Price Point: Bitcoin was holding onto gains after the U.S. GDP report early Thursday, changing hands at just above $23,000. Another crypto exchange succumbs to this year's contagion, as Zipmex files for bankruptcy protection in Singapore.

- Just In: The U.S. gross domestic product declined at an annualized pace of 0.9% in the second quarter, marking two consecutive quarters of economic contraction, Helene Braun reports. One widely used definition for a recession is when GDP contracts over two consecutive quarters. However, many economists – and even Federal Reserve Chairman Jerome Powell at a press conference on Wednesday – have refrained from calling a recession.

Market Moves: The crypto options market is abuzz as traders scramble to place bets ahead of Ethereum's upcoming "Merge," with open interest in the contracts now at a record.

Chart of The Day: Ether has crossed above the Ichimoku Cloud for the first time since April in an early sign of bullish revival.

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Price Point

Bitcoin (BTC) was mostly holding steady early Thursday amid a classic risk-off move in traditional markets after data reported by the U.S. Bureau of Economic Analysis showed the world's largest economy contracted in the second quarter.

While bitcoin declined from $23,200 to $22,600 in a knee-jerk reaction to the data, the cryptocurrency was still up 7% on a 24-hour basis and was back over $23,000 by press time.

In traditional markets, the U.S. dollar index, which tracks the greenback's value against major fiat currencies, fell 0.3% to 106.60, and the 10-year Treasury yield slipped by five basis points (0.05 percentage point) to 2.74%.

Ether (ETH) traded near $1,360, representing an 11% gain. According to data from Coinalyze, bearish futures positions worth $200 million have been liquidated in the past 24 hours. The forced closure may have added to the increase in ether's price.

Meanwhile, the number of open positions in ether options market rose to a lifetime high of nearly 4 million as traders piled into call options or bullish bets on optimism the impending “Merge” would bring the bitcoin-like store-of-value appeal to the second-largest cryptocurrency. (Read more on this below in Market Moves.)

Zipmex files for bankruptcy

The troubled crypto exchange Zipmex filed applications in Singapore seeking bankruptcy protections amid the threat of legal actions from creditors. Such filings in Singapore grant relief for 30 days or until the Singapore Court makes a decision on the application. Last week, the Singapore-based exchange blocked users from taking direct custody of their coins, sparking fears of an eventual bankruptcy.

Nirvana Finance, a Solana-based yield protocol, suffered a $3.5 million exploit, with attackers using flash loans to drain its liquidity pools. Nirvana’s native token crashed on the news and its NIRV stablecoin lost the dollar peg, falling to 8 cents.

Bipartisan legislation that could establish U.S. regulations for stablecoins has formally been delayed until after the August congressional break. The Treasury Department won’t endorse the bill unless it also ensures the industry exchanges keep their money separate from the companies’ assets, which would protect them if the firms fail, CoinDesk reported.

A study published by the European Central Bank early Thursday said the central bank could set a limit on the number of digital euros in circulation to prevent outflows from traditional banks. Economists put an estimate of optimum amount of digital euros in circulation between 15% and 45% of the gross domestic product.

Elsewhere, the Law Commission of England and Wales – a statutory independent body tasked with reviewing and updating the law – said it wants to apply personal property rules to crypto and non-fungible tokens. That would make it easier for crypto investors to sue in case of losses suffered due to hacks or scams.

Biggest Gainers

Biggest Losers

There are no losers in CoinDesk 20 today.

Market Moves

Ether options market abuzz ahead as 'Merge' Optimism Drives Demand

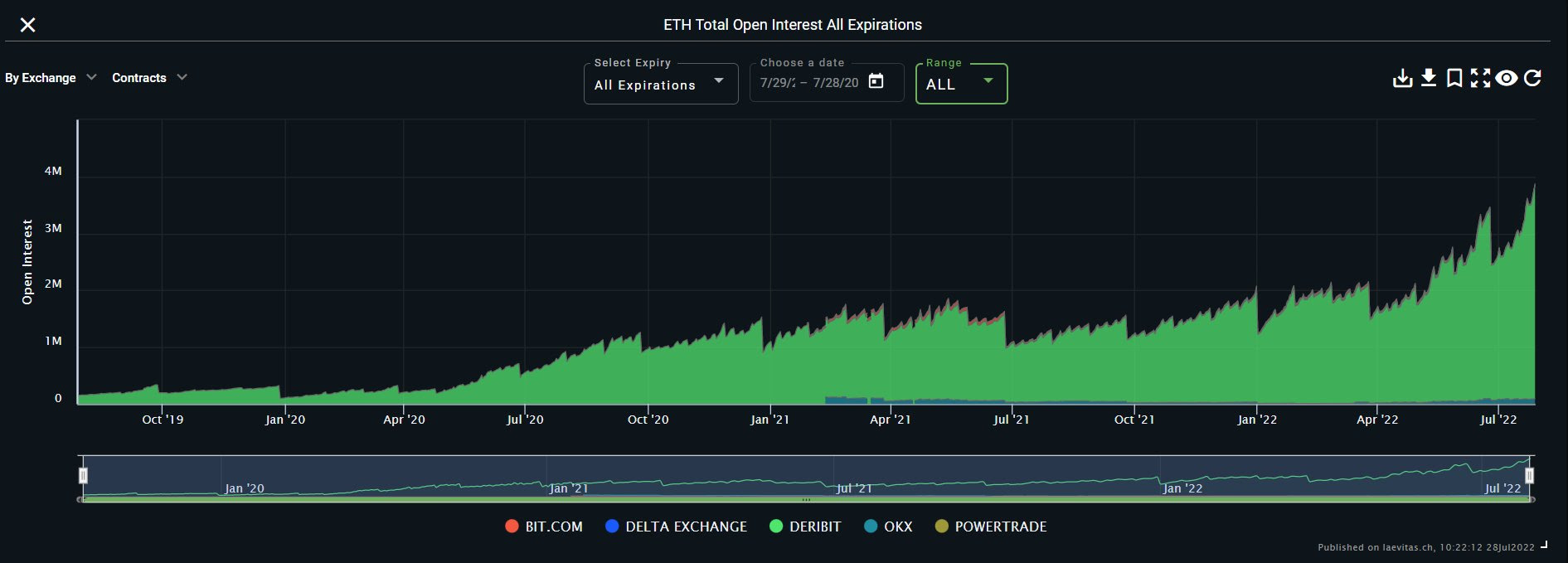

Open interest in ether options market has been rising ahead of Ethereum's Merge, expected in September (Laevitas)

The number of open positions in ether's options market has reached a record high as an updated timeline for Ethereum's long-awaited supposedly bullish software update known as the Merge has spurred demand for call options.

Open interest, or the number of options contracts traded but not squared off with an offsetting position, stood at a new lifetime peak of nearly 4 million, according to data from major exchanges, including Deribit, tracked by Swiss-based derivatives analytics firm Laevitas. The previous peak of around 3.5 million was registered in the second quarter.

"The desk has traded an incredible amount of ETH calls this week, over 250,000 ETH notional," Singapore-based options trading giant QCP Capital noted in a Telegram chat.

"A few hedge fund names have been large buyers of the ETH calls and the overwhelming demand has brought September volumes up to 100%," the trading firm said, adding, "We expect this demand to continue as we approach the Merge in September."

Chart of the Day

Ether tops the Ichimoku Cloud

The chart shows ether's bullish breakout above the Ichimoku Cloud. (TradingView)

- Ether has crossed above the Ichimoku Cloud for the first time since April in an early sign of a bullish revival.

Crossovers above or below the Cloud, created by Japanese journalist Goichi Hosoda in the late 1960s, are widely taken to represent early signs of a bullish or bearish trend change.

The indicator comprises two lines – the leading span A and the leading span B – plotted 26 days ahead of the last candle to indicate future support or resistance.

Ether has resistance at $1,782, the 100-day simple moving average. On the downside, the red line or the leading span B of the Ichimoku Cloud at $1,520 could offer support.

Latest Headlines

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments