charts and numbers Binance provides themself. In this post I want to provide hard evidence of the anomaly and would like to have a discussion about it and what it could lead to especially regarding crypto regulations. FDUSD - the Stablecoin that diddn't exist earlier this year and now dominatesOn 1st August 2023, just a bit more than 3 Months ago this Stablecoin was the first used on Binance and pretty much everything started there about the Stablecoin. Looking at it's history, it was sitting at 20 million market cap without any volume before this date. Immediately a few days later it was at $250 Million USD market cap with a $50m 24h volume. Although odd, it's somewhat understandable considering the huge partnership with Binance and Binance offering 0% maker fees on the pair. But we'll get there later. Here are some more sources about FDUSD, how it works and it's audit : FDUSD latest audit report being fully backed So far nothing wrong with it. Obviously it's a project most likely funded & supported by Binance from the start, ( and oddly timed right after BUSD shut down ) but everything so far seems fine. Pegged, fully backed. But here's what has been very weird over the last weeks that I've noticed and can't stop thinking about. Volume far greater than circulating supplyLet's take a look at the first anomaly. BTC/FDUSD pair on Binance Now take a look at the Volume. Look how incredible fast it grew to a peak today. As of writing right now, the current 24h Volume in FDUSD is $1.658Bn. That number is incredible when we compare it with all the other FDUSD pairs: But what's really interesting is that it even outnumbers BTCUSDT! The most popular and traded spot pair. And not just by a small number, it's actually $0.65bn more. That's +65% more than BTCUSDT. The odd part : There's only 406 Million FDUSD Just for comparison, there are 78 Billion USDT circulating. That is 169x more USDT existing than FDUSD. So every single FDUSD is being traded 4x every 24h right now on paper. The volume has 4x the size of circulating supply.That's just the base stats. Let's take a further look at what's going on with FDUSD : So currently 186/407 Million FDUSD are staked on launchpool. That's almost half of it. While they can be withdrawn at any moment, it's still odd to see that such a high amount is being staked therefore not used in the open market. So I looked on chain how much exists outside of Binance just to see if there might be another large amount not being traded and found out almost the entire supply is in the hands of Binance : I think it's safe to say that a Stablecoin being just created and traded on possibly only 70-75% of it's entire supply, has still a 4x higher volume in 24h than it's entire circulating supply. As a trader I've also noticed myself something odd happening in the last weeks and that's that Bitcoin is way more volatile than it was earlier this year. In fact, exactly once FDUSD started trading heavily, the volatility also accelerated heavily. Chart above you can see ( green ) the volatility of crypto. While there were partly 30-60 minutes of 0.05% price action, we now have a way higher volatility jumping around 0.2% easily in a few minutes. Some might even remember themself looking at the chart and the price barely changed except a few $. Now it keeps jumping around Comparison: BTCUSDT 1h chart from July -> September: BTCFDUSD 1h chart since it started on Binance until right now: BTCFDUSD is WAY MORE volatile than BTCUSDTTo visualize it better, I've removed the entire body of each candle so you can only see the wicks of a 1 minute chart. Those wicks represent the volatility each minute in both directions where BTC was traded outside of the open/close price. This is a very easy way to visualize volatility of an asset. You can see how the FDUSD pair is more "thick" and has more volatility each minute in both directions. Binance 0% Fee offerWhile I can totally understand that the 0% fee offer plays a role in here of traders switching pairs to benefit from it, the 0% fee still have the downside of spread being applied. So let's say you execute a market order ( taker ) to buy 1 BTC at 26500. Market makers now can sell you said BTC for 26505 because you executed an "market order" which is a "taker" order that takes the existing liquidity. So although 0% fees, you still paid a small premium in spread to the market maker. Wintermute and other Market Makers are involvedIt's safe to say at this point that FDUSD pair is heavily dominated by automated trades from Wintermute and other market makers that frequently deposit / withdraw FDUSD from Binance. Just today was another 50m / 5m moving around between both parties. They apply the spreads and "provide liquidity" to "stabilize" the asset in both directions. However, intraday and many proven cases in the past, once somebody larger actually starts selling or many smaller orders are executed, they purposefully thin out the book to apply as much spread as possible. This is btw also the reason why BTC sometimes heavily spikes & plunges - because they thin out order books to add as much spread as possible to the market orders. But to this extent this is somewhat normal and even happens in the traditional highly regulated market. Who profits out of this?Now you could technically speculate, that Wintermute as a market maker, also profits a lot of being able to move the BTC value themself even if it's just 0.5% in a day. Think about it if the Open Interest & Volume is worth Billions, how much profit in spread will they make if they push the price through stop losses and other orders all day? And since they got the control and based on the data perform majority of the trades, there's little risk as well. So Market Makers profit greatly from this and Binance might get a cut from them for providing level 3 data or have an agreement in general. Market makers at the end of the day are paid services from exchanges. BTC being easier to move = easier to fill orders / run stops = more spread to get appliedA bit speculation here: The chart above is Level 3 Data across all exchanges and shows where most liquidity is sitting when it comes to liquidation / stop losses. The more transparent the areas around the candle chart is, the more liquidity. Ranging from low visible dark blue -> green -> bright green -> yellow -> white. The yellow part for example, below 24k, is liquidation notional value of over 2 Million BTC so ~47,7Bn. This is mostly caused because the price hasn't moved there since 14th march, over 6 months ago so many traders & investors that bought since then are not expecting price to hit there placing their liquidation level / stop loss there. Now check out where most spikes / plunges moved to and bounced off immediately... almost like the price is looking for those liquidations, hits them, and immediately runs back. Let's say I'm a Market Maker and I profit of spread that can be applied the easiest to market / stop loss / liquidation orders, what if I move the price into those zones, fill all the orders, and immediately sell/buy back to cover the cost for the initial move? Just something to keep in mind Conclusion & Summary:This is all based on market data & intraday trading experience, backed up by charts & on chain numbers. It's safe to say that Binance has artificially increased the volatility of Bitcoin spot trading. Additionally, it's safe to say that Market Makers are the reason for the high volatility moving the price around quickly each minute to fill orders. While it doesn't look that special from the outside, if you are looking deeper into it this is clear market manipulation. There's nothing organic about this except a few traders that obviously jump in to make profit. But when the pair was created only a few months ago and is now dominating the entire BTC price action while most trading is in control of market makers? That's very far away from the traditional organic supply & demand price action and screams manipulation. The problem is, I don't know myself what to think about this. Why is Binance doing this ? What's the point? Why are they artificially increasing volatility ? They make profit of the fees therefore they might've done it to keep BTC interesting / volatile while profiting of a share from market maker profit but that feels so wrong considering all the regulatory pressure especially when it comes to delays in the BTC SPOT ETF's by the SEC that clearly signaled that the price "might be too manipulated for the normal consumer". On paper, Binance should actually lose / miss out on profit because of this. Since the USDT pair has actual fees, especially on derivative / futures which include leveraged fees, it's odd to see them promoting and pushing a new pair that should make them absolutely 0% profit for MONTHS now. What are your thoughts on this ? [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments