Bitcoin Inscriptions have increased the average size of the cryptocurrency’s blocks; here’s how this could impact the blockchain.

Impact Of Inscriptions On The Bitcoin Blocksize

Very recently, “Inscriptions” have emerged on the Bitcoin network, basically an application of the BTC blockchain similar to non-fungible tokens (NFTs), but not the same.

Unlike NFTs on other blockchains like Ethereum, these Inscriptions are directly inscribed on the Bitcoin blockchain (hence the name). Inscriptions can be data, images, audio, video, or even software.

Since they are directly stored as a transaction on the blockchain, they have been quickly inflating the size of the chain. This has made these assets a hotly debated topic around the community regarding their impact on the future of the cryptocurrency.

In its new report, the on-chain analytics firm Glassnode has shown how this new BTC application has affected the network. One obvious implication has been on the blocksize, which has been nearly pushed to its limit.

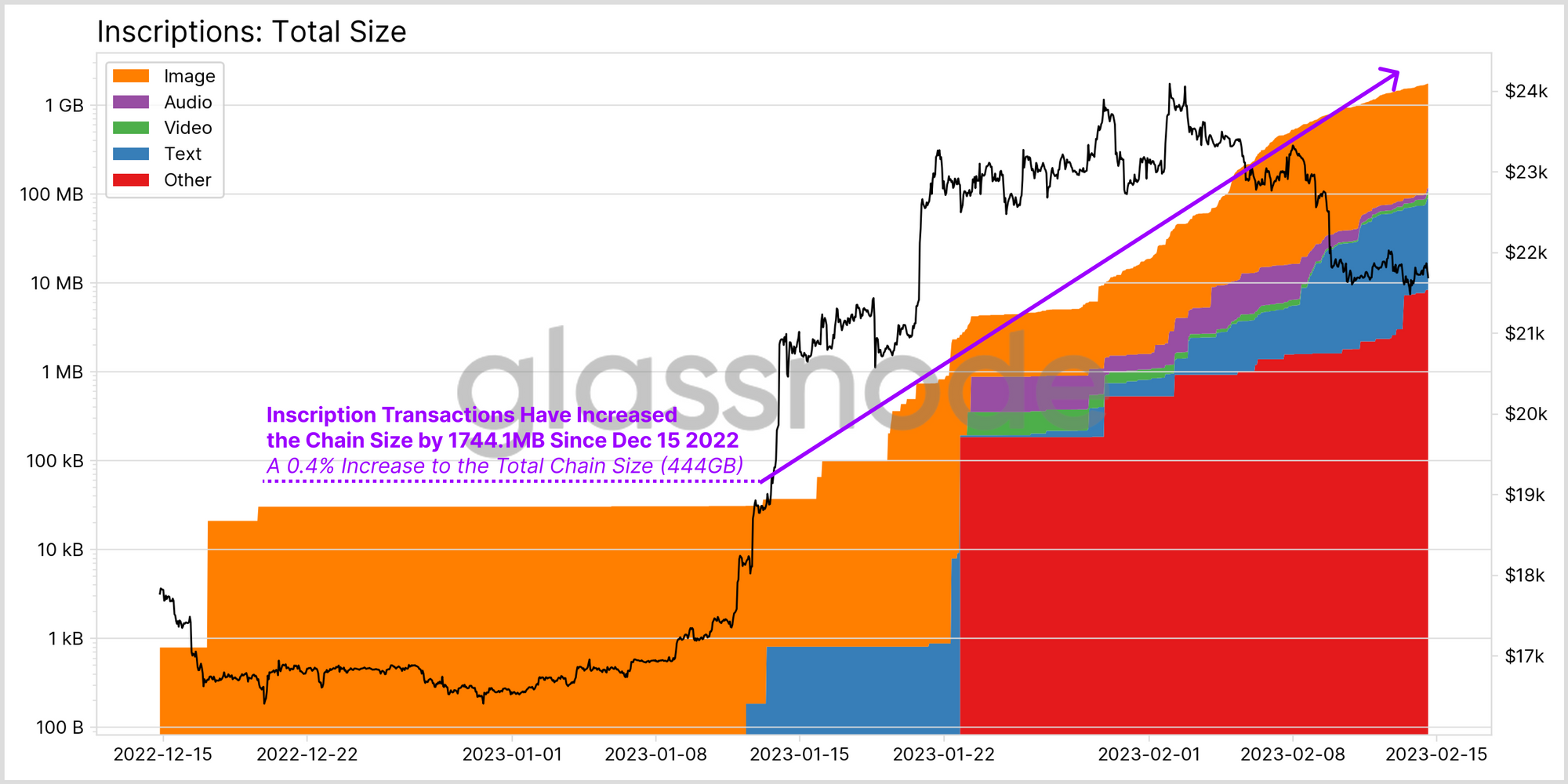

In terms of the impact on the total size of the blockchain itself, the Inscription transactions increased by 1.74GB since 15 December 2022 (when they first appeared), as the chart below displays.

Compared to the 444GB total size of the Bitcoin blockchain, the Inscriptions represent an increase of about 0.4%. Most of this rise has come from image Inscriptions, which is no surprise considering that they are the most popular type around.

In total, 93.3% of the data footprint has come from images, while text Inscriptions, the following best, have contributed around 4.59% to the increase. Audio, video and other Inscriptions have had a tiny data footprint.

However, audio and video types have been the largest in terms of the Bitcoin Inscriptions’ average size. Their footprint is still the lowest because their frequency has been significantly reduced compared to types like images or text.

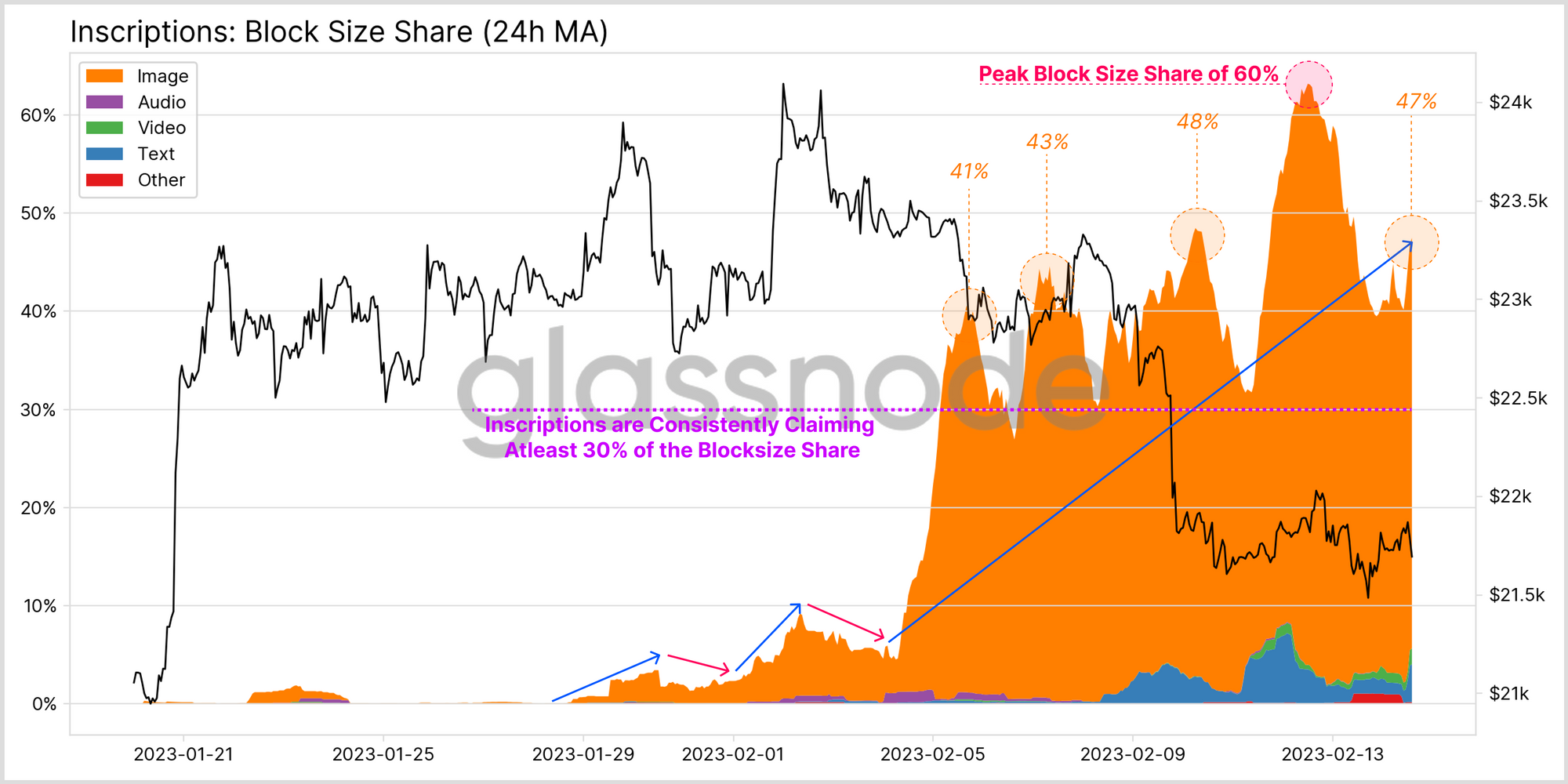

Inscriptions currently account for just 4.2% of all transactions on the network, but something interesting appears when looking at the blocksize share they occupy.

Inscriptions occupy 47% of the blockspace right now, despite accounting for only 4.2% of the transactions, showing how much more data-rich this transaction type is. At their peak, Inscriptions took 60% of the blocksize.

Glassnode notes that blocks were usually largely empty before the Inscriptions appeared on the scene, with transactions taking up just 25-50% of the available blockspace.

“This changed dramatically since the emergence of Inscriptions, with blocks now commonly reaching between 80-90% saturation (3.2-3.6MB),” the report explains. “Since blockspace cannot be stored for future availability, one could consider Inscriptions as a consumer of blockspace that would have otherwise finalized empty.”

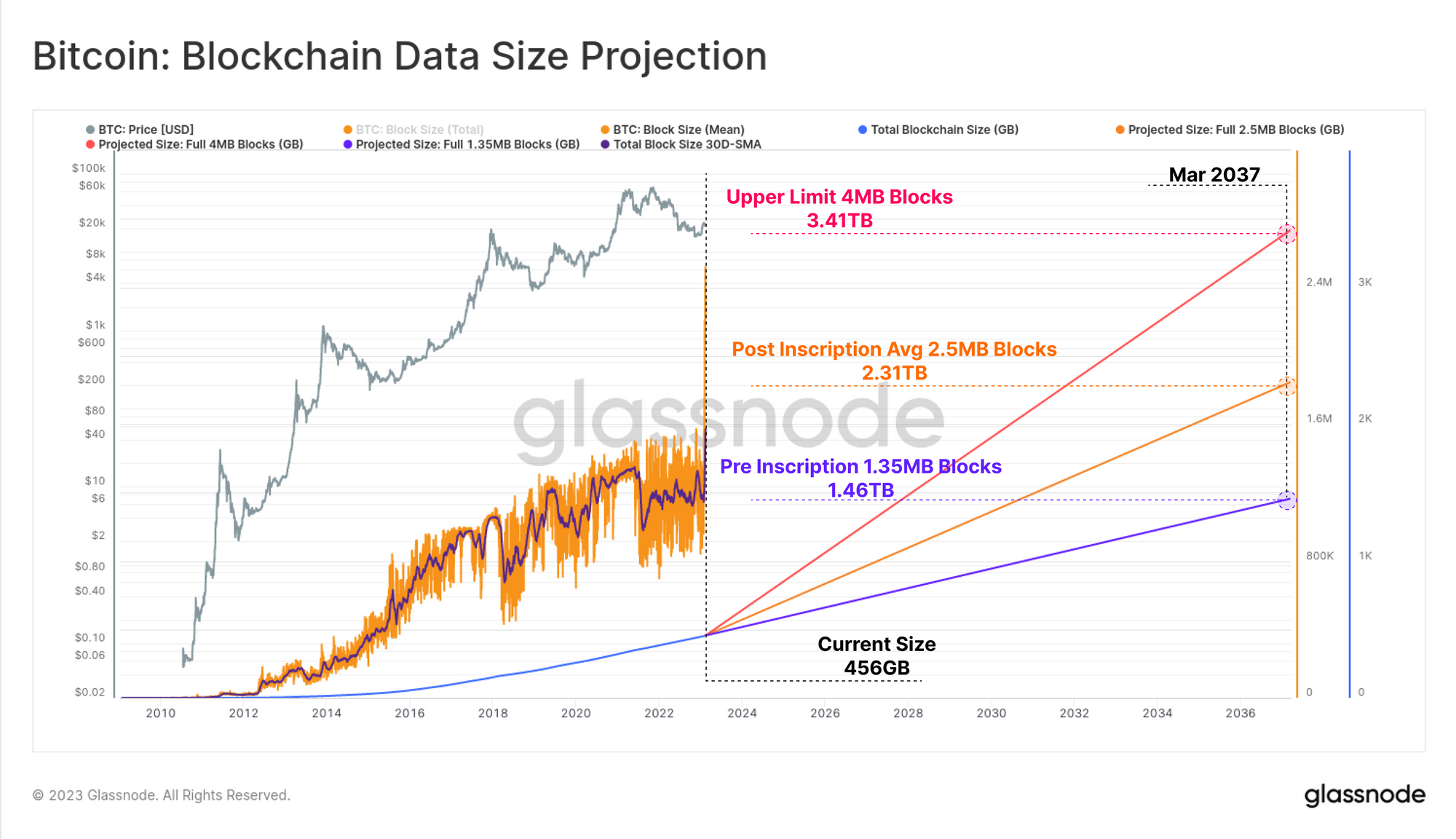

As this is just the present impact of Inscriptions on the Bitcoin blockchain, one big question remains: what could be the long-term impact on the chain size? To answer this question, Glassnode has modeled what the next 14 years could look like for BTC for three blocksize assumptions.

The three blocksize assumptions (on which the simulations are based) are as follows: 1.35MB (which is the peak 30-day average blocksize of the pre-Inscription days), 2.50MB (the peak post-Inscription average), and 4.00MB (the theoretical upper bound).

Assuming that the theoretical upper bound scenario follows, the Bitcoin blockchain size will have grown to 3.41TB by March 2037. At current hard drive prices, the hard drive needed to store a file of this size is just $120. This means that the future impact on the data storage requirements on the chain is likely insignificant.

BTC Price

At the time of writing, Bitcoin is trading around $24,900, up 10% in the last week.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments