Maker

Maker

MKR is a cryptocurrency depicted as a smart contract platform and works alongside the Dai coin and aims to act as a hedge currency that provides traders with a stable alternative to the majority of coins currently available on the market. Maker offers a transparent stablecoin system that is fully inspectable on the Ethereum blockchain. Founded almost three years ago, MakerDao is lead by Rune Christensen, its CEO and founder. Maker’s MKR coin is a recent entrant to the market and is not a well known project. However, after today it will be known by many more people after blowing up 40% and it is one of the coins to rise to prominence during the recent peaks and troughs.

After being developed by the MakerDAO team, Maker Dai officially went live on December 18th, 2017. Dai is a price stable coin that is suitable for payments, savings, or collateral and provides cryptocurrency traders with increased options concerning opening and closing positions. Dai lives completely on the blockchain chain with its stability unmediated by the legal system or trusted counterparties and helps facilitate trading while staying entirely in the world of cryptocurrencies. The concept of a stablecoin is fairly straight forward – it’s a token that has its price or value pegged to a particular fiat currency. A stablecoin is a token (like Bitcoin and Ethereum) that exists on a blockchain, but unlike Bitcoin or Ethereum, Dai has no volatility.

MKR is an ERC-20 token on the Ethereum blockchain and can not be mined. It’s instead created/destroyed in response to DAI price fluctuations in order to keep it hovering around $1 USD. MKR is used to pay transaction fees on the Maker system, and it collateralizes the system. Holding MKR comes with voting rights within Maker’s continuous approval voting system. Bad governance devalues MKR tokens, so MKR holders are incentivized to vote for the good of the entire system. It’s a fully decentralized and democratic structure, then, which is an underutilized USP of blockchain tech.

Value volatility is a relative concept among both cryptos and fiat currencies. The US dollar, for example, was worth 110.748 yen on July 9, 2018. On July 4, 2011, $1 was worth 80.64 yen, and on March 18, 1985, $1 was worth 255.65 yen. These are major differences in exchange rates, and inflation within each country makes each currency worth different values even when compared to themselves. One USD in 1913 is worth the equivalent of $25.41 today, and even $1 in 1993 is worth the equivalent of $1.74 today. Stablecoins don’t negate these basic economic principles of value. Instead, both Tether and Dai have values pegged to the U.S. dollar. This is done to stabilize the price.

Cryptocoins News / The Cointelegraph - 2 years ago

Former Senator Patrick Toomey, former Representative Tim Ryan, former Representative Sean Patrick Maloney, and others will advise Coinbase on crypto policies. Followin...

Cryptocoins News / The Cointelegraph - 2 years ago

DAI stablecoin proprietor MakerDAO offered up an AI-heavy roadmap for the future with plans for a new blockchain. MakerDAO, the decentralized autonomous organization...

Cryptocoins News / CoinJournal - 2 years ago

Key Takeaways

Jane Street and Jump Crypto, two prominent crypto market makers, are scaling back crypto operations

The decision comes as US regulators continue an aggressive clampdown on the sector

Liquidity is already thin in crypto, and these moves...

Cryptocoins News / The Cointelegraph - 2 years ago

With the European Union coming closer to passing the Markets in Crypto-Assets framework and Kraken in the process of investing in the United Kingdom, lawmakers are taking notice....

by COINS NEWS - 2 years ago

Two of the world’s leading market-making firms are getting cold feet on digital asset trading as America’s war on crypto intensifies. Jane Street Group and Jump Crypto are pulling back from their crypto trading ambitions as U.S. regulators up t...

Bitcoin News / Bitcoin.com - 2 years ago

The top Democrat on the House Intelligence Committee has warned that China and Russia would seek to exploit the chaos resulting from a U.S. default. He further cautioned that the U.S. dollar’s reserve currency status could be eroded if the U.S. defau...

Cryptocoins News / The Cointelegraph - 2 years ago

The initial iteration of the Spark Protocol will function as a lending platform, offering supply and borrow functionalities for cryptocurrencies ETH, stETH, DAI and sDAI....

Cryptocoins News / The Cointelegraph - 2 years ago

National Assembly member Kim Nam-kuk had authority in handling laws related to digital assets in South Korea, reportedly backing a bill proposing a 20% crypto gains tax be deferred....

Cryptocoins News / EthereumWorldNews - 2 years ago

Summary:

Coinbase CEO Brian Armstrong hailed legislators in the United Arab Emirates for developing reasonable guidelines for crypto businesses and policies to protect users.Indeed the UAE was one of the first jurisdictions to establish a dedica...

Cryptocoins News / Finance Magnates - 2 years ago

South Korean prosecutors made an

effort to probe a main opposition party lawmaker, Rep. Kim Nam-kuk of the

Democratic Party, over some crypto transactions he allegedly made last year.

However, they faced a stumbling block when the Seoul Southern Dist...

Bitcoin News / Bitcoin.com - 2 years ago

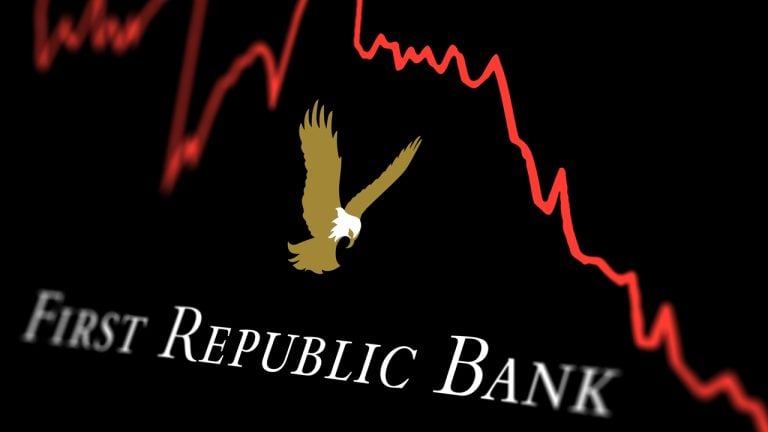

After the second largest bank failure in history, the U.S. Securities and Exchange Commission (SEC) is reportedly investigating First Republic Bank executives for allegedly engaging in insider trading. Two sources have claimed that the securities reg...

Cryptocoins News / The Cointelegraph - 2 years ago

Representatives Alexandria Ocasio-Cortez and Matt Gaetz — lawmakers diametrically opposed on a variety of issues — joined forces to stop congressional members from trading stocks....

Bitcoin News / Google News Bitcoin - 2 years ago

Core Market Makers Begin Longing Bitcoin and Ethereum At Current Levels According To Avorak AI& & Coinpedia Fintech News

Cryptocoins News / The Cointelegraph - 2 years ago

“When you think about Bitcoin, it’s potentially the largest country or one of the largest countries today. But it’s digital and it’s spread out everywhere,” Jeff Booth told Cointelegraph....

by COINS NEWS - 2 years ago

-No, crypto isn't unregulated, and it's no longer the complete "wild west" portrayed in the media. First off, there's too much bullshit in how crypto is painted as an unregulated "wild west". Crypto is regulated in mos...