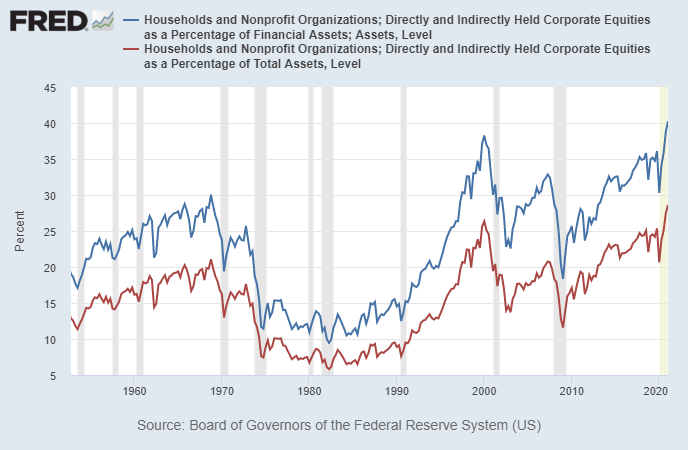

While inflation has kicked up in the U.S., following the massive stimulus issued by the Federal Reserve, investor and financial writer Lyn Alden Schwartzer published a report that shows “U.S. households now have record high exposure to stocks.” The news comes at a time when many analysts and economists believe equities markets are in a colossal bubble.

Dow Sheds 900 Points, Financial Expert Lyn Alden Schwartzer Publishes Report on US Household exposure to Stocks

Stock markets saw some significant carnage on Monday as the Dow Jones Industrial Average lost 900 points in the morning (EDT) or 2.3% as it was the largest decline in value this year. Similarly, the Nasdaq Composite came awfully close to losing 1% and the S&P 500 index shed 1.5% on July 19. Mainstream media reports are blaming the market downturn on the recent surge of Covid cases worldwide and the delta variant.

Meanwhile, Travis Kling, the crypto proponent and executive at Ikigai Asset Management shared a tweet from the financial expert Lyn Alden Schwartzer that said: “U.S. households now have record high exposure to stocks.” Kling also spoke about the issue at hand and stressed that the Fed could make this a national security problem.

“Been saying for over a year now- the SPX going up is a matter [of] national security for the United States. The Fed has the ability to make that happen (for now). What do you think they’re going to do?” Kling asked.

Schwartzer didn’t just tweet about the equities U.S. households own, as the investor also published a blog post about the subject on Seeking Alpha. The financial analyst said that last May, the researcher published a report that highlights how the United States is currently fueled by “fiscal-driven inflation.” In the latest report, the analyst says that this “is what the U.S. is experiencing at the moment.”

“Due to stimulus effects and a rapid growth in the broad money supply,” Schwartzer’s report notes. “Consumers have more money in their pockets to spend, while the production of certain supplies and services remains constrained in various ways. That combination results in prices going up for whichever goods and services are constrained, until those prices go up enough to curtail demand.”

Schwartzer: ‘Treasuries Are Not Keeping up With Inflation, and Thus Are Losing Purchasing Power’

Schwartzer further explains that the “effects of fiscal-driven inflation are still occurring, with 5.39% year-over-year average price increases.” Meanwhile, bank account interest rates and Treasury notes (T-bills) are considerably low.

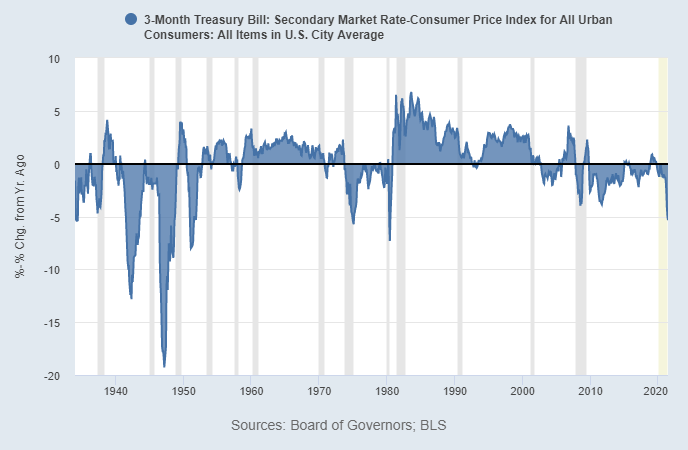

While showing a St. Louis Fed 3-month T-bill chart, Schwartzer remarks: “If we zoom out, here’s the real interest rate of 3-month T-bills over the long run, meaning the interest rate that T-bills pay minus the prevailing consumer price inflation rate.” Schwartzer’s analysis adds:

Those T-bills tend to be a pretty good proxy for bank account interest as well. Basically, whenever that blue area is below zero, it means that interest rates for bank accounts and short-duration Treasuries are not keeping up with inflation, and thus are losing purchasing power.

In addition to the U.S. household allocations of equities, Schwartzer remarks that a big risk facing markets right now is “this new wave of delta-variant virus cases.” The economist also highlights that this “is the first time that the U.S. stock market reached 200% the size of U.S. GDP.”

The investor is bullish on the energy sector but sees Covid cases and “government lockdown responses to it as a near-term risk factor for a correction in the industry.” This means the energy market could stop swelling for a brief period of time, Schwartzer explains. While Schwartzer is bullish on the energy sector, the investor has also mentioned diversifying in bitcoin (BTC) as well in a recent video published by the Youtube channel Financial Monster.

In addition to the fiscal-driven inflation, the number of U.S. homes allocating stocks is also driven by rising prices and speculative investing, Schwartzer’s report details. “U.S. household allocations to stocks are currently at a record high percentage of total US household assets, from a combination of high valuations and speculation.”

What do you think about Lyn Alden Schwartzer’s assessment and U.S. households’ current record exposure to stocks? Let us know what you think about this subject in the comments section below.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments