Gary Gensler is currently testifying on cryptocurrency regulations before Senate banking committee.

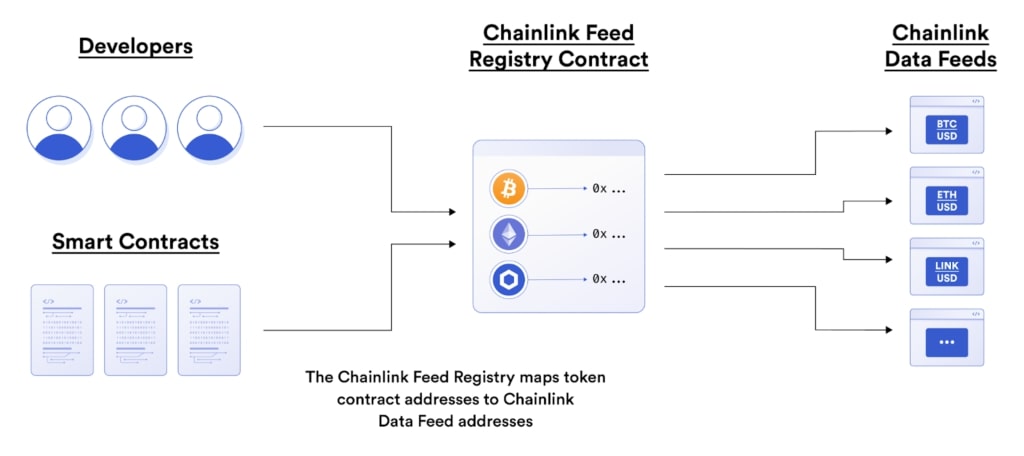

According to Gensler only a small number of cryptocurrencies are not securities. He says even stable coins could be securities and DeFi is mostly decentralized in name only.

The highlight so far has been Elizabeth Warren complaining about exchange outages and ETH fees. This was the full convo between Warren and Gensler.

Warren We hear a lot about how crypto is all about financial inclusion. Banks have done a lousy job of it. I want to test out with you if crypto is an improvement. Last Tuesday in a matter of hours 400 billion dollars in market value disappeared. Meanwhile several exchanges like Coinbase had outages which kept customers from making withdrawals or trades. How did that affect people who don't have a lot of money to lose? Was there anything they could have done to get their money out?

Gensler Not at a federal agency level because Coinbase hasn't registered with us yet even though they have dozens of tokens that may be securities.

Warren That sounds risky. But let's say instead of buying on Coinbase I decided to buy a cool new token called newcoin that was being hyped on Twitter. Newcoin is only available on a DEX. To buy $100 worth of newcoin I have to pay $20 fees. I decide that's ok because Twitter told me newcoin will make me a lot of money. Then the market tanks and I want to sell it. How much would I have had to pay? Another $20 to sell it or more?

Gensler You put quotes around DeFi. I think that's useful because they're decentralized in name only. But I don't know what the particular fees would be.

Warren Actually we do know some of the fees from last Tuesday. The fee to swap two tokens on Ethereum was more than $500. Obviously way more than the $100 I had to trade with in the first place. In the face of these high unpredictable fees small investors could get jammed and wiped out entirely. Does this sound like a path to financial inclusion? There are many other issues with crypto but high unpredictable fees makes crypto trading really dangerous for people who aren't rich. Regulators need to step up immediately and I expect SEC to take a leading role in getting this done.

Surprisingly there was not much of energy FUD from Warren. She just made a passing mention. I felt her arguments were overall pretty fair.

[link] [comments]

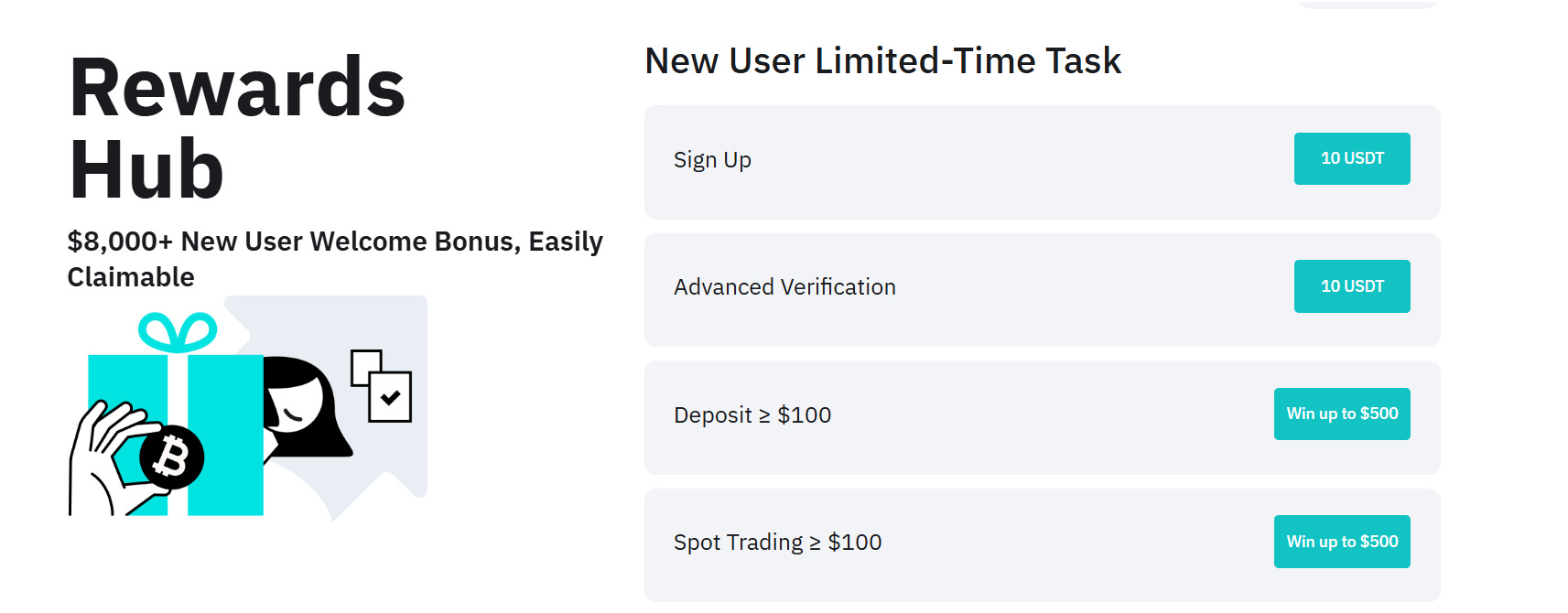

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments