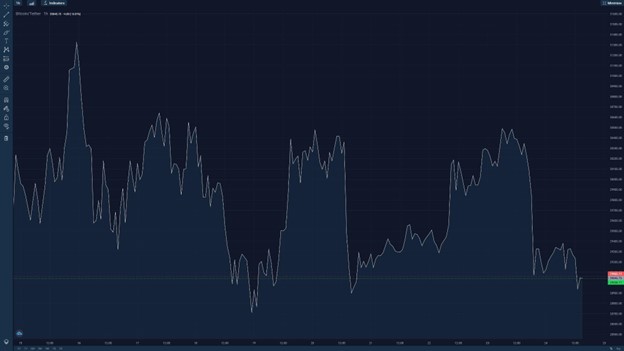

The latest market information shows BTC/USD continuing to hover around $29,000 after failing to hold the crucial $30,000 support.

BTC price movements, 15-25 May 2022. / Source: StormGain

As the original cryptocurrency stalls, traders and analysts are chiming in with observations about what the next price movement could be. Some are looking for positive signs from the ongoing World Economic Forum (WEF) Annual Meeting at Davos, while others are pointing to historical chart patterns or highlighting cryptocurrency’s correlations with the wider stock market. Whether Bitcoin is set to plunge below pre-2020 levels or not, there are useful strategies that traders can employ to stay profitable even during a crypto winter.

BTC at the world economic forum

Cryptocurrency was a significant topic at the WEF summit, with multiple panels concerning crypto, DeFi, and CBDCs featuring a mix of thought leaders from the traditional finance, fintech and crypto sectors. Miami mayor Francis Suarez spoke in support of crypto’s innovative uses amidst the bear market: “We live in a world where investors only look at things from a return perspective, but Bitcoin should be seen from an innovative and technology perspective”. Jeremy Allaire, chairman and CEO at Circle Pay, and Brad Garlinghouse, CEO of Ripple, were also present, exploring crypto’s potential for cross-border payments and national stablecoins.

Despite crypto being a hot topic, however, Bitcoin’s market price does not appear to have been meaningfully affected by discussions at the conference this week. Nonetheless, it is a sign that cryptocurrency’s outsider status in the global economic system is a thing of the past. For the moment, if crypto is still being treated mainly as an investment asset, could the wider stock market hold a clue to the next move?

Relation with US stocks

Bitcoin’s market behaviour recently has been closely correlated with US stocks, especially tech stocks. The latter sector, in particular, is struggling to cope with the post-pandemic market adjustment, but the stock market is showing positive signs of life. The S&P 500, Dow and Nasdaq have all started to rise up after a heavy rout, which is a positive indicator for crypto, too.

One indicator being watched is the CME futures gap. BTC futures are not traded 24/7 on the CME, so the price there will often move to fill the gap between CME trading close and open. BTC/USD did manage to close the CME futures gap on the downside, so the expectation is that it will rebound to fill it. However, it does not always do so swiftly.

Crypto is still seen as more of a risk asset than a safe haven, and even the current weakness of the US dollar is not enough to send investors flocking to Bitcoin. One factor is surely the US Federal Reserve, which is raising dollar interest rates in an attempt to stave off inflation.

Given crypto’s famous volatility compared to the stock market, a breakout for Bitcoin and Co. could be more sudden and dramatic than anything occurring on Wall Street. Looking at the BTC charts, we can see a few interesting patterns that serve as a basis for price analysis.

The triangle: where will we see the breakout?

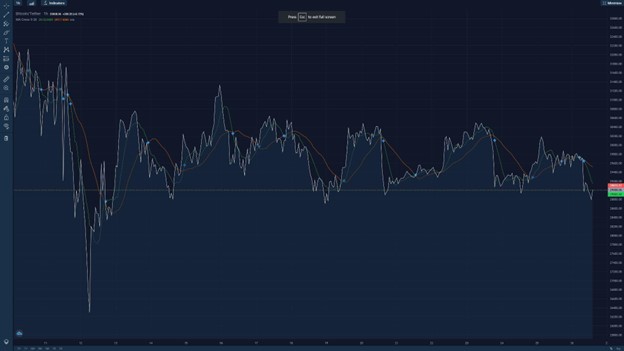

Over the last two weeks, Bitcoin’s price chart has formed a symmetrical triangle in the narrow range of $28,900 to $30,900. It is likely that this pattern will continue for another fortnight before breaking out in either direction.

BTC/USD chart showing symmetrical triangle pattern. / Source: TradingView

The symmetrical triangle represents a pattern of lower peaks and higher lows as the triangle narrows. Typically, the pattern ends in a bullish or bearish breakout when the price moves beyond the support or resistance threshold. The current investor mood is bearish, with most betting on a downturn, but this increases the potential rewards for a bullish position if developing economic trends catch bears by surprise. This can happen if geopolitical events give an unexpected boost to the economy.

The Crypto Fear & Greed Index has been locked into “extreme fear” all month, with a small recovery this week that suggests that the bearish offensive may be relaxing slightly, especially if BTC recovers above $30,000. As we near the triangle’s breakout point, the adage of being brave when all others are fearful may encourage bulls to take a risk for a correspondingly high reward.

The death cross prediction

Analysts have been discussing the so-called “death cross” patterns on the Bitcoin chart. This phenomenon occurs when the declining 50-period moving average (50MA) crosses under the 200MA. Historically, the death cross signifies a significant price downturn, and the current situation with BTC/USD indicates that a death cross is imminent.

1hr BTC/USD chart showing MA cross indicator / Source: StormGain

Based on historical precedent, BTC will drop following a death cross, usually by a percentage matching the pre-cross drop. The current pre-cross drop was 43%, so we could expect a price drop down to around $22K if this pattern holds. However, during previous death crosses in 2020 and 2021, the cross itself marked the bottom of the price action and the beginning of an extraordinary rebound.

Traders should watch the action around the cross closely. If it appears to follow the previous two years, then it would be a good time to buy before the recovery. If it behaves like pre-2020 crosses, then we could roughly predict the price will drop further.

A two-year trough? What to know before buying the dip

Crypto market crashes have historically proven to be good opportunities to buy up coins for cheap before selling them for profit in the next bull run. For example, buying Bitcoin for around $6K in 2020 and selling for $60K before 2022. Bitcoin is currently expected to pull below $24K, and altcoins will follow the first mover’s pattern. So, if anyone is picking up discount BTC, when should they expect new highs? The long-term outlook for Bitcoin will certainly test the patience of some traders.

Popular crypto Twitter commentator, Il Capo of Crypto (@CryptoCapo), set a credible target: hodlers should only expect BTC to breach new all-time highs in 2024. Why? Bitcoin’s next block halving is scheduled for that year, and the reward given to miners will drop from 6.25 BTC to 3.125 BTC per block, slowing the supply and making buying more attractive. At that point, Bitcoin has the potential to surpass $70K and reach new heights.

Historically, the bear market periods for Bitcoin have been where retail traders buy into the crypto market, and on-chain data shows that things are no different now. But new traders must be patient and also prepare strategies to survive the winter. Fortunately, the best crypto exchanges offer a range of options to profit in both rising and falling markets.

Trading strategies to weather the winter

StormGain is an all-in-one crypto platform designed to enable profitable trading strategies regardless of market conditions. Not only does it feature built-in crypto wallets with bonuses for trading and holding in the long term, but also low, low fees to help you seize those exciting market opportunities as soon as they arise. This allows new traders to buy the dip, enter the market at a discount price, and accumulate crypto until the next bull run.

For traders concerned with risk management, StormGain also offers crypto indices. They are asset bundles of different tokens to diversify your portfolio to avoid being too exposed to the performance of any one asset while being positioned to benefit from the market recovery overall.

In addition, traders can purchase call and put options to short the price. If you believe the consensus that the market is likely to fall in the short term, then shorting the price of crypto is a viable strategy for profit in the bear market.

Whatever strategy you choose, StormGain rewards all traders with free BTC simply for actively trading on the platform, thanks to its built-in Bitcoin cloud miner.

All of these features are available on StormGain’s easy-to-use mobile app or web platform. Not a StormGain member yet? To sweeten the pot, new StormGain clients who register by 31 May 2022 will receive a 20% bonus for their first deposit of 10 USDT or more. Register in just a few seconds to join the crypto platform with the best perks in the business!

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments