I have started implementing an Infinite Banking strategy for buying Bitcoin as explained below, before I send it to my hardware wallet. Make sure you don't send less than 2 million sats at a time to your HW to protect you from having smaller UTXOs while preserving some sense of privacy.

As a primer, look up the book by Nelson Nash, called Becoming Your Own Banker. The general idea is that The Infinite Banking Concept (IBC) is a financial strategy that involves using MUTUALLY OWNED whole life insurance policies to create a personal banking system. By overfunding these policies, individuals can borrow against the cash value for personal financing needs, while still earning dividends and interest on the whole cash value of the policy, thereby achieving greater control and flexibility over your financial life as you STACK SATS.

An example of how it works. You're contributing $15,000 annually to a whole life insurance policy. Here's how the contributions might be split: Base Premium: 20% of your annual contribution goes towards the base premium of the insurance policy. So, 20% of $15,000 is $3,000. This portion primarily contributes to the death benefit and builds cash value slowly. Paid-Up Additions (PUA): 80% of your annual contribution is directed towards PUAs. So, 80% of $15,000 is $12,000. PUAs are additional premiums that immediately increase both the cash value and the death benefit of the policy. That 12k is available immediately to take a loan from at 4-5% interest depending on what Mutually Owned Whole Life company you decide to use. You take that 12k out to buy BTC. Send that to hardware wallet.

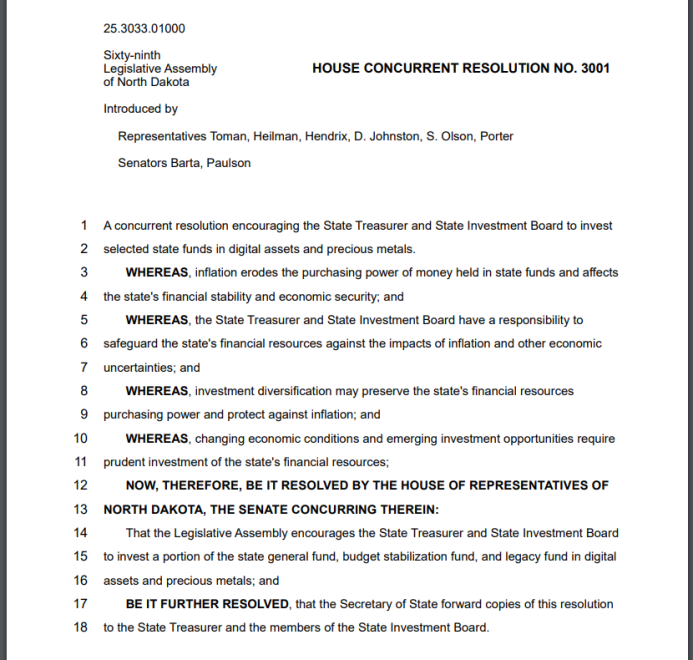

This is the best part... The privacy of this policy agreement can provide certain asset protections, such as protection from creditors, judgments, and asset searches and seizures, and the loans are contractually guaranteed regardless of employment or credit score factoring in. And you don't necessarily have to pay your loan back! Although it would behoove you to pay it back for short term cash growth.

TLDR: Use the Infinite Banking Concept by investing in a whole life insurance policy with a high proportion of your premiums allocated to Paid-Up Additions (PUAs). Borrow against the cash value to purchase Bitcoin, allowing you to potentially benefit from Bitcoin's growth while your ENTIRE policy continues to grow through dividends and interest repayments. This strategy provides a way to invest in BTC while maintaining a private and immediate access to liquidity. BTW, any deposit into a regular bank is a "loan" to the bank legally speaking. When you put it into a Mutually Owned Life insurance policy, that is legally considered an asset you own in a legally binding contractual agreement. The privacy of this agreement can provide certain asset protections, such as protection from creditors, judgments, and asset searches and seizures. So while you are completely exiting FIAT, you are also making it harder for legacy banks to rehypothecate your hard earned cash, and you are using the insurance company's cash to buy BTC.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments