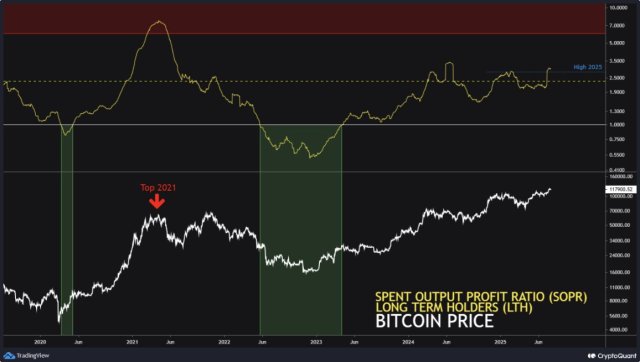

| A lot of people seem to be struggling with what has happened in the last 48 hours. We're down 16% in the last 10 days and 10% of that happened in less than 30 hours. That makes life worse for DCAers who bought early and leverage degens who thought their longs were safe. But how does it compare to other spots we've seen this year? The top-to-bottom dump in March was twice as fast and even more severe. That was SVB-related and was a pretty obvious panic-dump and/or scam-dump as there was virtually no way that the post-2008 financial system was going to collapse on the back of a few regional banks collapsing. Systemic risk was a non-factor and the FUDers had a field day convincing sellers the world was ending. Then, there was an equal-sized (to today's current state) meltdown in Q2 (which kicked off just in time for 4/20 buyers to "enjoy" a steady grind past their often publicly predicted "worst it gets" lows (and, of course, there was a sturdy helping of leverage degens in there with them)). That one felt particularly rough when it entered the spring phase of the chart design (not shown but it's the low before the upthrust in mid-June). The false starts had gone on, by that point, for almost 5 weeks and each time felt like "maybe this is the time it recovers". Just another day in the world of Bitcoin and crypto Today's situation is par for the course in Bitcoin. Whenever it finds it's bottom, the dump will lead to a consolidation phase which could last days, weeks or months, but let's remember that Bitcoin is an asset that likes to parabola when the bull or bear run kicks into high gear (invert the chart for the bear parabola fyi and btw) and that's not what we're seeing in 2023. Bitcoin parabolas tend to be quite dramatic. 2023, however, has been a 2x (i.e. 15K to 30K)and that isn't exactly what Bitcoin bull runs are known for. Therefore, what has happened this year is one of three things: 1) part of the bear (I'll interject here that my personal opinion is that this is technically invalid, for a variety of reasons, however I do realize that some analysts will disagree), 2) the early part of the bull run, or 3) a dead cat bounce. Given that Blackrock, Fidelity and others have thrown their hat into the ring just in time to be spot buyers pre-halving, I think it's safe to say that there's a decent chance that we won't see a dead cat bounce. Does it get to $100K this time (or way beyond that) I don't know, but I do think the sky will stay overhead, if you know what I mean. There are all kinds of factors that can change that but if there's no massive alteration to the global and/or global financial landscape(s), there should be enough upward-leaning development in crypto and finance that option 1 or 2 are the odds-on bets (and as I mentioned, my all-in bet is option 2 (insert Homer praying to Jebus meme for how I feel when I think about the various potential futures and how unbelievably ill-prepared I am to be wrong). tldr: dumps are normal, sometimes quick, sometimes slow. NFA tldr: stop using leverage. DCA and chill. [link] [comments] |

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments