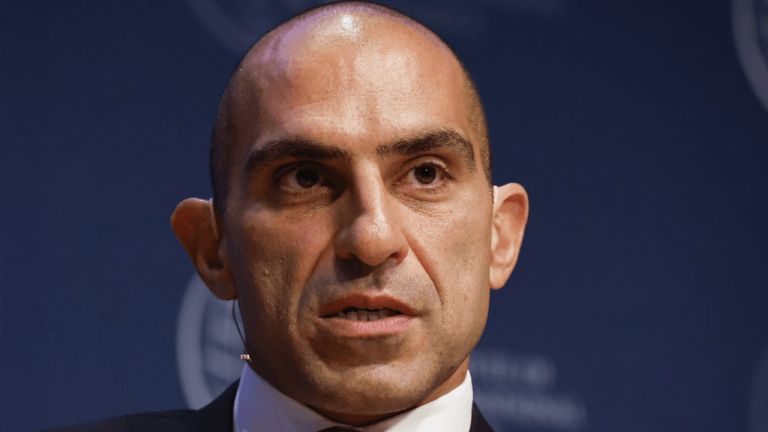

The chief executive of Coinbase, Brian Armstrong, has eased out concerns regarding bankruptcy in one of his tweets. He further allayed the fears of Coinbase users by stating that the company’s latest quarterly filing was performed keeping in mind the requirements of the US Securities and Exchange Commission (SEC).

Further adding to that he mentions that there, was no correlation to the firm undergoing a risk of bankruptcy. This statement by Armstrong comes after Coinbase included the new risk factor in a mandated disclosure in the quarterly filing which stated,

In the event of bankruptcy, crypto assets held by the exchange could be considered property of the bankruptcy proceedings, and customers could be treated as general unsecured creditors. An unsecured creditor would be one of the last to be paid in any bankruptcy and last in line for claims.

This bit of disclosure stirred panic among users followed by an outpouring of messages by users on Twitter. Users feared that keeping coins on the platform would be a risky move.

Related Reading | 33% Of Britain’s Consumers Have Used Crypto, Coinbase Report Reveals

No Fear Of Bankruptcy

Through a series of tweets, all the speculative fear was addressed by Armstrong. He states that there was no risk of bankruptcy additionally the funds of customers were perfectly safe on the platform. The clarification also included that the disclosure was provided to meet the requirements of the SEC.

Additionally, he tweeted that it was unlikely that “a court would decide to consider customer assets as part of the company in bankruptcy proceedings,” although it could remain a possibility.

Further, there were “strong legal protections in their terms of service that protect their assets, even in a black swan event like this” for Prime and Custody customers.

He stated that to look into the best interests of retail customers, Coinbase is working towards updating the terms which shall ensure an equal amount of protection to retail customers as well.

In one of his others statements, he added,

We should have updated our retail terms sooner, and we didn’t communicate proactively when this risk disclosure was added. My deepest apologies

Suggested Reading | Coinbase And Goldman Sachs Join Forces On First Bitcoin-Backed Loan

Coinbase Has Fallen Short Of Their Market Expectations

As per reports, Coinbase’s shares have fallen by 15% as seen 24 hours ago. The exchange platform also reported a net loss as a public company of $430 million in the first quarter of this year.

The fear among customers soared significantly amidst this as the firm’s shares plunged by almost a little over 70%, owing to broader market weakness.

The revenue of Coinbase fell by 27% to $1.17 billion, down from $1.6 billion in the first quarter of 2021. Even monthly users were seen decreasing in number by above 19% to 9.2 million, amidst ongoing tumultuous times witnessed by the global cryptocurrency market. At the time of writing, Coinbase shares have declined by 17.4%.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments