Ethereum has fallen below its $1,600 support level and has displayed bearish sentiment on the chart. Broader market weakness has also contributed to Ethereum’s current price action.

Bitcoin had fallen to the $20,000 price mark and altcoins depicted similar price movements.

Ethereum over the last 24 hours depicted some minor appreciation on the chart. The altcoin’s technical outlook remained bearish.

Buying strength had fallen over the past two days and at press time the coin ‘s movement was dominated by sellers.

Continued selling pressure can pull ETH to the $1,100 price level before it starts to pick up momentum again.

In case the bulls find their way back into the market, ETH might continue to consolidate on its chart and then try to rise.

Buying strength also has to recover significantly for Ethereum to invalidate the bearish thesis. Over the last week, Ethereum lost 4% of its market value.

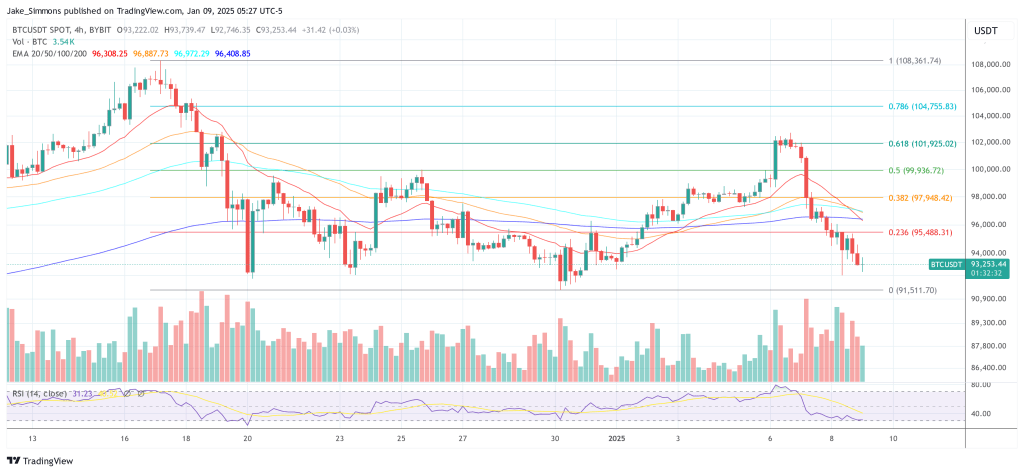

Ethereum Price Analysis: Four Hour Chart

ETH was exchanging hands at $1472 at the time of writing. After Ethereum witnessed a sharp fall, it tried to recover slowly but bearish pressure was still strong in the market.

Overhead resistance for the altcoin was at $1,542 and a current fall in price will drag ETH to $1,260.

For bearish thesis to be negated Ethereum has to trade above the $1,600 price mark for longer than a few trading sessions. If buying strength doesn’t display consistency then Ethereum can fall to $1,100 in just a matter of time.

The volume of ETH traded in the last session rose which indicated that buying strength struggled to move north on the chart.

Technical Analysis

The altcoin over the last 24 hours registered some increase in price, although technical outlook was bearish, buying strength tried to recover.

The Relative Strength Index was below the half-line but over the last trading sessions, there was an uptick in the indicator.

This meant that buying strength was recovering on the four hour chart.

Despite the recovery, the price of the altcoin was below the 20-SMA line, a reading below the 20-SMA line points towards sellers driving the price momentum in the market.

Related Reading | Shiba Inu Whales Trading Volume Surges 640% As SHIB Holds Critical Support

The fall in price can be directly tied to a sell signal. The Moving Average Convergence Divergence depicts price momentum and reversals in the same.

MACD underwent a bearish crossover and flashed red signal bars which are tied to sell signal for the coin.

Directional Movement Index presents price direction and where the coin is headed next. DMI was negative as the -DI line was above the +DI line.

The Average Directional Index (Red) was below the 20 mark which meant that the current price action was losing steam.

Related Reading | TA: Ethereum Recovery Faces Major Hurdle, Risk of Fresh Decline Exits

Featured image from UnSplash, chart from TradingView.com

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments