Not financial advice.

Greetings All,

This is my 19 month update since I first took out an unsecured personal loan to buy Bitcoin. You can find my previous updates in my post history. The first is from June 2022.

A lot has happened since my last update, so I’ll get right to it…

First off, I managed to completely pay off my 2nd loan of $20,000!

Work has been better than usual and I had a big job in December that netted me a $12,000 windfall of which the entirety was put towards my loan balance.

Next I decided to buy even more Bitcoin by taking advantage of some really awesome Credit Card Balance Transfer offers that appeared in August/September…

Two of my credit cards were offering 0% APR for the first 18 and 21 months with a one time 3% and 5% transfer fee respectively. I also opened a new card that was offering a similar deal and was approved for a $12,000 limit. That combined with my previous two credit card brought my total to $40,000 in balance transfer potential.

Balance transfer offers are great because they allow you to simply write a check to yourself and cash it in your bank account like any other check. Also, I’m only responsible to pay 1% each month, so servicing it is really easy.

I ended up using $35,000 in balance transfer loans and buying 1.35 Bitcoin at an average price of ~$26,500. This brings my total amount of Bitcoin purchased with loans to 4 Bitcoin!!!!

With the balance transfer monthly payments, plus the previous loans, my total monthly cost to service all these loans is ~$800.

I can easily afford this. In fact, I’m putting almost double that towards these loans each month to pay them down aggressively so I don’t end up paying a lot of interest when it’s all said and done. I plan to have everything paid off in less than two years.

*****************************

As of today, of the combined loans / balance transfers I have a total remaining balance of ~$56,000.

It works out like this:

$21,000 remaining balance from unsecured personal loan.

$35,000 from new balance transfer loans.

This brings the total amount of loans that I’ve taken out so far to $94,000. I’ve paid a total of ~$4,500 in interest to date, which brings the total cost basis of these loans to ~$98,500 as of January 24th, 2024.

I have acquired a total of 4 Bitcoin at an average price of ~$24,625 per coin: $98,500 / 4 = $24,625.

As of today, January 25th, 2024, the current price of Bitcoin is ~$40,000.

This brings the total value of the Bitcoin I acquired from loans to $160,000.

This represents an unrealized USD profit of ~$61,500.

The math is simple: $160,000 - $98,500 = $61,500

Lastly, I’m officially done taking out loans and balance transfers. I have a nice round number of Bitcoin from loans, plus my personal stack which I’ve been slowly adding to from earned income. Now it’s time to focus on paying everything down over the next 2 years with earned income. I have no desire to sell my Bitcoin regardless of how high its price goes.

Let me know if you have any questions.

Not financial advice.

[link] [comments]

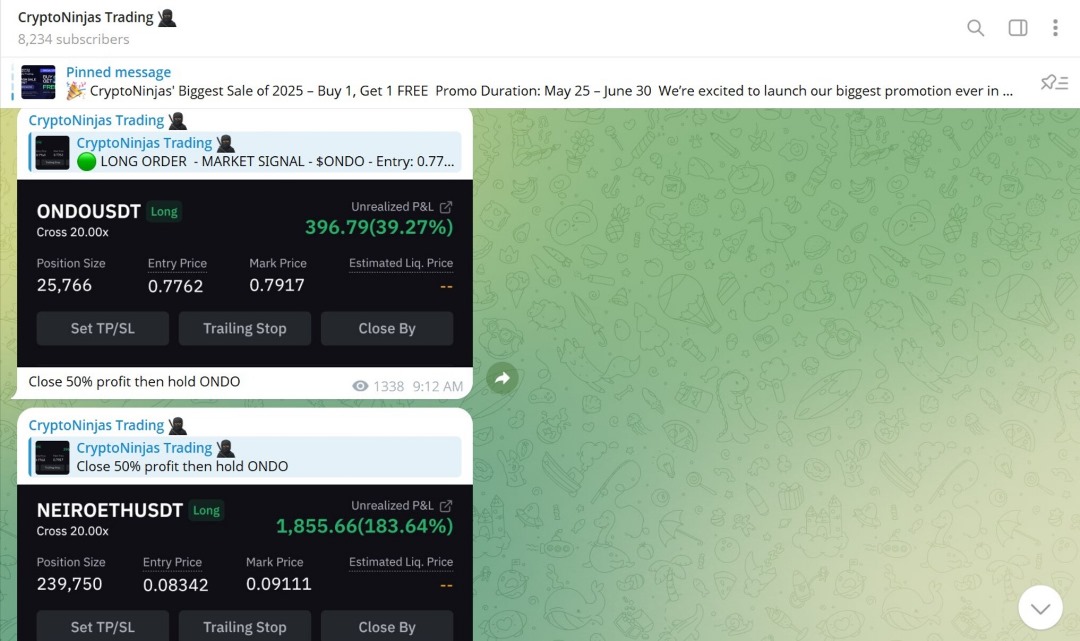

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments