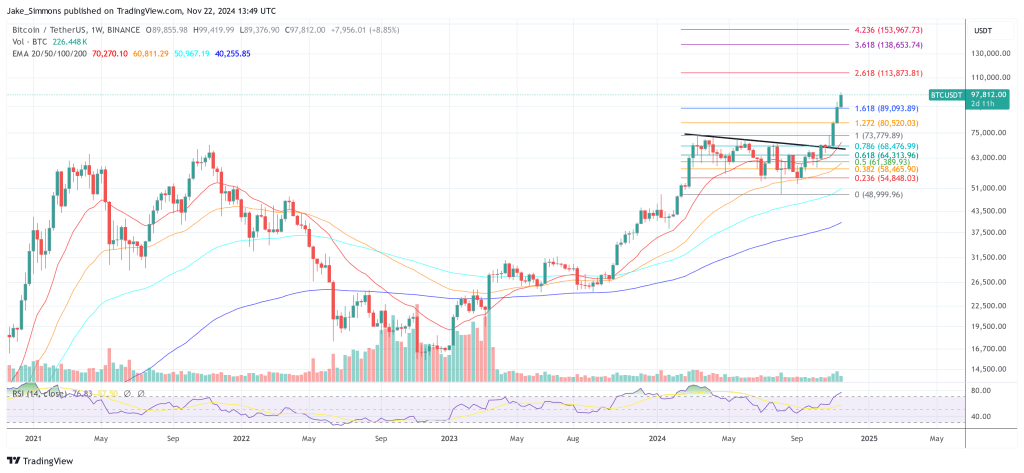

| tl;dr : they're both moving towards the right This is a follow-up to an earlier post comparing Bitcoin's previous cycles to today. Credits to u/Mutchmore for the initial idea. The chart compares the market cap among all cryptocurrencies relative to time. It uses a logarithmic scale, meaning the growth is proportional (i.e. the growth of $1 to $10 is equal to the growth of $10 to $100). The 20-21 market is green, the 17-18 market is red. Side by side comparison of 2017-2018 and 2020-2021 chart Total Crypto Market Cap by TradingView Key Considerations: - I took the chart snapshots from the respective halving periods of BTC: July 9, 2016 and May 11, 2020. "Why use BTC as a reference for a cycle of global cryptocurrencies?" Because there's no definitive starting point for these cycles, and one is needed to limit biases.

- There are only two available data sets since the data only go as far as 2014. This is also a visual analysis, one of the weaker types of analysis. So take this analysis with a pinch of salt—it's not enough for any definitive assumptions.

- The cycle comparisons start at the most recent halving on May 11, 2020. As of today, we are ~370 days in the current cycle, with a total market cap of ~2.3 Trillion.

Key Takeaways (ELI5) - Metcalfe's law that states that the cryptocurrency market will grow relative to the growth of investors. Hence, the use of a logarithmic scale.

- The law of diminishing returns in markets that states it's much harder to grow the larger you get.

- The 20-21 cycle is still 50% - 70% of the 17-18 cycle in both growth percentage and number of days.

Possible Outcomes - Bullish: The 17-18 bull run saw the total market cap grow from ~$10B to ~777B: a growth percentage of 7,670%. The 20-21 bull run started at $230B and today, halfway through, we are at $2 trillion; using the same growth percentage would project a ~$17T market cap.

| Market Cap | | Global Crypto Market (2018) | 777 Billion | | Global Crypto Market (current) | 2 Trillion | | Gold Market | 12 Trillion | | Global Crypto Market (projected) | 17 Trillion | | US Stock Market (as of 3/31/2021) | 50 Trillion | - Assuming currency dominance (BTC: 39% ; ETH 20%) stays as it is, this would project a ~$360,000 Bitcoin and a ~$29,500 Ethereum. Of course, these numbers use rather lofty assumptions and are unlikely outcomes. But, it does provide a decent maximum projection. Note: this projection would dwarf even the most ambitious projections such as Plan B's $288k Bitcoin and double modest projections such as the log rainbow at ~$150k by October.

- Taking diminishing returns into consideration would indicate a ~$10 - $7T market cap. Still under Gold, but those are some pretty good returns!

- Bearish: I've mentioned before that the 20-21 market is outpacing the 17-18 market for many reasons including COVID-19, fiat inflation, institutional involvement, and others. And that the law of diminishing returns suggest that should not happen. If your outlook is bearish, this could indicate that we're in a bubble and would either have a correction soon or be in a consolidation period for a few months. The latter is sort of happening now based on the last few weeks.

A lot of people like to compare the 17-18 cycles based on sentiment alone. This post just provides a different perspective. Of course, "you cannot use the past to predict the future". This is, by no means, an attempt to predict the market; so take this with a pinch of salt based on your preference. Salt makes everything taste better; too little makes things bland and too much can kill youTM.

[link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments