2024 was indeed a banner year for the cryptocurrency market. Thanks to a multitude of positive trends, Bitcoin more than doubled in price. Many major and emerging altcoins experienced even higher levels of price appreciation.

As 2025 begins, there may be concern that, following this latest wave of bullishness, a slowdown in enthusiasm—and with it a slowdown or reversal in crypto prices, is just around the corner.

But while this asset class is likely to remain highly volatile, a 2025 “crypto cooldown” is not inevitable. In fact, given a trio of trends poised to either continue or take shape in the coming year, that could bring forth a further bull run.

By keeping an eye on these trends, crypto investors, from experienced HODL-ers to those just starting out, may be able to gauge where the crypto market is heading over the next twelve months.

Institutional and Retail Investor Inflows Into Crypto Investing Products

During 2024, a massive amount of institutional and retail investor capital entered the cryptocurrency space. Numerous factors played a role in this, but an important one was the regulatory approval and launch of spot Bitcoin exchange-traded funds (ETFs) in the U.S.

ETFs and other exchange-traded products (ETPs) have attracted interest from both types of investors, likely due to these products providing a convenient, straightforward way to add Bitcoin exposure to a diversified portfolio. In 2024, these products attracted investor inflows totaling $44.2 billion.

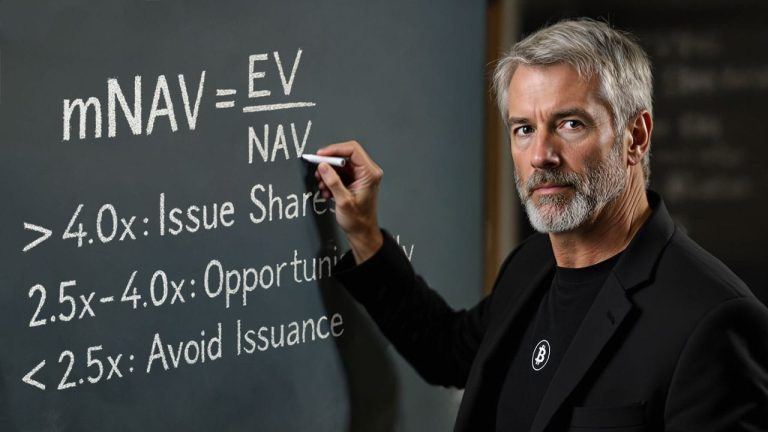

Inflows could stay robust going into 2025, leading to additional upward pressure on the price of Bitcoin and other cryptocurrencies. The reasons for this are twofold. First, due to the continued increase in crypto investing product options. Second, with investment firms such as BlackRock now recommending investors allocate up to 2% of their portfolio to Bitcoin, retail and institutional investors could cycle a greater portion of their capital into crypto investing products.

Binance CEO Richard Teng shares his views on crypto market trends from 2024 into 2025, “In terms of institutional interest, financial giants like BlackRock and Fidelity entered the crypto business in 2024, and we expect to see more new players next year. More companies are learning about crypto and integrating crypto features like tokenization into their business. This is a trend that has grown for years and we expect to see more development in.” Teng continued by explaining, “Given the pro-crypto government set to come in in January 2025, and the recent filings of new ETFs by existing issuers, we are likely to see more ETFs approved next year. This will bring in more institutional investors as crypto becomes a bigger part of the traditional market.”

Regulatory Clarity

In recent years, enforcement actions by U.S. federal securities regulators have led to a high degree of regulatory uncertainty when it comes to crypto. However, big changes are on the horizon. Expectations run high for the incoming U.S. Presidential administration will bring forth “regulatory clarity,” which could also serve as a positive catalyst for Bitcoin and other cryptocurrencies during 2025.

With this in mind, it makes sense that Bitcoin surged after last November’s U.S. Presidential election, from under $75,000 on election day, to as much as $108,135 in late December. The post-election “Trump trade” with crypto has simmered down more recently. However, there could still be a resurgence in this trade in the months ahead.

For instance, if the new administration quickly issues out pro-crypto Executive Orders, this could have a positive impact on Bitcoin and other cryptocurrency prices. Atop the expectation the upcoming Trump administration will bring about more pro-crypto policy changes, other crypto-related policies touted by president-elect Trump on the campaign trail, such as the launch of a US bitcoin strategic reserve, would also likely have a positive impact on Bitcoin and other cryptocurrency prices.

Continued Adoption of Bitcoin as a U.S. Dollar Alternative

The two aforementioned trends were key to crypto’s 2024 bull run. Only time will tell, but each one could help drive a continued bull market for crypto in 2025. Still, atop these existing trends, there’s another trend emerging, one that stands to have a positive impact on Bitcoin and other cryptocurrency prices. That would be the adoption of Bitcoin as a U.S. dollar alternative by countries around the world.

Russia has started to use Bitcoin in foreign trade, as part of efforts to get around western economic sanctions. Russia and other members of the BRICS intergovernmental organization have held talks about developing a new, digital-based reserve currency. The U.S. may only be starting to discuss building a strategic Bitcoin reserve, but other central banks have already started to do so.

According to analysts at Fidelity, this trend is expected to accelerate in 2025. As a hedge against inflation and currency debasement, more nations could begin stockpiling Bitcoin. This points to further capital inflows into this asset class, which may in turn help to drive price appreciation.

This article was written by Finance Magnates Staff at www.financemagnates.com.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments