Summary:

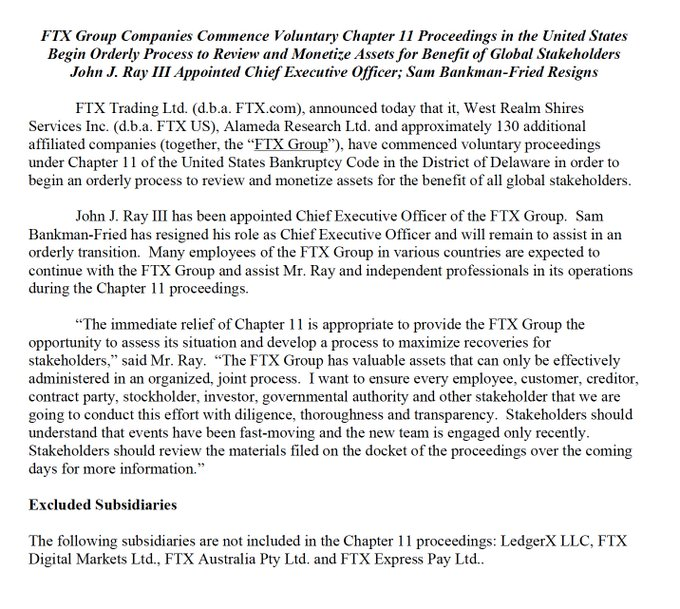

- FTX has filed for bankruptcy after pausing withdrawals earlier.

- The chapter 11 bankruptcy filing includes FTX US, Alameda, and around 130 other affiliated entities.

- Founder and CEO Sam Bankman-Fried has also resigned.

Cryptocurrency exchange FTX filed for chapter 11 bankruptcy under the United States Bankruptcy code after a botched bailout deal with Binance and a massive “liquidity crunch”.

FTX.US, the American subsidiary of Sam Bankman-Fried’s crypto exchange giant, and his trading firm Alameda Research are included in the filing, per Friday’s official announcement. Over130 other affiliated companies are included in the proceedings as well.

Bankman-Fried has stepped down as CEO but will remain to “assist in an orderly transition”, Friday’s statement read. SBF’s $32 billion fortune evaporated following revelations about massive illiquid assets on Alameda’s balance sheets. A report from Reuters said Bankman-Fried sent billions in customer funds to his trading giant.

What next for FTX?

The chapter 11 filing affords Bankman’s entity an automatic global moratorium. In other words, creditors are legally restricted from claiming any debt or pursuing legal recovery. The crypto and trading entity also has 120 days to submit a recovery plan to the Delaware District court.

In place of Bankman, John J. Ray III will assume leadership as CEO. Entities like LedgerX, Express Pay, and the exchange’s Australia division were excluded from the filing.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments