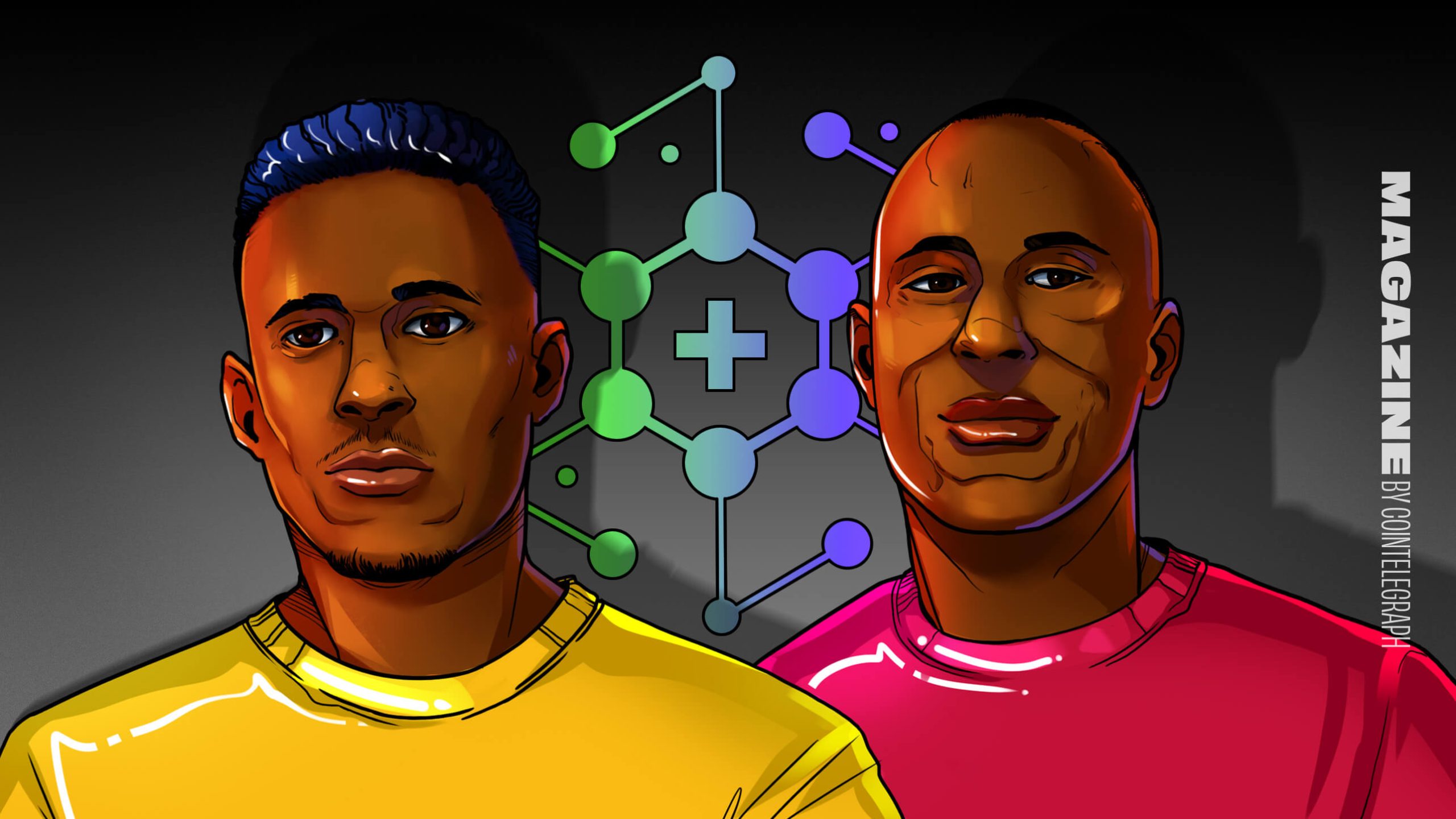

On September 18th, 2023, Chainlink's Co-Founder Sergey Nazarov was on NASDAQ's Trade Talk to discuss the future of Web3 and banks moving on chain.

He goes on to say, "Chainlink's collaboration with SWIFT and more than a dozen leading financial institutions proved that you can use existing bank infrastructure like SWIFT and SWIFT messages to easily connect to hundreds of chains with a very minimal amount of effort from banks. This means that banks can go onto hundreds of chains very efficiently. The second thing that it proved is that multiple chains, both public and private, can be connected efficiently and reliably for those banks to transact with each other. And the final thing that it proved is that those private chains can transact with those public chains effectively, meaning that value from the private bank industry can flow into the public blockchain industry which I think will have a very important impact on both the banking world, and the public blockchain world. "

A couple other smaller quotes from this interview that stood out to me were these.

- "Every bank will likely have their own chain, and at least 1 stable coin. Every bank will probably have 100’s of real world asset tokens that they all generate.”

- "CCIP will allow any chains built with different technologies on different systems to interact with each other." (We already know that's what CCIP basically is, but for the people who don't know much about LINK it can be nice to see explained).

I'm curious about every major bank having their own chains and stable coin. Would these stable coins just be paired to USD like the majority already are, or the potential USD CBDC? Which, if the USD CBDC exists, why wouldn't banks just be using that over creating their own stable coins? Perhaps I can understand having their own chain for RWA's and tokenization, but I feel like (at least in the US) the government will want the banks all on the same page with their currency.

The plan isn't to recreate the banks infrastructure, but to build on top of it.

- "Banks have made a very large investment in the security of their infrastructure and they’ve trained a lot of people to use that infrastructure, which is very different from startups that began their entire journey on the blockchain so they have no existing systems that they have to keep secure."

How do you envision cross-chain banking? Sergey truly seems to believe that LINK and their CCIP will connect the entire global finance world on chain in a similar fashion that TCP/IP did with the internet.

Is it possible for banks having their own chains, and potentially their own stable coins to be enough to eliminate the need for full blown CBDC's?

Do you agree and think this can all come to fruition, or is Sergey and the team dreaming too big here?

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments