The Binance CEO has announced that they restricted the 281 personal accounts of Nigerian users due to a need for compliance with international money laundering laws.

The growth of cryptocurrency crimes has been a significant reason for using and enforcing securities laws.

Changpeng Zhao, the CEO of Binance, wrote an open letter on Saturday addressing user concerns about security. He cited that anti-money laundering measures and account restrictions are in place before mentioning their top priority: protecting users from hacking attacks.

In order to rebuild trust within the Nigerian users, Zhao highlighted what Binance is doing.

Foremost, CZ said that Binance is “making sure we get right down to the core of your issue as soon as possible and solve it externally,” noting;

“Currently, we have resolved 79 cases and continue to work through others. We will resolve all non-law enforcement-related cases within two weeks.”

In order to better serve their customers in the region, Zhao announced that they would be increasing staffing by adding more customer service agents. These hires are expected to have a deep understanding of Nigeria’s market and provide quick responses when needed most.

Law Enforcement Requested Nigerian Users Accounts Restrictions

Binance has released a statement concerning recent events in which restricted users boycotted their platform due to freezing user accounts. The company says that whenever an account needs restricting, it will only happen after being requested by law enforcement or proactively shutting down newly registered users’ access without warning.”

Cryptocurrency exchanges Binance is constantly under scrutiny for its regulatory status in various countries. The most recent countries are the U.S, Pakistan, Canada, the U.K., South Africa, Norway, Australia, Netherlands, Germany, Hong Kong, Italy, India, Malaysia, Turkey, Lithuania, and Singapore.

In a move that will drastically change its business model, Binance has announced they are transitioning from an open-source software company to one focused on servicing financial needs. The cryptocurrency exchange giant says this shift reflects regulatory compliance and security standards needed for handling customer funds legally across various countries around the world – something which was previously lacking in their existing structure as initially designed.

The Central Bank of Nigeria has already banned cryptocurrency. Currently, as the Naira currency has lost its value, people in the country continue to adopt crypto businesses to secure their profits. They often send payments abroad as it is hard to get dollars locally.

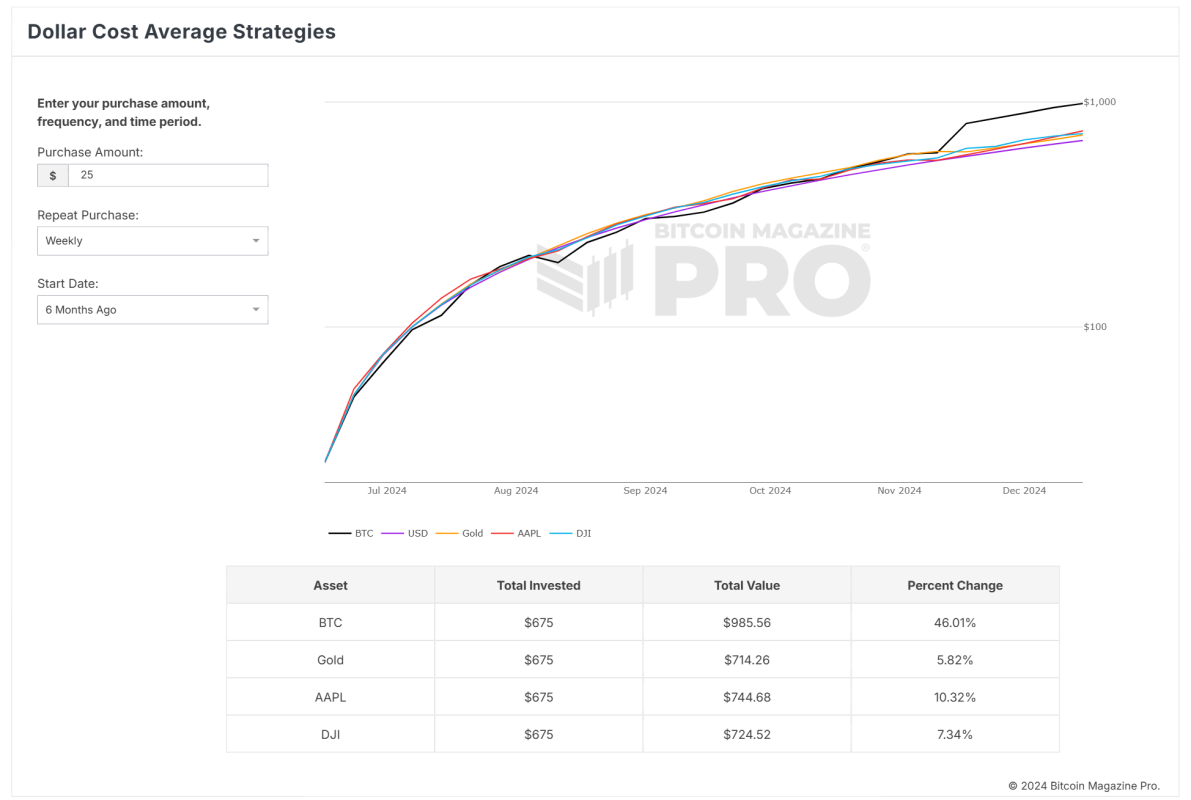

Featured Image From Pixabay and chart from TradingView.Com

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments