Hi all,

I’ve been in crypto for around 1 year. It’s been a hell of a ride, and I’m only really just getting started.

I thought I’d put down a few thoughts that may hopefully reassure those of you that are new to the space … and with any luck you can learn from my mistakes.

All of these are just observations from a keen amateur fumbling his way forward … none of this is financial advice (ofc), and I don’t profess to being an expert at all. I’ve become rather passionate about crypto, and if I can offer anything of value, great – if not, that’s fine too – after all, this is a long road and I’m learning every day.

For those of you just jumping in now – welcome! Reddit is where I got my start, and I had great help and a friendly welcome – there are many, many, many more folks in here wayyyy more experienced than I – true veterans – and most of them are very generous and welcoming – a huge thanks to them.

So, a few thoughts from someone who’s been in the deep end floundering around for a year. Take this as me talking to myself 12 months ago and imparting the stuff I wish I’d known. In no particular order:

a) RTFM. This may seem obvious, and even boring, but it’s well worth reading everything you can get your hands on about blockchain tech, and the genesis of bitcoin … always good to be aware of what you are investing in.

b) Extreme volatility is normal – it spooked the living shit out of me at first, but by the time the climb to ~$69k happened, and the eventual correction, I was inured enough to simply go ‘meh’. It gets easier to bear, promise!

c) On that note – if the volatility is freaking you out, you might have too much skin in the game. I am super comfy as I have less than 5% of my net worth in crypto – and I arrived at that figure through more and more conviction. I started out with $500 I could happily piss up against a wall.

d) Take the time to learn the acronyms and the lingo. This is a constant learning curve, but having the basics under your belt helps enormously. It was bewildering at first, but gets easier.

e) Market Capitalisation is the key metric you need to be aware of – not the price in USD.

f) Exchanges – shop around. I’m in Australia and had to hunt around before I settled on one I liked. It was primarily the customer service and the features that sold me. The team is highly responsive, very reactive to customer ideas, and they are adding features all the time. Talk to the team directly. Check what the spreads are. Check what the fees are. How easy is it to get fiat on and off the exchange?

g) Get to know the essentials of the tech for investing in this space … they are:

a. A good exchange

b. A hardware wallet (for larger amounts – more on this in a sec)

c. Software wallets (i.e. metamask, specific chain/coin wallets)

d. Ways and means of sending crypto around (always send a small amount first – I’ve fucked up several transactions and lost coins … test, test, test! Luckily one transaction was supposed to be back to my exchange – I sent to the wrong chain … they were super helpful and managed to get my coins back … a good exchange is invaluable!)

e. Staking and rewards – buying and selling is fine, but holding and earning is also pretty sick.

h) Hardware wallets – this might be a controversial take, but I wouldn’t bother for small amounts. Veterans, feel free to take me down on this.

i) BTC and ETH are the big boys in town. If you are new, I would highly recommend starting with these two as investments. I wouldn’t be using the ETH network for any transactions unless you’re really really rich … the gas fees (transaction costs) are just fucking stupidly high for now. I spent time playing around learning the space, and ended up spending hundreds of dollars in gas fees moving around paltry sums. I learnt how things work, so I think of this as the price of learning. But yeah, ETH is for whales right now. Hopefully the scaling solutions will fix this.

j) Sentiment moves at a breakneck pace – this space is super dynamic, which is really exciting, and can be overwhelming. There’s always so much to learn – take it slow, and really absorb things. Biggest mistakes I’ve made have been from apeing into positions without really understanding what I was doing. I’ve learnt the hard way.

k) Spend time learning about the other chains … my journey in crypto started with learning about BTC and ETH, and then progressing through Polygon/Matic, and eventually Avalanche. These last two chains are awesome for learning about ecosystems and what you can do as the transactions fees are tiny compared to ETH.

l) There are so many ecosystems … I’m yet to wrap my head around Solana, Fantom, etc etc … slowly slowly … maybe I’m too slow, but I’m conservative in this space.

m) DeFi is a great way to actually use crypto and get a sense of what is possible. What attracted me to the space is the possibility of earning ‘interest’ via rewards etc that is way way higher than anything you can get from any bank anywhere in the world. For instance, I learnt about DeFi by using the Avalanche chain and the Curve system to stake stablecoins and earn AVAX rewards. Well worth looking into. A great way to learn about the space, and earn in the process!

n) Influencers (YouTube, Twitter, etc) are mostly total trash. There are some great diamonds in the rough (I’ll make a list below of folks I like – others, please chime in), and this took me fucking ages to figure out. Morons like Bitboy Crypto need to fuck right off.

o) Also, assume that 99% of influencers have already made the trade they are now spruiking you. Learn the phrases ‘exit liquidity’ and ‘zero sum game’ … so many influencers out there use their platforms to shill their coins, and then dump on their followers. Be cautious and always ask yourself ‘why would some random on the internet try and help me make millions?’, and ‘if it’s too good to be true, it is’.

p) Having said that, Twitter can be a great source of info on crypto … but it’s a time sink. Well worth it though.

q) FOMO is a nasty evil drug that will get you rekt. I have fallen prey to this too many times, and have bought a coin after a 15% pump, or because it was flavour of the month on Reddit or Twitter or whatever. I know, I know, fucking stupid – and I said to myself I would avoid this – it’s hard! Read widely, build your convictions, and stay in projects long term. The hourly and daily timeframes are often just noise; some would say even the weekly and monthly are just noise! It’s a long game.

r) Most altcoins (95%+) seem to die in a hole, looking at historical data. Be careful.

s) Day trading is only for people with legit crystal balls, money they can happily piss up against a wall, or the insanely brave. I mucked around with small amounts to prove it to myself, and yep – lost the fucking lot. Lesson learnt. Leave the day trading to those with serious experience – or, bone up and go hard if that’s your vibe.

t) If your exchange of choice has a ‘demo’ mode – use it! It was a great way to learn a few things and ‘try before you buy’. I still have a demo account I settled on, and the bloody thing has wayyyyy outperformed my actual portfolio. I leave it there and look at it regularly as a reminder to think long term, and at the macro level.

u) For the love of all that’s holy, avoid the fucking meme coins like Dogecoin. If you think you’re into that ish, fine – but be prepared to lose the lot. These things are manipulated by folks with large holdings.

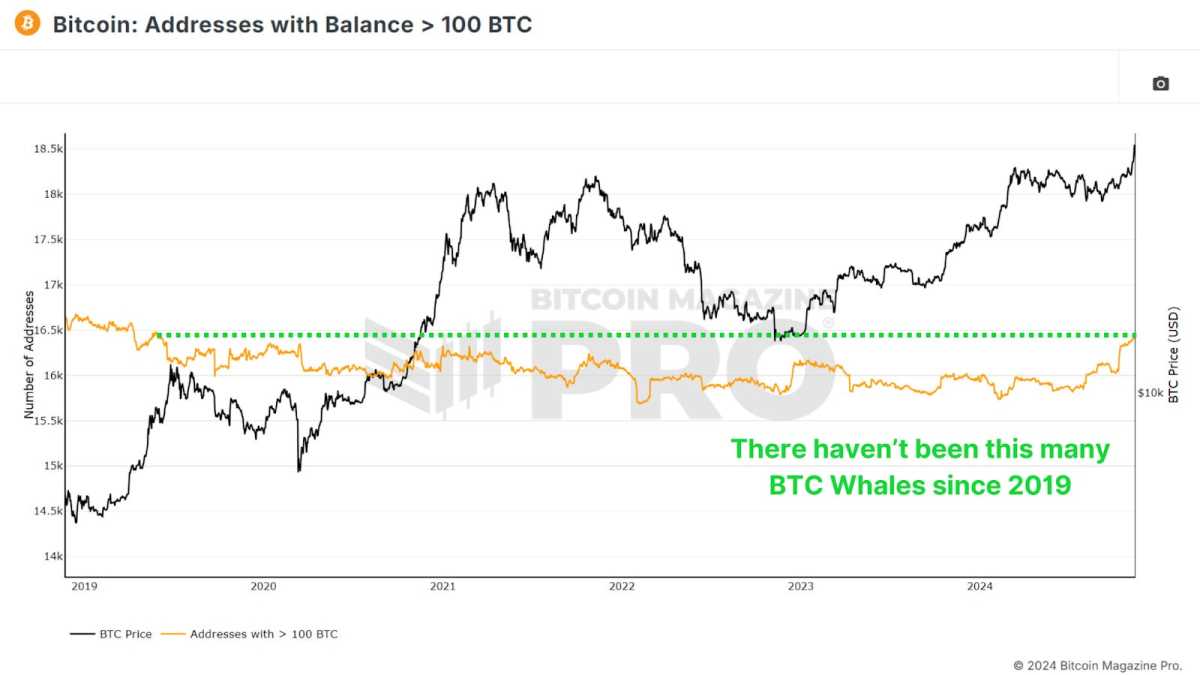

v) Speaking of manipulation – ‘retail’ crypto (us little guys) have fuck all influence on the market. This space is dominated by high-net-worth individuals, and, increasingly, institutional actors. They are the whales, we are the krill.

w) Be careful of degen yield farms … high APYs are usually too good to be true.

x) …I’m sure there’s plenty more here … I’ll add stuff in the comments as I think about it. Below I’ll make a list of websites and channels etc that I’ve found useful … hope they may be of some interest and help to you as well. This is far from exhaustive – I’ve tried to keep it succinct.

y) Veterans – call out any bullshit you see above, and please chime in with your wisdom. We’re all here to learn, embrace the tech, and make some coin.

Helpful spaces around the web:

Benjamin Cowen – this guy is the shiz … by FAR the most rational actor I’ve come across in the space. He’s a math PhD. Head over to the ‘playlists’ and check out the ‘modern portfolio theory’ stuff first, then dive in.

https://www.youtube.com/channel/UCRvqjQPSeaWn-uEx-w0XOIg/featured

Coinbureau – Guy is good; bit slicker, but a GREAT source of info, especially for beginners.

https://www.youtube.com/c/CoinBureau

Taiki Maeda – full time ‘yield farmer’. Memes are lyf.

https://www.youtube.com/channel/UC7B3Y1yrg4S7mmgoR-NsfxA

InvestAnswers – some great stuff here.

https://www.youtube.com/c/InvestAnswers

Noah Siedman – Captain Rational – really deep finance knowledge and understanding of crypto vs TradFi … I gotta watch these a couple times usually to get all the good stuff into my tiny mind …

https://www.youtube.com/channel/UCvau2hf5EXDy6Flu-tZZ0Sg

Hxro Labs – these guys are super knowledgeable, but it’s heavy data – I’m still learning lots in this space.

https://www.youtube.com/channel/UCrTIa05xVF0HSIeLgLEl97g

Bitcoin basics – the theory, and the info to being reading:

https://bitcoin.org/en/how-it-works

The original whitepaper by Satoshi Nakamoto:

https://bitcoin.org/bitcoin.pdf

Metamask – a browser extension wallet.

Curve Finance – one of the best spaces in DeFi.

Aave – a money market for DeFi.

https://app.aave.com/#/markets

Yield Yak – an autocompounder in the DeFi space.

Cryptowatch – a useful dashboard for tracking the markets.

Coingecko – a site I use to check the crypto list by market capitalisation – market cap is THE metric, not the USD price … this will become clearer as you go down the rabbit hole.

Zapper – a great site for tracking all of your DeFi in one place.

Cheers, have fun out there!

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments