- Ark Invest published its monthly Bitcoin report, detailing several bullish signs for the asset and the general market.

- It notes that Bitcoin is in oversold condition, and the asset might have reached a strong bottom, pointing to Bitcoin’s short-term-holder cost basis crossing below the long-term-holder equivalent for the first time since late 2018.

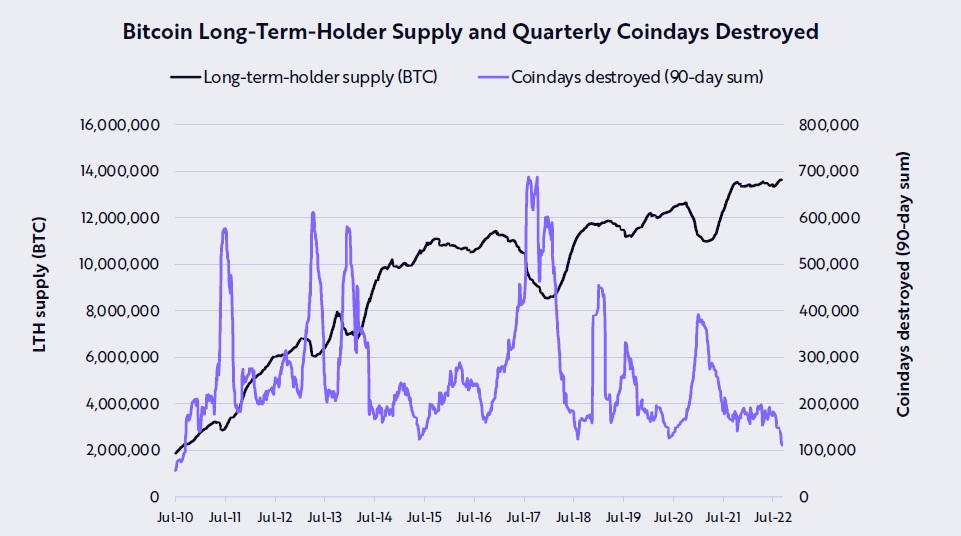

- Bitcoin’s long-term holder supply reached an all-time high of 13.7 million BTC, accounting for 71.5% of the outstanding supply.

Ark Invest has released its monthly Bitcoin report, and some of the statistics in the report indicate a bullish future for the asset. While Bitcoin did find resistance at its 200-week moving average of $23,500, there are signs that the cryptocurrency has found its bottom.

To support the theory that Bitcoin has reached a strong market bottom, Ark Invest says that the digital asset’s short-term-holder cost basis crossed below its long-term-holder cost basis for the first time since late 2018.

But perhaps most interestingly, Bitcoin’s long-term holder supply reached an all-time high of 13.7 million BTC, which accounts for 71.5% of the outstanding supply. The firm defines long-term holders as those who have held Bitcoin in their wallets for over 155 days. Year-over-year, this figure has increased by 2.19%.

Ark Invest also points to the locked supply as another bullish sign. This statistic is currently at 14.18 million BTC, which is a 5.39% increase over the past year.

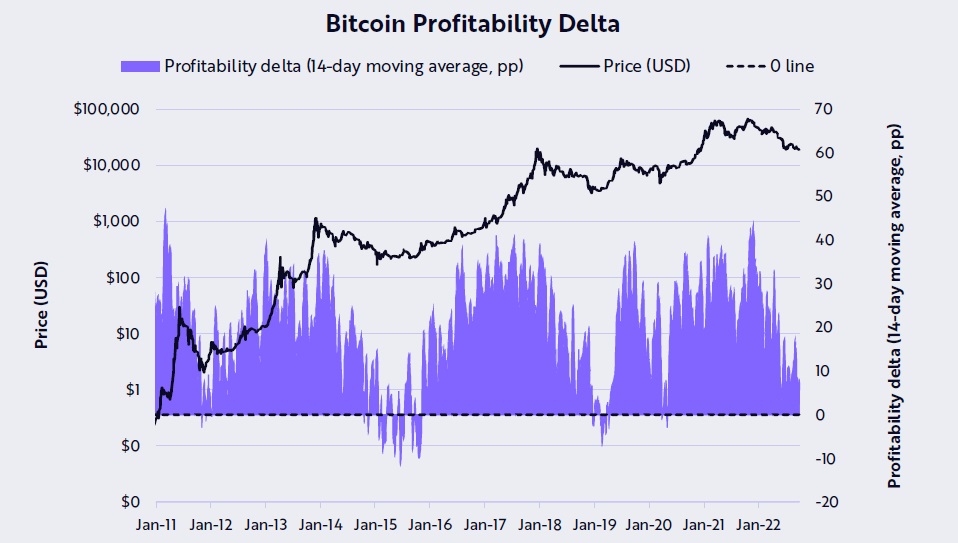

The firm also firmly believes that Bitcoin is oversold, pointing to the profitability delta being near 0. This suggests that most trading activity is seller-exhausted.

The takeaway from these on-chain indicators, according to Ark Invest, is that Bitcoin’s price does not reflect its positivity. However, it does see several macroeconomic factors as being bearish influences on the market. In recent years, the crypto market has become more closely connected to other markets, and negative macroeconomic forces would undoubtedly have an effect on the asset class.

Mining Statistics Also Indicate Bullish Future

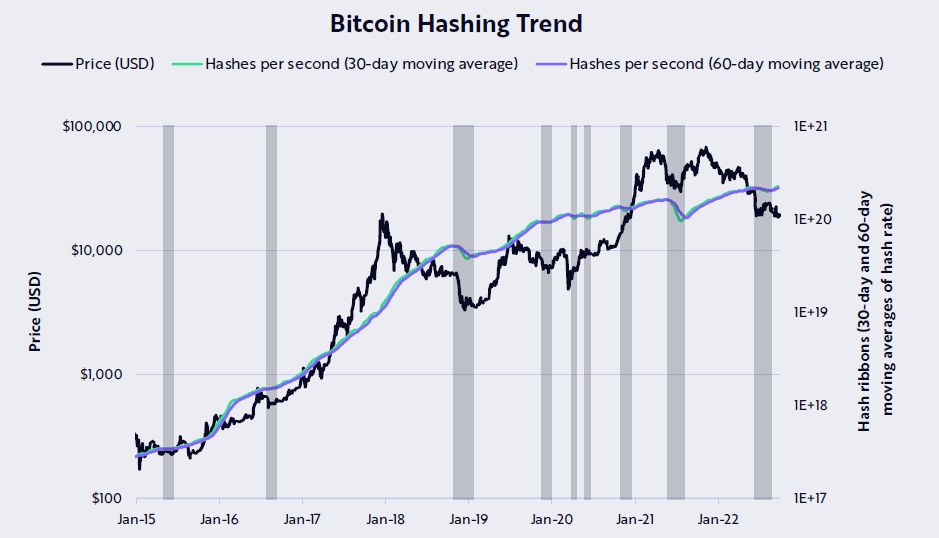

Ark Invest reports several other positive indicators that the market is doing well. One of these is the fact that miners are “no longer in capitulation mode,” pointing to new all-time highs of the hash rate. Bitcoin’s hash rate is currently 272.81 million TH/s. Another factor it shows as being a bullish sign is the net realized profit and loss, which suggests a capitulation proportional to prior cycle bottoms.

The market may be in the middle of a rut, but on-chain factors and general sentiment hint that it might not last for long. Investors will be keen to see a movement upwards, and Bitcoin and the crypto market have proven to be strong towards the end of the year on multiple occasions. Ark Invest and Cathie Wood have felt that way for some time.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments