Look at the following two-step approach in buying/selling Bitcoins.

First you buy stablecoins. USD<->USDT (or any other stablecoin).

There are not supposed to be any capital gains on those transactions.

Next, you exchange USDT<->BTC.

This is a crypto-to-crypto trade (C2C).

Exchange platforms that specialize in crypto-to-crypto (C2C) trades generally do not have any links with the banking system, and therefore, do not implement KYC or AML.

C2C also do not cooperate with any government agency because they simply don't have to. They are usually also not incorporated anywhere. The current situation is that no country can successfully claim jurisdiction over them.

Hence, since the only visible transactions that could reveal capital gains are specifically designed not to yield any, I don't see how any tax department would be able to collect enough information to systematically impose capital gains taxes on cryptocurrencies.

The only people who will pay them are the ones who believe that they somehow should. Everybody else won't.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

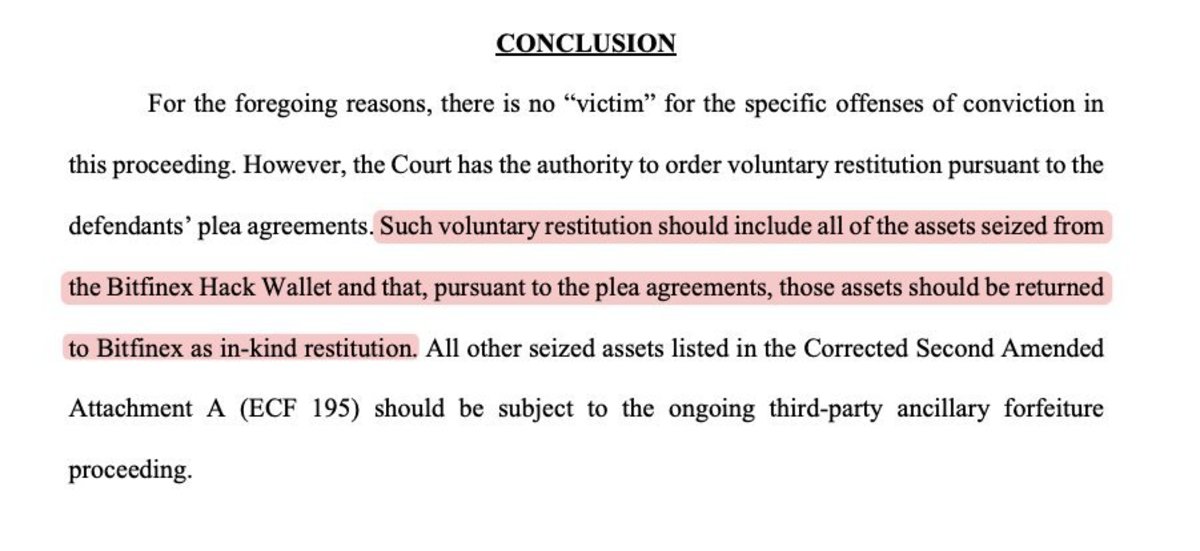

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments