I decided with wife's support) to divert all future retirement contributions from my employer-sponsored Roth IRA to Bitcoin (self-custody). Wifey's been supportive of our bi-weekly DCA of a few hundred, but this plan concerned her. So I made a list of likelihoods (i.e., predictions), which we have discussed, that suggest Bitcoin's dominance will only grow over the next two decades.

Edit: my wife and decided this together after discussing everything in the list below and risks that are not included in the list.

What is likely to happen in the next 10-20 years?

- Many more alt coins will fail and people will either get out of crypto completely or move to Bitcoin

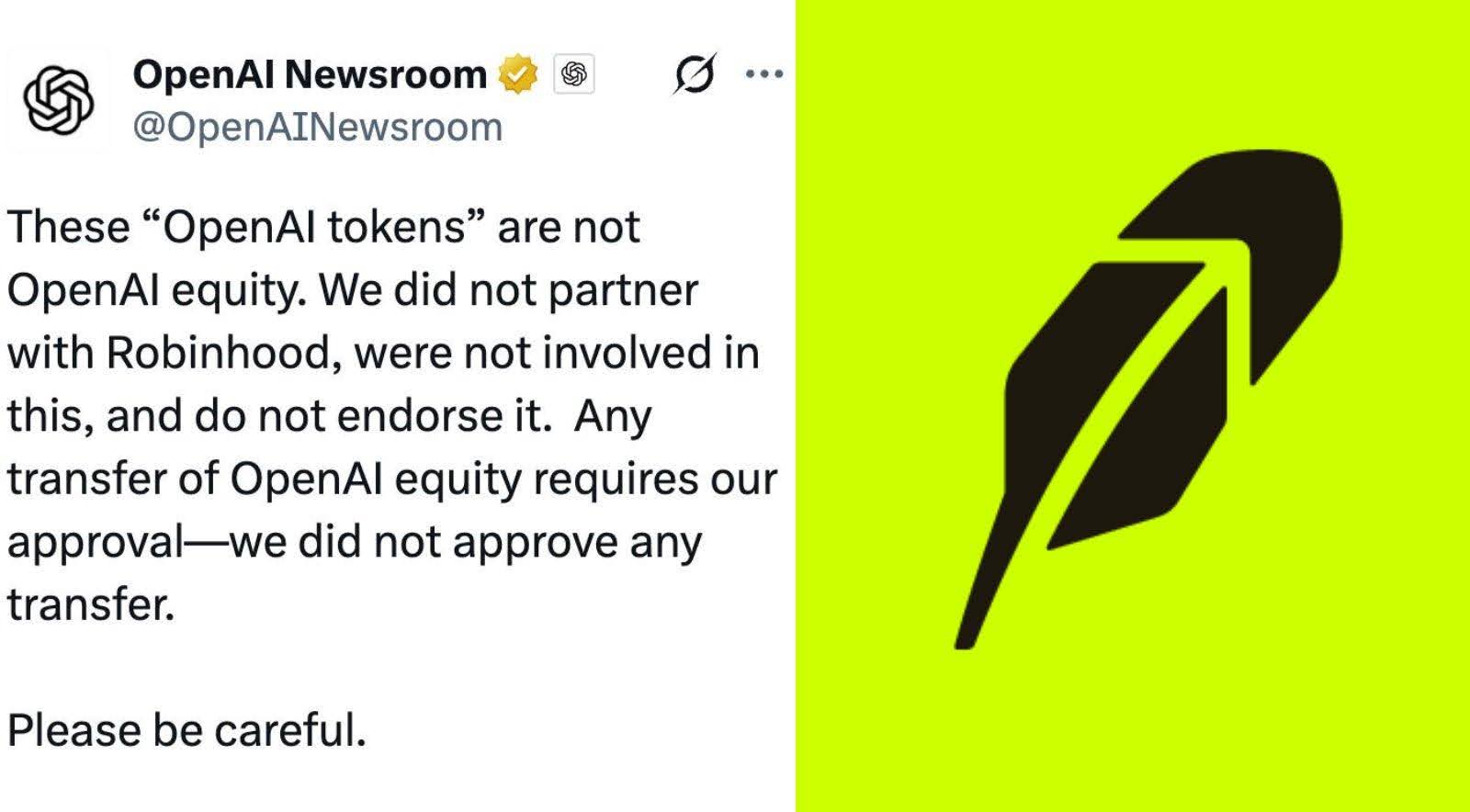

- More exchanges will succumb to fraud or fractional reserve shenanigans making the case for self custody.

- Crypto industry will become regulated which will give institutional investors, investment firms, and financial advisors confidence to recommend bitcoin.

- The Lightning network will become more robust giving Bitcoin increased capacity for transactions and merchant adoption.

- More world currencies will collapse driving some in those countries and outsiders paying attention to consider Bitcoin

- Bitcoiners like me will educate their children on money’s purpose, how Bitcoin is the hardest money and how to self custody, among other things. This means elementary and middle school kids of today will likely be more comfortable with the concept of digital money and those who buy into the concept will prefer the most established and just decentralized option.

- More wealthy people will become orange pilled and Bitcoin will make more people very wealthy. Since wealthy people often have greater influence over the government, laws attempting to restrict Bitcoin adoption will become less likely to pass

- CBDC conversations and considerations by world governments will increase which will get more people talking about the nature of money and how it should or shouldn't be controlled. Conversations like these should lead more people to the entrance of the rabbit hole. If a CBDC actually does get off the ground it will make Bitcoin’s use case and value even more clear.

- World governments will continue to debase there currencies, stealing value (and hope) from would-be savers.

- We will experience the halving of the block subsidy in 2024, 2028, 2032, 2036 and 2040 which will reinforce Bitcoin’s claim of digital scarcity and a more than 30-year history of functioning as designed (assuming it continues to do so). It will still be “new” compared to the dollar or gold, but it'll have a whole generation that never knew a world without Bitcoin.

- In the long run, I think Bitcoin significantly outperforms stocks, mutual funds and EFTs.

Anything you'd add to this list? Anything you'd challenge as not being likely? Let me know in the comment section down below. And remember to like and subscribe to Bitcoin.

Notes:

- I'm keeping the existing retirement money where it is, only new contributions will go to Bitcoin for now

- I'm still new and learning. I welcome constructive criticism and factual corrections.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments