Text size

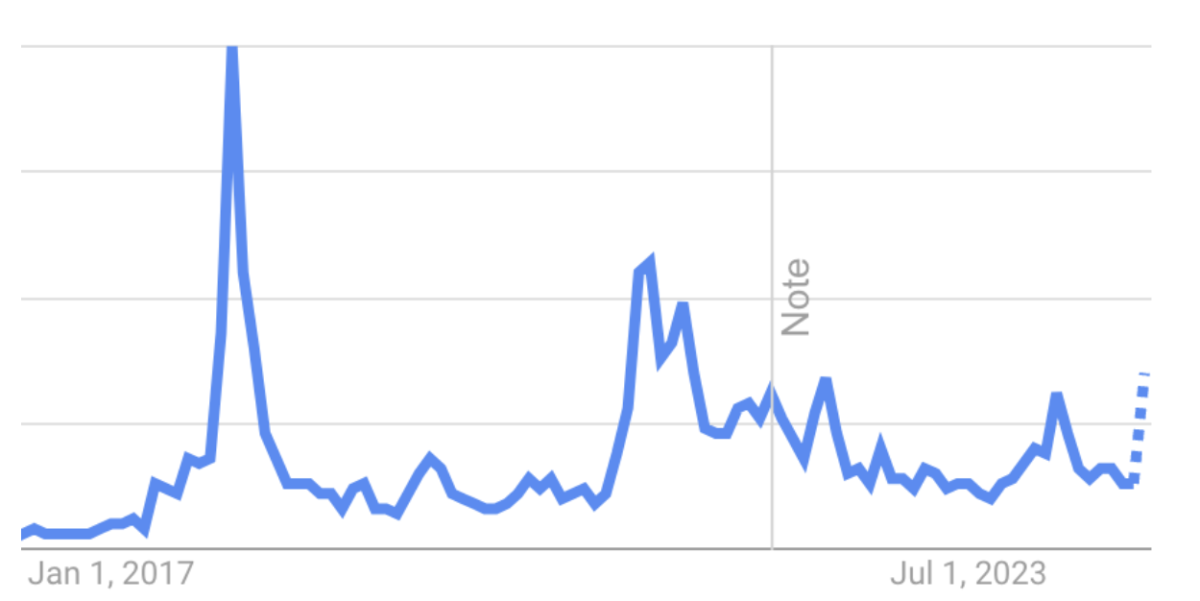

Crypto prices have rallied off the bottom hit in a dramatic selloff in mid-June.

Dusan Zidar/DreamstimeBitcoin and other cryptocurrencies were tumbling Tuesday amid a wider selloff in risk-sensitive assets, with the picture for cryptos indicating further declines could be on the way.

But investor inflows into digital-asset funds have recently jumped, signaling what could be a crucial turn in investor sentiment.

The price of Bitcoin has fallen 4% over the past 24 hours to $21,000. The largest crypto has failed to consolidate gains from a recent rally that saw it top $24,000 last week, but remains above the bottom from a dramatic selloff in June that took it below $18,000.

“Bitcoin briefly got above its 50-day moving average last week before pulling back in a reaction to short term overbought conditions,” Katie Stockton, the managing partner at technical research firm Fairlead Strategies, wrote in a note. “The primary trend in Bitcoin is lower, noting the downward sloping 200-day moving average, and negative long-term momentum keeps growing.”

Stockton noted that technical analysis indicated that Bitcoin looked overbought in the short-term and was at risk of testing key support levels, but that it would likely continue to find long-term support in the $18,300 to $19,500 price range. “If this level is taken out, our attention would turn to secondary support [around] $13,900,” the analyst said.

Beyond Bitcoin, Ether —the second largest token—dropped 8% to $1,400. Altcoins, or smaller cryptos, were similarly weak, with Solana down 8% and Cardano 5% lower. Memecoins—initially intended as internet jokes—were not spared, as Dogecoin and Shiba Inu lost 4% and 7%, respectively.

Cryptos likely were being dragged around by their connection to stocks, and especially tech stocks. While Bitcoin and its peers should theoretically trade independently of mainstream markets, they have shown to be largely correlated to other risk-sensitive assets like equities, following the S&P 500 and Nasdaq into a bear market this year.

It is likely to be a turbulent week for digital assets. Inflation is top-of-mind for investors, and especially how the Federal Reserve’s plans to fight it with tighter monetary policy risks spurring an economic slowdown.

The Fed starts a two-day policy meeting Tuesday that is expected to culminate in another 75 basis-point rate hike Wednesday. In June, the central bank raised rates by 75 basis points, or three-quarters of a percentage point, for the first time since 1994. The fear is that continuing to aggressively raise borrowing costs could start a recession, an environment that would be very unkind to risky bets like Bitcoin.

Stocks were heading lower on Tuesday as recession fears came back to the fore. Corporate earnings were also in focus, with results in the day ahead and days to come likely to add further volatility to Bitcoin. Given digital assets’ correlation with tech stocks, earnings reports from tech giants Alphabet (ticker: GOOGL) and Microsoft (MSFT) are likely to have an impact, as will results from Meta (META) on Wednesday before Apple (AAPL) and Amazon (AMZN) Thursday.

But stocks are unlikely to be the only thing weighing on cryptos. A selloff this year, which has knocked two-thirds off the nearly $3 trillion digital-asset market capitalization since November 2021, has shown that cracks in crypto can be just as damaging. Bitcoin’s worst quarter in more than 10 years was ushered in by the meltdown of stablecoin Terra and failure of once high-flying hedge fund Three Arrows Capital.

Major cryptocurrency exchange Coinbase Global (COIN) is facing a Securities and Exchange Commission investigation into whether tokens it listed were unregistered securities, Bloomberg reported Tuesday. The question of whether tokens should be classified as currencies, commodities, or securities has loomed large over the industry amid growing regulation. Barron’s reported on Monday that Coinbase and the SEC appeared to be facing off in a conflict over the matter.

Nevertheless, data from digital-asset manager CoinShares (CS.Sweden) revealed some reason for optimism. Revised fund flow data from two weeks ago reveals inflows of $343 million into digital-asset investment products, according to CoinShares, which represents the largest single week of inflows since November 2021, when Bitcoin was at an all-time high. Revised data from the same period showed $206 million in inflows to Bitcoin funds, the highest since May 2022, when Bitcoin traded around $40,000.

Write to Jack Denton at [email protected]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments