Bitcoin price is still trading at more than $25,000 less than the local highs set earlier in the year, and bulls have a lot of ground to reclaim.

However, the lost ground might not be so bad after all, as it has brought the current market cycle a lot closer to past bull cycle comparisons, which could shed some light on what’s left for Bitcoin in terms of price action in the months ahead.

Bitcoin Collapse Puts Market Cycle On Par With Previous Bull Run

Following a sharp more than 55% decline across the board in cryptocurrencies &- even the top dog Bitcoin &- the market is mixed on whether or not the bull run has ended and if a new bear market has begun.

The standard definition of a bear market in “securities” is a 20% or more decline. By those standards Bitcoin is in a bear market every other week and has been in one since April 2021.

Related Reading | The Fibonacci Sequence And Why $30K Bitcoin Is So Important

The massive plunge was among the worst monthly declines on record and the most devastating Q2 in crypto history &- and it might have been enough of a drop to prevent a full fledged crypto bear market.

It also has brought prices back down to a level that’s a lot more on par with past bull market cycles.

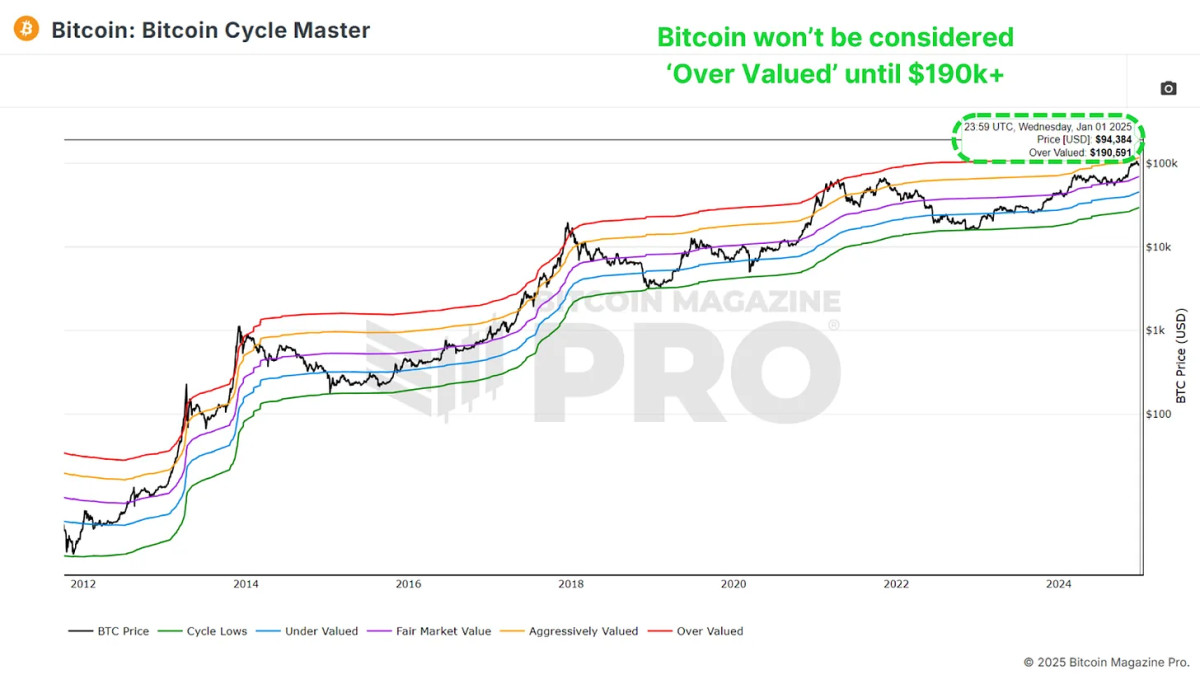

The recent crash put this cycle on par with the last | Source: BLX on TradingView.com

Will The Parabolic Curve In Crypto Behave The Same Way Again?

The chart above takes an exact carbon copy of the 2016 and 2017 bull market, and juxtaposes it over the current market cycle. A similar parabolic curve is drawn to show the possible trajectory.

From 2015 through 2018, Bitcoin price grinded against the support curve the entire way up. There was very little divergence from the rounding, upward trending line.

Related Reading | Why The Next Bitcoin Bear Market Will Be The Worst Yet

There’s no denying this recent market cycle is very different than the last, but the recent 55% collapse has made things a lot more similar in scope.

Much like in early 2019 Bitcoin price deviated away from the curve, then overcorrected back down to it, the leading cryptocurrency by market cap could have done the very same thing from April through the recent bottom put in around the start of this month.

There’s still some room between today and the next bump into the parabolic curve. This could suggest there’s more sideways ahead, but further downside is likely limited thanks to what has already been a large enough correction.

Follow @TonySpilotroBTC on Twitter or via the TonyTradesBTC Telegram. Content is& educational and should not be& considered investment advice.

Featured image from iStockPhoto, Charts from TradingView.com

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments