The 1inch exchange is a non-custodial decentralized exchange (DEX) aggregator and liquidity provider that displays the prices and liquidity available on multiple exchanges helping crypto investors discover the best rates and lowest fees for their trades. The system accommodates the investors' needs and finds the best exchange rate across many platforms.

& 1INCH is the platform's native token that serves as a utility and a governance token. Holders of the 1INCH token can use their voting power to decide on various parameters of the 1inch network, including the governance reward, the swap fee for the liquidity protocol, the price impact fee, etc. The platform supports staking 1INCH tokens to supply liquidity to the 1inch liquidity pools and earn rewards.

Read on to learn everything you need to know about the 1inch project and the 1INCH token and proceed for our tutorial on how to buy 1inch on the best cryptocurrency exchanges in the market.

Let's get right to it!&

Where to Buy 1inch

Since 1inch is amongst the world's top 150 cryptocurrencies, 1inch tokens are listed on almost all major cryptocurrency exchanges, including:

- Binance

- Coinbase

- Huobi Global

- FTX

- KuCoin.

The process of buying the 1inch token is similar on all cryptocurrency exchanges. Below, we'll look into buying 1inch on Binance and Coinbase, two of the world's most popular crypto exchanges.

How to Buy 1inch on Binance

Binance is the world's largest crypto exchange in terms of trading volume. It has one of the lowest fees, a vibrant Peer-to-Peer (P2P) platform, and high liquidity. Follow the steps highlighted below to purchase 1inch on Binance.&

Create a Binance Account

To purchase cryptocurrency on Binance, you must create an account if you don't already have one. Creating a user account on Binance is simple - you must enter a valid email address and provide a phone number to set up two-factor authentication. After that, you must create a strong password, and your Binance account will get activated.&

However, to take advantage of all Binance features, you must complete your KYC verification by uploading a government-issued ID and undergoing facial verification. The entire process takes only a few minutes, and you're all set to buy 1inch tokens upon completion.

Deposit Funds

You can deposit crypto directly into your Binance account to purchase 1inch. BTC, BUSD, or USDT are the trading pairs for 1INCH tokens.& Binance also supports fiat currencies and accepts payment methods such as debit/credit cards, bank deposits from your bank account, and third-party payments such as Simplex. The fees for buying crypto through the methods described above vary, so you should check them before making a purchase is highly recommended.

Buy 1inch Tokens

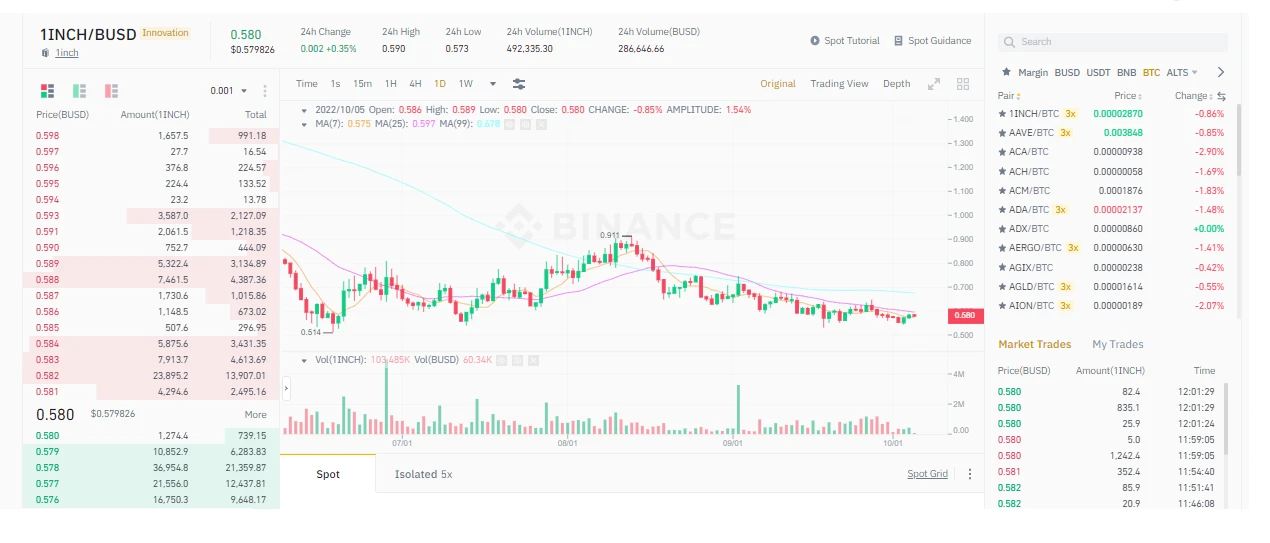

Once you've deposited the required amount of funds, the next and final step is to buy 1INCH tokens.&

- Go to Markets and search for 1INCH.&

- Select 1INCH/BUSD, 1INCH/BTC, or 1INCH/USDT, depending on which trading pair you wish to buy 1inch against.&

- Enter the number of 1inch tokens you wish to buy and click on Buy 1INCH.&

- The order will be filled instantly for the market price, and your newly purchased 1INCH tokens will be reflected in your spot wallet.&

Remember that users in the US must use Binance.us, which isn't available in all US states.&

Buying 1inch on Coinbase

Coinbase is the largest exchange in the US and the second-largest in the world by transaction volume, after Binance. & Coinbase has attracted beginners to the platform thanks to its robust security features and 24/7 customer support. The exchange allows users to buy crypto directly through bank deposits, credit/debit cards, or a wire transfer. The following steps will guide you on buying 1inch tokens on Coinbase.

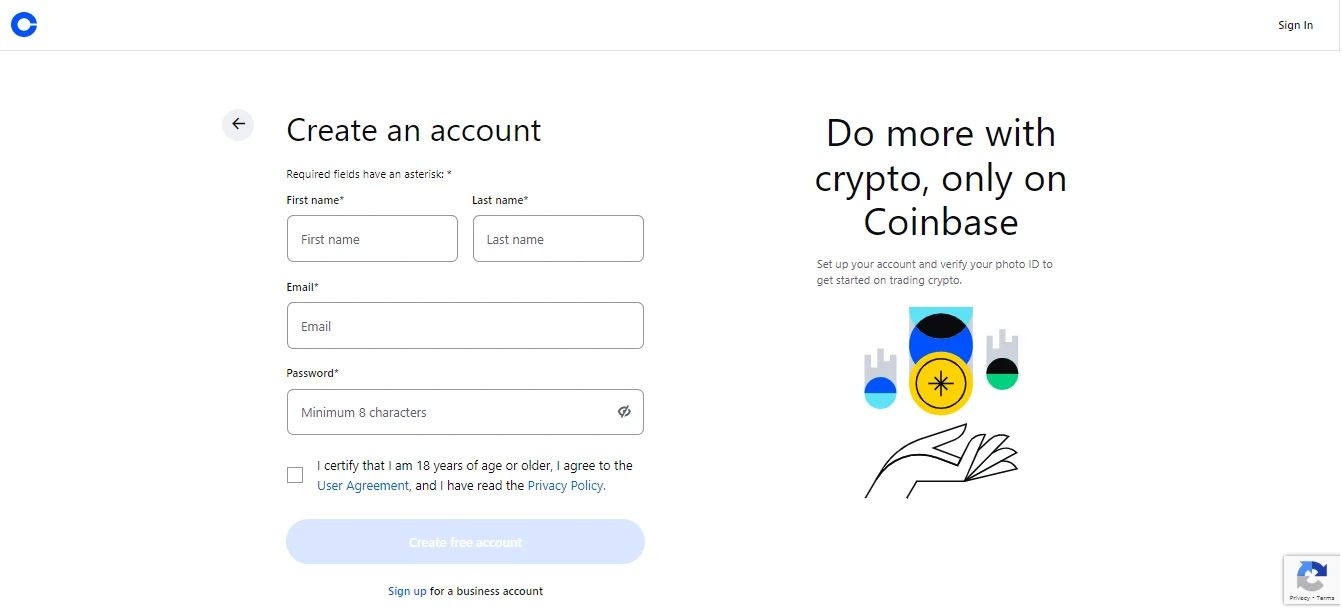

Create a Coinbase Account

Like on Binance, the first step is creating a Coinbase account. In so doing, you must enter a valid email address and a phone number. Coinbase complies with Anti-Money Laundering and KYC regulations. In line with the regulations, Coinbase users must verify their identities by submitting a government-issued passport, driver's license, or national identity card.

The verification process usually takes only a few minutes, and once it's completed, you can start trading cryptocurrencies on the platform.

Add Payment Method

Coinbase supports a wide range of funding options, including direct transfers from your bank account, debit cards, PayPal, and wire transfers, depending on your location.

Funding your Coinbase account using debit cards is ideal for small purchases, while wire transfers are preferable for more significant amounts, over $25,000. Before choosing a deposit method, consider its fees and limits. You can also use cryptocurrencies to fund your account by transferring them to your Coinbase wallet. Coinbase fees can be confusing, and some variations exist depending on your region.

You can't deposit dollars to Coinbase, but you can buy Bitcoin worth the amount you want to deposit and then trade Bitcoin for 1inch instead.

Buy 1inch

Go to buy and sell on the Coinbase.com website, click on Buy and search for 1inch. You'll see a chart, the asset's brief description, and other metrics like its market cap, transaction volume over 24 hours, total supply, etc.

Scroll down to submit a buy order for 1INCH tokens, input the amount used to purchase 1inch, and Coinbase’s algorithm will automatically calculate the number of tokens you'll get based on its current trading value.

Double-check and confirm the details before you click the submit button. Upon submission, the order will be processed immediately.&

Coinbase supports swapping your cryptocurrencies for 1INCH tokens. Users should navigate to the order box and select the convert button. Select the cryptocurrency you want to swap for 1inch, and enter the amount in US dollars. Confirm the details and click submit.&

Congratulations! You've successfully purchased 1INCH tokens, and they'll reflect in your Coinbase account.

Storing Your Tokens

While crypto exchanges enable you to trade cryptocurrencies using their own built-in wallets, experts highly recommend storing your precious coins away from exchange wallets, as those might be susceptible to hacks and interference.&

We highly recommend creating a personal wallet with your own set of keys. You might choose between software and hardware wallets depending on your investing preferences.

Software Wallets

If you’re looking to trade 1inch regularly, software or hot wallets provided by your selected crypto exchange will suit you. The strength of software wallets lies in their flexibility and ease of use. A software wallet is the most easy-to-set-up crypto wallet and lets you easily interact with several decentralized finance (DeFi) applications. However, these wallets are vulnerable to security leaks because they're hosted online. So, if you want to keep your private keys in a software wallet, conduct due diligence before choosing one to avoid security issues. We recommend a platform that offers 2-factor authentication as an extra layer of security.

The best software wallets include CoinStats Wallet, MetaMask, Coinbase Wallet, Trust Wallet, and Edge Wallet, among others.

Hardware Wallets

Hardware or cold wallets are usually considered the safest way to store your cryptocurrencies as they offer offline storage, thereby significantly reducing the risks of a hack. They are secured by a pin and will erase all information after many failed attempts, preventing physical theft. Hardware wallets also let you sign and confirm transactions on the blockchain, giving you an extra layer of protection against cyber attacks. These are more suitable for experienced users who own large amounts of tokens.

Ledger hardware wallets are arguably the most secure hardware wallets letting you securely manage your digital assets. The Nano X is designed for advanced users and offers more storage space and advanced features than Ledger Nano S,& designed for crypto beginners.

A hardware wallet is more expensive than a hot wallet, with prices ranging between& $50 - $200.

Examples of cold wallets are Trezor Model T, Ledger Nano X, CoolWallet Pro, KeepKey, Ellipal Titan, and SafePal S1, amongst others.&

Tracking Your Tokens

The crypto market is volatile, and managing your portfolio could get tricky if you hold multiple assets. Utilizing a portfolio tracker will help you keep track of your 1INCH tokens and all your crypto investments from one platform at all times. CoinStats offers one of the best crypto portfolio trackers in the market; you can find more information here.&

You can also monitor the profit, loss, and liquidity of 1inch across several exchanges on CoinStats.

CoinStats supports over 250 cryptocurrency exchanges and over 7,000 cryptocurrencies. It offers charting tools, analytical data, advanced search features, and up-to-date news. Here you have the opportunity to connect an unlimited number of portfolios (wallets and exchanges), including:

- Binance

- MetaMask

- Trust Wallet

- Coinbase

- Kraken

- Kucoin

- Bitstamp and 500 others.&

To connect, go to the CoinStats Portfolio Tracker page and:

- Click Add Portfolio and Connect Wallet.

- Click the wallet you want to connect to (e.g., Ethereum Wallet).

- Input the wallet address and press Submit.

Now that you know how to buy, store, and track your 1INCH tokens, let's look into the 1inch network and explore why buying 1inch tokens is a good investment.&

1inch History

1inch exchange was created by Sergey Kunz and Anton Bukov, now the platform's CEO and CTO. They first launched their own decentralized exchange (DEX) named Mooniswap (a version of UniSwap) before switching to their own liquidity protocol and creating the 1inch DEX aggregator.

In 2020 the executives launched a Seed round, raising over $2.8 million from Binance Labs and another $12 million in the second funding round led by Pantera Capital.

What Is 1inch Network

1inch is a decentralized exchange (DEX) aggregator that aims to find the most efficient swapping routes across leading decentralized exchanges. It saves users' money by finding the best prices and fastest transactions stored on the Ethereum blockchain and facilitated without an intermediary.

The 1inch network uses the Pathfinder API, a routing algorithm, to find the best trading path for a token swap across multiple markets while considering gas fees.

The 1inch liquidity protocol sources liquidity across three blockchains: Ethereum, Binance Smart Chains, and Polygon. You can read more about the 1inch protocol and how it works in our detailed "1inch review."

1inch Token Price and Tokenomics

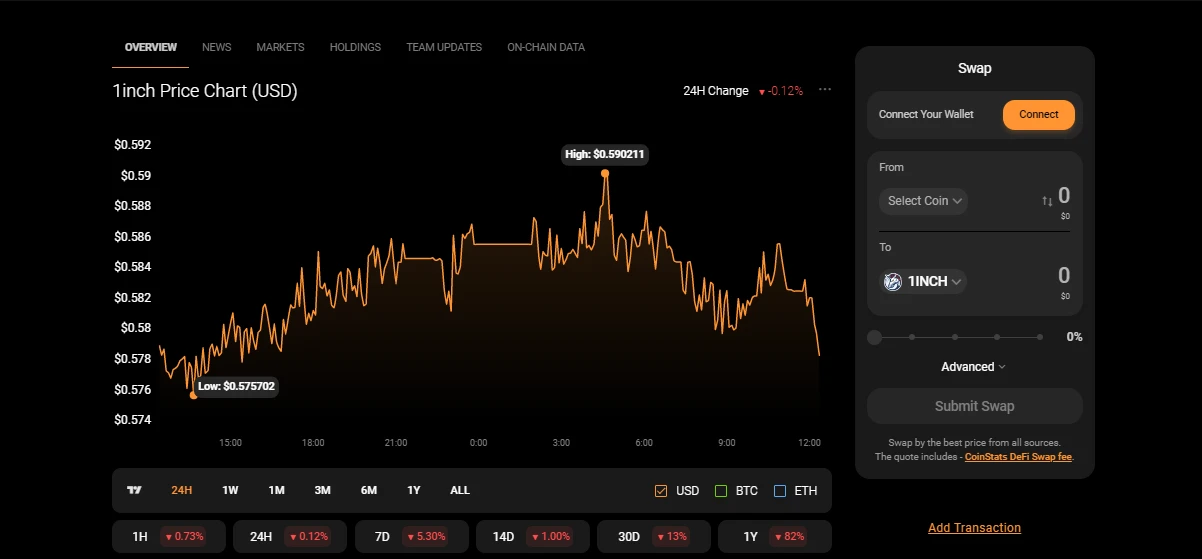

1INCH token, the native governance and utility token of the 1inch protocol, was launched on December 25th, 2020. Check the 1INCH token current price on CoinStats at 1inch price.

According to the 1inch website, the total supply of 1INCH tokens is 1.5 billion. 30% of the total supply will go to community incentive programs, 14.5% is reserved for the network's growth and development, and the remaining tokens are controlled by the DAO and distributed to backers and core contributors.

The 1inch token reached an all-time high price of USD 7.86 on October 21st, 2021; since then, it has fallen more than 90 percent.

Conclusion

1inch exchange occupies a unique position among decentralized exchanges, as it compares exchange rates between multiple platforms to provide the best possible options to investors. The exchange allows you to earn 1INCH tokens by participating in liquidity mining programs or providing liquidity to the 1inch pools. If you want to learn about decentralized finance and how to make the most of it, read our guide "What Is DeFi."

Disclaimer: The information contained on this website is provided to you solely for informational purposes and does not constitute a recommendation by CoinStats to buy, sell, or hold any security, financial product, or instrument mentioned in the content, nor does it constitute an investment advice, financial advice, trading advice, or any other type of advice. This is not a recommendation to employ a particular investment strategy.

Cryptocurrencies are speculative, complex, and involve significant risks – they are highly volatile and sensitive to secondary activity. Performance is unpredictable, and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice before relying on this information. Cryptocurrency is a highly volatile market, do your independent research and verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any decision.

There are significant risks involved in trading CFDs, stocks, and cryptocurrencies. You should consider your own circumstances and take the time to explore all your options before making any investment.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments